Market Overview

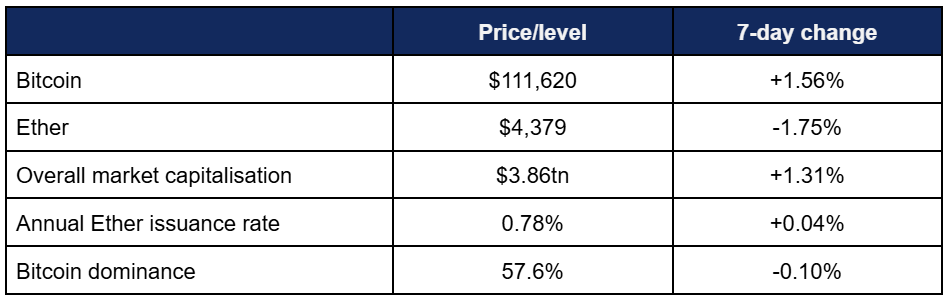

- Bitcoin recovered above $110,000 as some positive momentum returned to the leading digital asset

- Bitcoin rose from a Tuesday low of $108,790 to reach a weekly high of $113,220 on Friday, before falling back sharply following negative US jobs data

- Bitcoin also marked four consecutive months above the $100,000 mark, having last traded below those levels on the 8th of May

- Ether peaked at $4,483 on Thursday, slumping to weekly lows of $4,260 on Saturday

- Despite broader market uncertainty, overall market capitalisation increased by about $50bn from last week, to $3.86tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi remained increased by $2.5bn to $153.8bn

Digital assets experienced modest growth, amidst a flurry of tokenisation, regulation, and treasury activity. This borderless asset class continued to demonstrate its global appeal, ranging from digital bonds and $500m raises in Hong Kong, to regulatory cooperation in the US and legislation in South Korea, to private asset management in Brazil and everyday use in inflation-stricken Venezuela. Elsewhere, stablecoins and tokenisation continued gaining steam, as one of America’s largest banks (re)entered the custody space.

What happened: ETF News

How is this significant?

- Digital asset investment products experienced relatively minor outflows this week, with weak US payroll data cited as a key cause of investor caution as trading volumes declined 27%

- According to Coinshares data published on Monday, crypto asset funds recorded $352m outflows during the trading week ending Friday the 5th; the third week of outflows in the last 21 weeks

- As in recent times, flows were dominated by Ether products, albeit in a negative direction this time, as they totalled $912m

- Bitcoin funds meanwhile equalled $524m inflows

- Spot Bitcoin ETFs performed well in early during a truncated trading week, adding over $630m before surrendering some gains later on

- BlackRock’s IBIT and Fidelity’s FBTC both logged nine-figure daily inflows, with the former doing so twice and adding $299m on Wednesday

- When the market moved to outflows on Thursday, FBTC and ARK Invest’s suffered the most, with each shedding nine figures as the day’s total outflows hit $223m

- Spot Ether ETFs reversed its recent bullish momentum, as every trading day last week posted outflows, ranging from $38m to $447m

- As the leading fund, BlackRock’s ETHA lost the most, including $310m on Friday; a figure followed by $217m outflows for Fidelity’s FETH, and a second major loss of $151m for ETHA

What happened: Tokenisation news

How is this significant?

- Numerous developments in the tokenisation field this week continued to demonstrate the rising appeal and advantages of blockchain as a medium of financial record-keeping and transactions

- Bloomberg noted a spate of digital bond issuance activity in Hong Kong, with a source revealing the city’s government has appointed banks for the sale

- This would mark the third government-led digital bond issuance in Hong Kong, and the initiative follows almost immediately after Shenzen Futian Investment issued a $70m bond (with 2.62% interest) on Ethereum

- Just a few days earlier, Shandong Hi-Speed Holdings also issued a digital bond in Hong Kong, likewise on Ethereum

- Crucially, both Shenzen Futian and Shandong Hi-Speed are mainland China state-owned enterprises, demonstrating continued policy support for Hong Kong’s digital asset embrace, despite continued official mainland bans

- About 70% of the $1bn raised thus far by digital bonds in Hong Kong have come in 2025, indicating rising adoption of tokenised products

- Michael Lu, securities lawyer in the city’s King & Wood Mallesons firm commented “We’ve seen a growing number of inquiries from companies who are interested in fundraising by way of issuing digital bonds for the past few months”

- Germany’s Boerse Stuttgart Group this week launched the first pan-European digital settlement platform for tokenised assets

- The new platform, called Seturion, was previously tested in ECB trials last year, and is open to banks, brokers, and both traditional and digital trading venues

- Boerse Stuttgart CEO Matthias Voelke said in a press release “Seturion is the first digital pan-European settlement platform for tokenised assets. With a truly open architecture, we want to overcome current national settlement infrastructure silos and turn a unified European capital market into reality”

- Reuters reported on Monday that Nasdaq is currently requesting SEC permission to list tokenised stocks on the same order book as their traditional equivalents

- According to analysts, this “could bring blockchain-based settlement into the national market system as soon as the third quarter of 2026”

- In a new report, banking giant Bank of America lauded the technology, calling it “Mutual Fund 3.0” and the next great evolution in financial products after ETFs

- The bank noted that “[tokenisation] firms like Securitize are working with managers including BlackRock (BLK), Apollo, KKR and Hamilton Lane to issue tokenized funds”

- However, tokenisation efforts could move slower than some may wish; the latest draft of a crypto market bill seeks to rein in stock tokenisation by ensuring that stocks and other tokenised securities cannot be treated as commodities after transferring to the blockchain

- Senator Cynthia Lummis told CNBC she wants a version of the Responsible Financial Innovation Act of 2025 on president Trump’s before the end of the year, potentially setting the scene for tokenisation efforts in 2026

What happened: CFTC and SEC collaborate on registration pathway for spot crypto trading

How is this significant?

- America’s top financial regulators revealed a collaboration this week, issuing guidance on spot trading of certain crypto products

- According to their joint statement, the agencies will promptly “review requests and answer questions from designated contract markets, foreign boards of trade, and national securities exchanges seeking to trade certain spot crypto assets”

- SEC chair Paul Atkins declared it “a significant step forward in bringing innovation in the crypto asset markets back to America”, whilst acting CFTC chair Caroline Pham commented the move would support growth and development of crypto in the States

- Unlike the previous administration, where agencies disagreed on definitions of the same digital assets, and jostled for control of the market, this endeavour illustrates a greater (Republican) desire to establish specific regulatory guidelines

- The latest draft of the US Senate’s crypto market structure bill, and called for the SEC and CFTC to set up a Joint Advisory Committee on Digital Assets in order to ensure inter-agency “regulatory harmonisation”

- The first such step could take place as soon as September 29th, when the two agencies host a public crypto roundtable

- In other regulatory news, OCC head Jonathan Gould stated that his office is moving to eliminate “debanking” efforts which some argue deliberately excluded crypto firms from the banking system

- Gould stated “The OCC is taking steps to end the weaponisation of the financial system”

What happened: US Bancorp returns to crypto custody field

How is this significant?

- America’s fifth-largest commercial bank, US Bancorp (aka US Bank), announced this week that it would resume its previous crypto custody services, suspended in 2021 due to regulatory uncertainty of the previous White House

- In particular, CEO Stephen Philipson cited the former SEC accounting guideline SAB121 (which required banks hold digital assets on their own balance sheets) as a key roadblock to custody; a block which was removed in January

- It will relaunch the offering with its original partner, institutional Bitcoin firm NYDIG, who will act as sub-custodian

- As per NYDIG’s expertise, custody will roll out for global fund services clients, initially limited to Bitcoin alongside select Bitcoin funds and ETFs, but the scope of assets stored could increase in future

- Philipson commented “We had the playbook and it’s sort of opening it up and executing it again. As we gauge demand and as the marketplace develops, we’ll probably scale more broadly”

- He added that in future crypto and stablecoins could find a place in the bank’s wealth, payments, and consumer banking departments

- US Bancorp joins BNY Mellon and Fidelity as major American financial institutions offering digital asset custody for clients

What happened: EasyJet founder launches digital asset trading platform

How is this significant?

- Billionaire entrepreneur Stelios Haji-Ioannou—best known as a budget travel pioneer and founder of airline EasyJet—is expanding his business empire into a new field; digital asset trading

- His EasyGroup holding company will launch (and help market) EasyBitcoin, following a licensing agreement with registered trading platform Uphold

- In a rare interview, he indicated that he will operate the exchange on the same principles as his airline; bringing costs down for consumers by way of reduced trading fees

- Stelios said “I’m only doing it because the Trump second election has made it completely mainstream. Competition will bring these prices down… People are going to buy and sell Bitcoin. So you might as well offer them a platform where they can do it more fairly, more transparently, more economically”

What happened: Stripe confirms payment-centric stablecoin blockchain

How is this significant?

- Payments processor Stripe confirmed long-running rumours regarding a payment-centric stablecoin blockchain this week, after CEO Patrick Collison confirmed the funding of a new blockchain company called Tempo

- Stripe has already assembled a formidable roster of businesses to aid in the design of the new blockchain; including AI firm Anthropic, Deutsche Bank, DoorDash, Nubank, OpenAI, Revolut, Shopify, Standard Chartered, and Visa

- Crypto VC Paradigm is Stripe’s main partner in the development of the new chain, with Paradigm co-founder Matt Huang acting as the first chief of Tempo

- Huang tweeted Tempo will be built with “principles of decentralisation and neutrality”, launching with a broad range of validators and evolving to fully permissionless systems in future

- Tempo aims to service transactions (100,000 a second) rather than trading, including “global payments, payroll, remittances, tokenised deposits and other financial flows”

- Collison said Tempo will run in the background as an execution layer, much like SWIFT, and added that stablecoins are gaining traction for providing faster, cheaper, more reliable payments than existing systems

- He cited companies as diverse as SpaceX, DolarApp, and an Argentinian bike importer as firms that benefit from the improved efficiencies afforded by stablecoins

- The news comes just a few weeks after stablecoin issuer Circle announced its own planned blockchain, Arc

- In other stablecoin news, USDT issuer Tether continued its diversification push as the Financial Times reported it plans to invest in physical gold miners to complement its digital gold (Bitcoin) holdings as a reserve asset

- Tether also confirmed an additional $100m investment in Canadian gold royalty firm Elemental Altus, adding to its existing 37.8% stake

- Galaxy Digital CEO Mike Novogratz predicted that the rise of artificial intelligence will prove a positive corollary for stablecoins

- He told Bloomberg that agentic transactions could increase exponentially soon; “In the not so distant future the biggest user of stablecoins is going to be AI… Sometime in the near distant future, I don’t know if it’s one year or five years, you are going to see an explosion of stablecoin transactions”

What happened: South Korea launches legislation limiting crypto loan interest

How is this significant?

- South Korea’s Financial Services Commission (FSC) continued the leading Asian crypto market’s recent legislative push this week, publishing new guidelines designed to protect consumers

- Under the new guidelines, crypto lending interest rates are capped at 20%, and leveraged lending exceeding collateral value is banned

- Additionally, companies providing lending services must do so purely with their own capital, rather than utilising any third parties

- Users face lending limits based on experience and transaction history, and must be notified when in danger of liquidation

- In a press release, the FSC stated “The guideline clearly defines the scope of virtual asset lending services by referring to global cases, providing various user protection measures”

- Perhaps to the chagrin of the historically-altcoin-friendly local retail traders, any lending will be limited to the top 20 assets by market capitalisation

What happened: Real estate giant signs up for JP Morgan’s blockchain

How is this significant?

- Commercial real estate loan servicer Trimont LLC became the latest to adopt JP Morgan’s proprietary Kinexys blockchain this week, citing improved efficiencies over legacy infrastructure

- Trimont CEO Bill Sexton said the firm executed its first transaction on the network in August, and will increase use over the next year

- Thanks to automated detection and fund verification processes via blockchain smart contracts, transaction times are reduced from the existing two day standard to just minutes

- Sexton stated “There is significant financial benefit to our clients being able to receive the payments two days earlier”

- Naveen Mallela, Kinexys co-head, commented “Programmable payments are one of the innovations that blockchain and digital currencies bring to the digitisation of money. It’s the ability to embed software in money and make money smart”

What happened: Brazil’s largest asset manager launches digital asset division

How is this significant?

- Itaú Asset, the asset management arm of Brazil’s largest private bank, is launching its own digital asset division to develop crypto investment products, according to reports in the local press

- Itaú Bank already manages three regulated crypto products with a combined $156m value, and launched Bitcoin trading for clients back in December 2023

- Recently, it also considered its own stablecoin launch, as stablecoin usage has seen strong uptake within Latin America due to a history of economic instability

- The Financial Times reported that in Venezuela, digital assets are becoming “a significant feature of Venezuela’s economy” due to rampant hyperinflation above 200%

- Venezuelan economist Aaron Olmos said “Venezuelans started using crypto out of necessity [due to] inflation, low wages, foreign currency shortages, and the inaccessibility of opening a bank account”

- Stablecoins in particular are a popular means of bypassing the local Bolívar’s weakness, as “In the midst of adversity, a community is forming—one that is increasingly critical and better informed”

What happened: Crypto Treasury news

How is this significant?

- A flurry of digital asset treasury activity occurred this week, as multiple new companies and assets entered the adoption conversation

- Leading Bitcoin treasury firm Strategy (formerly MicroStrategy) purchased another $217m worth of the top digital asset, bringing its total holdings to 638,460 Bitcoin

- However, the firm faced a setback of sorts, as against expectations it was denied entry into the S&P 500, with some analysts claiming “bias against Bitcoin” on the part of the index’s selection committee

- Metaplanet shareholders approved a plan for Japan’s top treasury firm to raise up to $3.8bn via preferred shares, as per CEO Simon Gerovich

- Bitcoin mining giant Marathon increased its Bitcoin stash to 52,477, according to its newest monthly production report

- Nasdaq-listed Ethereum treasury firm ETHZilla disclosed holdings of 102,246 Ether at an average acquisition price of $3,949

- It also revealed over $210m in cash equivalents, and “an over-the-counter financing with crypto liquidity provider Cumberland DRW for up to $80 million, collateralized by a portion of its ETH”

- Leading Ether treasury firm Bitmine meanwhile announced crypto and cash reserves above $9bn, anchored by 2.069 million Ether—a weekly addition of over 319,000 Ether for an estimated $1.4bn

- South African firm Altvest Capital announced a $210m raise to fund a crypto treasury, e-commerce firm Eightco Holdings saw 3,000% stock growth after revealing a Worldcoin treasury (the digital asset founded by AI billionaire Sam Altman), and Forward Industries confirmed a $165m raise in cash and stablecoins to buy Solana for its corporate treasury (marking the largest Solana treasury to date)

- Hong Kong-based exchange HashKey may dwarf all those efforts though, announcing plans to build a diversified treasury of mainstream crypto assets financed by a $500m warchest

- Although it plans to diversify, initial holdings will focus on Bitcoin and Ether

- Finally, El Salvador celebrated the fourth anniversary of its Bitcoin legal tender law by purchasing 21 Bitcoin (a reference to the maximum total mineable supply of 21 million)

- President Nayib Bukele tweeted “buying 21 Bitcoin for Bitcoin day”, bringing the nation’s holdings above 6,300 Bitcoin

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.