Market Overview

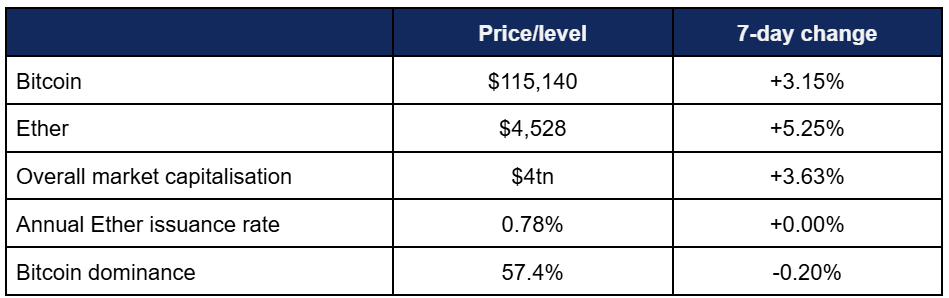

- Bitcoin approached its highest levels in a month, as expectations of potential future Federal Reserve rate cuts appeared to buoy investor confidence

- Bitcoin increased steadily throughout the week, trading above $110,000 for all seven days

- The asset’s weekly low of $110,830 on Tuesday gave way to a Friday high of $116,740, with the majority of weekly trading taking place between $114,500 and $116,000

- Ether moved back into growth mode, rising from a Tuesday low of $4,281 to a Saturday high of $4,759

- This brought it near to its recent record highs from August, when it traded at around $4,950

- Overall market capitalisation reclaimed $4tn, peaking at $4.09tn during intraweek trading

- According to industry monitoring site DeFi Llama, total value locked in DeFi grew by around $6bn, to $160bn

Digital assets performed positively, reaching the $4tn market capitalisation landmark once again as they were buoyed by strong ETF volume, successful IPOs, large treasury purchases, and policy optimism. Elsewhere, the world’s largest exchange combined forces with a trillion-dollar asset manager to develop crypto products, tokenisation efforts included BlackRock and the London Stock Exchange, stablecoin giant Tether announced a new token shaped by US regulations, PayPal expanded its crypto offering, and much more.

What happened: ETF News

How is this significant?

- Digital asset investment products logged significant inflows, with one of their best weeks in history

- According to Coinshares data published on Monday, crypto asset funds recorded $3.3bn inflows during the trading week ending Friday the 12th

- Bitcoin dominated these volumes, experiencing its best week since July, posting $2.4bn inflows

- Despite a lack of spot ETFs (yet), Coinbase head of research James Butterfill noted that Solana-based investment funds experienced their best-ever daily performance, with $145m inflows on Friday—reflecting the smart contract blockchain’s rising profile as a potential crypto treasury asset

- Spot Bitcoin ETFs performed strongly throughout the week, with only three funds posting any daily outflows (all of them on Tuesday)

- Four of the five trading days recorded nine-figure daily inflows, ranging from $364m to $742m

- BlackRock’s IBIT and Fidelity’s FBTC both mirrored this pattern, with four days of nine-figure inflows, including $366m from IBIT on Thursday and $299m from FBTC

- ARK Invest’s ARKB also joined the nine-figure flow club, adding $145m on Wednesday

- Notably, Grayscale’s converted GBTC fund posted zero outflows this week (albeit with multiple net zero flow days); a rarity since its launch, as its 1.5% management fee is at least six times that of any competitors

- Spot Ether ETFs moved back into bullish momentum after six consecutive days of outflows, posting positive results from Tuesday to Friday

- This included $406m inflows on Friday, featuring nine-figure flows for both BlackRock’s ETHA and Fidelity’s FETH

- Uncharacteristically, BlackRock didn’t post the largest daily inflows, as FETH just edged ETHA by $168m to $166m; both nonetheless well in excess of the category’s average daily post-launch flows of $47m

- In other ETF news, Bloomberg’s chief ETF analyst Eric Balchunas noted that the first memecoin-linked ETF could begin trading this week, providing at least 80% exposure to Elon Musk’s favourite memecoin, DOGE

- Late on Monday, digital asset manager Bitwise filed to issue a spot ETF based on AVAX, the central token of the Avalanche smart contract blockchain

What happened: Tokenisation news

How is this significant?

- On the subject of ETFs, Bloomberg wrote that BlackRock plans to tokenise ETFs for broader access and functionality

- According to the article, potential advantages include “trading beyond Wall Street’s set hours, making US products easier to access abroad, and creating potential new uses as collateral in crypto networks”

- Additionally, proponents argue that tokenisation enables fractional shares, making ETFs more accessible as an investment class

- The report cites the success of both BlackRock’s tokenised money market fund BUIDL and its IBIT spot Bitcoin ETF as key drivers behind the move towards more tokenisation

- In a press release on Monday, the London Stock Exchange Group (LSEG) launched a tokenisation platform for private funds, and facilitated its first transaction with MembersCap and Archax

- LSEG seeks to “deliver blockchain-powered scale and efficiencies for the full asset lifecycle—from issuance, tokenisation and distribution to post trade asset settlement and servicing”

- The new Digital Markets Infrastructure (DMI) platform was developed in partnership with Microsoft Azure in order to enhance scalability for institutional customers

- LSEG head of digital markets infrastructure Dr. Darko Hajdukovic commented “There are many processes in private markets today that can be improved… The onboarding of our first clients and this first transaction are significant milestones, demonstrating the appetite for an end-to-end, interoperable, regulated financial markets DLT [i.e. blockchain] infrastructure”

- ETF issuer WisdomTree put its first fund on the blockchain, tokenising its Private Credit and Alternative Income Digital Fund

- The fund has a minimum $25 exposure, as head of digital assets Will Peck told Bloomberg that tokenisation allows the firm to expand beyond its 90% institutional customer base

- “It’s really just about bringing the asset class to a whole universe of different investors… For us, it’s marrying what we think is a great exposure to private credit in a vehicle that works for the DeFi community”

- Crypto exchange Kraken expanded its tokenised US stock trading to customers within Europe

- The exchange currently offers tokenised versions of about 60 major US stocks, powered by Backed Finance’s xStocks service

- As things stand, the tokenised stock space remains relatively modest, at a total $510m value according to rwa.xyz—less than a quarter of BlackRock’s tokenised money market fund BUIDL

- Earlier in the week, Reuters reported that Nasdaq is currently cooperating with US legislators for the launch of tokenised securities in the US

- This followed on just days after the SEC unveiled its new crypto rulemaking agenda, including provisions for potential securities tokenisation

- In its filing for the rule-change, Nasdaq stated that tokenised stocks would enjoy “the same material rights and privileges as do traditional securities of an equivalent class… on the same order book and according to the same execution priority rules”

- Nasdaq forecasts settlement of the first “token-settled trades of securities” within Q3 of 2026

- On the other side of the world, Japanese credit card issuer Credit Saison launched a $50m blockchain venture fund called Onigiri Capital, intended to fund startups focused on real-world asset (RWA) tokenisation efforts

- Onigiri managing partner and Saison Capital partner Qin En Looi stated “The centre of gravity for real-world asset innovation is shifting, and Asia’s role is growing at an exponential rate. We saw a critical gap in the US market: an absence of the specialised expertise… in dynamic Asian markets”

What happened: Crypto exchange Gemini goes public

How is this significant?

- Gemini, the digital asset exchange founded by twin brothers Cameron and Tyler Winklevoss, became the latest crypto IPO success story, after going public on the Nasdaq Friday as Gemini Space Station (GEM)

- Shares closed up 14% from their $28 IPO price, and at one point in trading hit almost $46

- On Friday morning the Winklevosses, early Bitcoin adopters, told CNBC that they believe the leading digital asset could hit $1m in price within the next decade

- The initial IPO price valued the exchange at over $3bn, and it raised $425m for the launch by selling 15.2 million shares, including a $50m private placement from Nasdaq itself

- According to Reuters, the raise was 20 times oversubscribed, indicating the increased appeal of crypto industry IPOs following the success of stablecoin issuer Circle’s launch this year

- Mark Beylin of crypto VC Haun Ventures commented “Owning a piece of an exchange like Gemini lets investors get upside in crypto cyclicality, but in a package they’re more used to. As we’ve seen from the recent Circle IPO, public market investors haven’t had any trouble getting acquainted with these novel crypto-native business models”

- The firm reserved 10% of shares for leadership, long-term staff, and users, whilst setting aside 30% for retail traders across multiple platforms

What happened: Binance and Franklin Templeton collaborate on digital asset products

How is this significant?

- Reporting this week revealed that digital asset exchange Binance is working alongside $1.6tn asset manager Franklin Templeton to develop a suit of as-yet unnamed digital asset products “for a range of investors”

- Franklin Templeton is one of the most forward-thinking asset managers vis-a-vis digital assets, issuing spot ETFs and creating the first tokenised money market fund, BENJI

- According to a joint statement, the collaboration will focus on tokenisation opportunities and “aims to enhance capital market efficiency through blockchain technology, focusing on improved transparency, accessibility and settlement processes”

- Franklin’s head of digital assets, Roger Bayston, said “Investors are asking about digital assets to remain ahead of the curve, but they need to be accessible and dependable… Our goal is to take tokenisation from concept to practice for clients to achieve efficiencies in settlement, collateral management, and portfolio construction at scale”

- The firm’s EVP Sandy Kaul commented “By working with Binance, we can harness tokenisation to bring institutional-grade solutions like our Benji Technology Platform to a wider set of investors and help bridge the worlds of traditional and decentralised finance”

- She added “We see blockchain not as a threat to legacy systems, but as an opportunity to reimagine them”

What happened: Blockchain lender Figure joins ranks of successful crypto IPOs

How is this significant?

- A day before Gemini’s public float, another digital asset firm listed on the stock exchange; blockchain-based credit company Figure

- This followed a dramatic late increase in its IPO raise, from an initial $526m at the start of September to a $693m upsize last Tuesday, to a final $787.5m before launch on Thursday

- This included a $50m declaration from billionaire Stanley Druckenmiller’s Duquesne Family Office

- Co-founder Mike Cagney told Bloomberg “Blockchain is a democratisation of financial services… [that’s why we] gave retail one of the largest allocations anyone has ever done”

- Its shares performed strongly in their debut, closing up 24% from their IPO price, with a $7.9bn valuation (at the time of writing)

- Reuters reported that Figure’s demand was driven by the firm’s strong financial performance, as well as broader crypto IPO hype; “It facilitated $6 billion in home equity lending for the twelve months ended June 30, up 29% from a year ago”

What happened: Stablecoin news

How is this significant?

- Leading stablecoin issuer Tether made a major announcement this week, holding a press conference and unveiling a US-regulated stablecoin called USAT

- The new dollar-pegged coin is developed in conjunction with Cantor Fitzgerald (for reserve asset custody) and Anchorage Digital bank (for issuance), ensuring GENIUS Act compliance

- Additionally, the firm’s new American division is headed by Bo Hines, the former director of the White House Crypto Council

- Hines put up a bold front in his first public statement, declaring “Let’s work together. Let’s find a way to revolutionise this system, and let’s do it quickly. I think our expansion will be exorbitant over the course of the next 12 to 24 months… I’m not shy saying this; we want to dominate, but we want to dominate for the US and we want to help people in doing so”

- He added “By building USAT with compliance, transparency and innovation at its core, we are ensuring that the dollar remains the foundation of trust in the digital asset space”

- Despite being dollar-pegged and the world’s largest stablecoin, Tether’s flagship USDT token is not currently compliant with regulations in the US, thus necessitating the creation of an America-focused alternative to capitalise on the burgeoning category acceptance there

- Tether has courted controversy in the past, particularly for its history of posting attestations rather than full audits for its assets

- At the beginning of the year, Tether relocated its headquarters to El Salvador, citing its crypto-friendly regulatory regime

- In the US state of Minnesota, St Cloud Credit Union ($407m AUM) announced the creation of its own Cloud Dollar—the first stablecoin issued by a credit union specifically

- EVP Chase Larson stated “With CLDUSD, we’re readying our shop for on-chain money movement—merchant payouts, member-to-member, institution-to-institution—at a fraction of card-network fees and with full transparency”

- In the UK, the Financial Times reported on opposition to current Bank of England (BoE) plans to limit stablecoin ownership, arguing that such standards are much more draconian than US and EU equivalents, and risk leaving

- The BoE currently proposes a limit of £20,000 stablecoin ownership for individuals, whilst businesses would be capped at £10m exposure

- Coinbase policy VP Tom Duff Gordon responded “Imposing caps on stablecoins is bad for UK savers, bad for the City and bad for [Pound] Sterling. No other major jurisdiction has deemed it necessary to impose caps”

- Imperial Business School Gilles Chemla added “Stablecoins are no longer experimental technologies—they are becoming the foundation of the global digital economy. London has the talent, the markets, and the history to lead the digital economy, but the delay in implementing a regulatory framework for stablecoins is eroding that advantage”

What happened: OCC head announces greater collaboration with crypto industry on banking

How is this significant?

- Jonathan Gould, head of the Office of the Comptroller of the Currency, confirmed this week that he wants to eradicate “stigmatisation” of digital assets and a “two-tiered banking system” that casts moral judgements on “legally permissible” activities between banks and crypto firms

- Speaking at a Coindesk event in Washington, he said “I view a lot of what crypto represents, as well as using the technology and processes underlying it, as being inherent to financial intermediation services”

- Gould added “We’re going to take a step back to see if we’re going to work much more closely with those who are interested in doing these activities, and we’re going to chart a path to ensure you can do it in a safe and sound manner”

- This follows on from last week’s OCC initiative to eliminate debanking efforts, which allegedly plagued the digital asset industry under the previous White House administration

- In other US regulatory news, Politico reported on rifts within Republicans, as Banking Committee member John Kennedy pushed back against committee chair Tim Scott’s pledge to pass a market structure bill this month, arguing “I don’t think we’re ready… I know I still have a lot of questions”

- He claimed that the increased scope called for increased scrutiny; “As important as the GENIUS [Stablecoin] Act was, it was a baby step. This is a full leap. And we’ve got to get it right”

- However, some politicians such as Senator Cynthia Lummis continue actively pushing for more digital asset legislation

- On Tuesday, Lummis hosts a roundtable with a dozen major crypto industry advocates, aimed at supporting a Bitcoin strategic reserve via her BITCOIN (Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide) Act

- A new bill, HR 1566, proposes a 90 day timeframe for the Treasury Department to publish a report on feasibility and implementation of both a Bitcoin and broader crypto reserve

- Meanwhile in India, a new government document seen by Reuters suggests that the government is leaning away from creating digital asset legislation

- The purported reasoning is that regulation grants legitimacy, and legitimacy “may cause the sector to become systemic”, creating potential economic risks

What happened: PayPal adds peer-to-peer digital asset payment functionality

How is this significant?

- Corporate crypto adoption pioneer PayPal extended its customers’ digital asset capabilities this week, almost five years after becoming one of the most significant firms to offer official support for the asset class

- Back in 2020, the company enabled users of its PayPal and Venmo apps to directly buy, hold, and sell digital assets on those platforms; now they can directly transfer them to other blockchain addresses

- In a Monday press release, PayPal announced that through PayPal Links “The peer-to-peer (P2P) experience is about to go even further. Crypto will soon be directly integrated into PayPal’s new P2P payment flow in the app. This will make it more convenient for users in the US to send Bitcoin, Ethereum, PYUSD, and more, to PayPal, Venmo, as well a rapidly growing number of digital wallets across the world that support crypto and stablecoins”

- Friends-and-family transfers will be exempted from US tax reporting requirements

- Earlier this year, PayPal released the Pay With Crypto program allowing merchants within its network to accept over 100 different digital assets as payment for services

- At the time, PayPal cited cross-border savings via blockchain as a key driver for the move, stating its fee for the services could still undercut international credit card processing costs by 90%

What happened: Crypto claimed as crucial (but controversial) component of US/UAE trade

How is this significant?

- The New York Times published an investigation on Monday, claiming that digital assets were key to brokering a recent UAE trade deal for the US, “testing the limits of ethics rules while enriching the president, his family and his inner circle”

- According to the NYT’s investigation, Steve Witkoff (President Trump’s Middle East envoy and father of World Liberty Financial lead Zach Witkoff), met with Sheikh Tahnoon bin Zayed Al Nahyan of the UAE royal family, negotiating a deal that included “two multibillion-dollar deals. One; a crypto company founded by the Witkoff and the Trump families that benefitted both financially. The other; the sale of valuable computer chips that benefitted the Emirates economically”

- Whilst the Times notes that “there is no evidence that one deal was explicitly offered in return for the other”, it opines “the confluence of the two agreements is itself extraordinary”

- The crypto deal in question involved a $2bn Emirati investment into the Trump-linked World Liberty Financial (WLF) project, followed soon after by the sale of processing chips essential to A.I. applications

- White House and WLF spokespeople both assert the crypto investment was “totally unrelated to any government business”, and that timings were coincidental

- The Times clearly claims conflict of interest, and the investments could “violate longstanding norms in the United States for political, diplomatic and private deal-making among senior officials and their children”

- Other recent reports also cited concerns over the Trump family’s growing digital asset exposure (and fortune)

- The Atlantic wrote that “World Liberty Finance certainly presents as a legitimate cryptocurrency business, but it is also… a way to put the Trump brand to work and potentially capitalise on the office of the presidency”

- Bloomberg noted that WLF and the IPO of Bitcoin miner American Bitcoin helped add “$1.3bn in crypto wealth in the span of weeks” for the family

What happened: Crypto Treasury news

How is this significant?

- Digital asset treasury acquisition continued this week, as multiple firms made major purchases or raises to secure crypto balance sheet exposure

- Leading Bitcoin treasury firm Strategy (formerly MicroStrategy) made a comparatively modest purchase by its own recent standards, adding 525 Bitcoin for $60.2m, financed by at-market sales of perpetual strife stocks

- This brought Strategy’s total holdings to 638,985 Bitcoin (worth over $73bn) at an average unit purchase price of $73,913 and total cost of around $47.2bn

- On Monday, leading Ether treasury firm BitMine announced total assets of $10.8bn, including 2.151 million Ether, and unencumbered cash of $569m

- Compared with its last weekly statement, this indicates the acquisition of another 82,233 Ether

- Chairman Tom Lee stated “We continue to believe Ethereum is one of the biggest macro trades over the next 10-15 years. “Wall Street and A.I. moving onto the blockchain should lead to a greater transformation of today’s financial system. And the majority of this is taking place on Ethereum”

- Analysts at Standard Chartered appear to agree, as digital asset research head Geoff Kendrick argued in a new report that “In a relative sense, we see DATs [digital asset treasuries] as being a more positive driver for Ether than for Bitcoin or Solana going forward”

- Nasdaq-listed Forward Industries closed a $1.65bn PIPE raise to create a crypto treasury with Solana as its anchor asset

- It quickly moved to spend this money, as a Monday press release revealed the purchase of over 6.8 million Solana tokens at an average price of $232, costing roughly $1.58bn

- This included cash and stablecoin commitments of $300m each from Galaxy Digital, Jump Crypto, and Multicoin Capital

- Bitcoin treasury firm Strive disclosed its initial Bitcoin acquisition strategy, after raising $750m in financing, with another potential $750m over the next year

- Helius Medical Technologies also benefited from a Solana strategy, as shares surged over 200% as it announced its shift towards a Solana balance sheet

- Helius confirmed an oversubscribed public offering for its $500m raise, expected to close on the 18th of September

- Finally, the Financial Times reported that the Avalanche blockchain foundation is raising $1bn to create two crypto treasury companies, with a focus on its proprietary AVAX token

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.