Market Overview

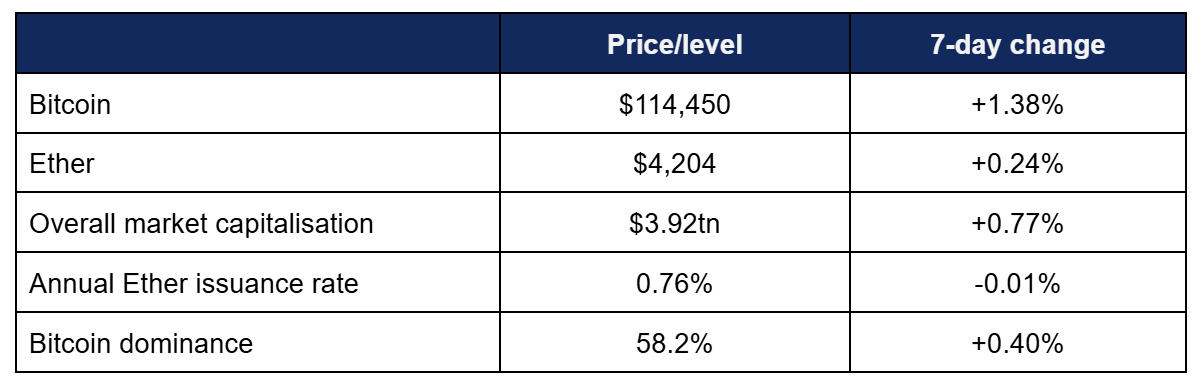

- Bitcoin struggled throughout the weekend, falling below $110,000 before a rally on Monday helped erase last week’s losses

- Bitcoin dropped as low as $108,780 on Friday, before reaching a weekly peak of $114,790 early this morning

- Ether showcased similar patterns, dropping below $4,000 before ultimately rallying from a Friday low of $3,840 to $4,232 in early trading today

- Overall, the top 100 coins and tokens by market capitalisation trended broadly positive, with two projects posting double-digit declines at the time of writing, whilst seven posted double-digit growth

- Investor sentiment on the Fear & Greed index recovered slightly, but remains in the lower reaches of “neutral” territory at 43/100

- Overall market capitalisation reached $3.92tn, a modest overall recovery from last week’s declines

- According to industry monitoring site DeFi Llama, total value locked in DeFi increased by $3.9bn, to $157.9bn

Digital assets recovered from last week’s losses, staging a late rally to erase significant weekend declines. Stablecoin giant Tether confirmed a private placement that could value the company as high as $500bn, Binance rolled out more institutional services, Kraken advanced its IPO plans, a collective of leading European banks announced plans to challenge US Dollar hegemony in the sector, and much more.

What happened: ETF News

How is this significant?

- Digital asset investment products moved back towards outflows last week, as markets reacted uncertainly to the Fed’s “hawkish cut”

- According to Coinshares data published on Monday, digital asset funds surrendered $812m in capital flows during the trading week ending Friday the 26th

- Coinshares head of research James Butterfill added some longer-term perspective after the recent trend of oscillation between inflows and outflows, writing “Nonetheless, cumulative inflows remain substantial, with month-to-date inflows at $4 billion and year-to-date inflows at $39.6 billion, maintaining momentum to potentially match last year’s record of $48.6 billion”

- Spot Bitcoin ETFs faced a challenging week, recording four days out nine-figure outflows, topping out at $418m on Friday

- There was however one spark of light, as funds registered net inflows of $241m on Wednesday, led by BlackRock’s IBIT on $129m

- This proved to be the only nine-figure inflow for any fund last week, as the next-best showing (also from IBIT) returned $80m

- The largest weekly outflows were derived from Fidelity’s FBTC, bookending the week with $277m and $300m outflows on Monday and Friday respectively

- Since launch, the scale of Bitcoin ETFs has grown so strongly that BlackRock’s IBIT recently surpassed Coinbase’s Deribit as the leading platform for Bitcoin Options

- Open Interest in IBIT stood at $38bn on Friday, compared to $32bn for Deribit (which was launched around eight years before BlackRock’s ETF)

- Spot Ether ETFs reversed their broadly positive momentum since US stablecoin legislation passed, registering outflows on every trading day last week

- Only two funds added any inflows at all last week, and those were at modest levels on Friday; Grayscale’s 2.5% fee ETHE fund gained $18m, whilst 21Shares’ TETH increased by $8m

- The largest losses came from the largest funds, as BlackRock’s ETHA dropped $200m on Friday, following Fidelity’s FETH falling $158m the day prior

- In other ETF news, Bloomberg noted the launch of a new index fund for crypto treasury firms; “just as the trend shows signs of cooling”

- Bloomberg chief ETF analyst Eric Balchunas appears optimistic about the immediate future for the asset class, forecasting a “Cointober” as spot ETF decision deadlines for several altcoins, believing “odds are really 100% now” for a Solana listing

- FOX Business report Eleanor Terrett noted that the SEC asked several issuers to withdraw their current ETF filings for assets such as Ripple, Solana, and Litecoin, in order to re-file them under its new generic listing standards

- Despite the withdrawal request appearing a backwards step, she assesses it as a positive move, with the generic standards streamlining the process compared to the previous 19b-4 form filing process

What happened: Stablecoin giant Tether raising money at $500bn valuation

How is this significant?

- Leading stablecoin issuer hit headlines this week, as reports emerged that it could be going public

- Bloomberg broke the news, citing sources who quoted a $20bn private placement round for 3% of (newly-created) equity—potentially propelling it “into the highest ranks of the world’s most valuable private companies”

- A $500bn valuation would put the El Salvador-based company on a par with Elon Musk’s SpaceX and artificial intelligence leader OpenAI, but one source did caution that it represents the very top end of Tether’s funding drive in the $15bn to $20bn range

- In comparison, the next-largest stablecoin firm, publicly-listed Circle, is currently trading at around $30bn

- Should Tether achieve the high end of its valuation, chairman Giancarlo Devasini could become the world’s fifth-richest man

- CEO Paolo Ardoino later confirmed these reports, saying that as the firm seeks to “maximise the scale” of its operations, it is now “evaluating a raise from a selected group of high-profile key investors”

- Softbank and ARK Invest are rumoured to be amongst those in early-stage investment discussions, underscoring a preference for tech industry veterans

- Tether has faced controversy in the past, primarily due to concerns over transparency, but remains popular across the world, including in countries and regions plagued by unstable currencies

- One key factor behind the rise of Tether’s profits has been historically elevated interest rates enhancing the yield of treasuries held as backing assets for its USDT stablecoin; but the company has been steadily diversifying in anticipation of cuts regressing rates to the mean

What happened: Binance offers “crypto as a service” to TradFi institutions

How is this significant?

- Leading crypto exchange Binance is capitalising on the resurgent asset class by lending its native expertise to TradFi firms seeking greater exposure

- Industry publication TheBlock reported the launch of a new “Crypto-as-a-Service” (CaaS) white label infrastructure for institutions, allowing financial firms and brokerages to “seamlessly offer crypto trading services to their clients”

- In a Monday press release, Binance listed several key value propositions, including internalised liquidity, access to Binance’s liquidity and markets, institutional dashboards, client management tools, and integrated tools for custody and compliance

- Crucially, the service allows institutions to maintain their client-facing control; “Institutions retain full control of the front end—their brand, client relationships, and user experience—while Binance powers the back end: supporting trading, liquidity, custody, compliance, and settlement”

- Binance Head of VIP & Institutional Catherine Chen commented “The demand for digital assets is growing faster than ever, and traditional financial institutions can no longer afford to be on the sidelines. However, building crypto capabilities from scratch is complex, costly, and can be risky. That’s why we created Crypto-as-a-Service—a turn-key solution that provides institutions with trusted, ready-made infrastructure”

- Early access launches at the end of the month, initially “reserved for established, licensed banks, brokerages, and exchanges that meet the scale requirements for CaaS”

What happened: Crypto asset exchange Kraken in investor talks at potential $20bn valuation

How is this significant?

- Although operating at rather more modest levels than Tether’s headline-hogging raise, crypto exchange Kraken is also undertaking a significant raise, with an eye to going public

- Reports state the exchange is raising at a $20bn valuation “as the company steps up capital-raising efforts ahead of a potential public listing”

- Discussions with a potential strategic investor are allegedly targeting between $200m and $300m at the above valuation

- Notably, this fresh raise and $20bn valuation followed just days after Kraken closed a $500m funding round valued at $15bn

- This indicates sustained interest in the firm, and securing early exposure following recent successful industry IPOs

- Kraken was founded in 2011, making it one of the oldest and most-established digital asset exchanges; until this year, its total lifetime capital raise stood at only $27m

- Recent financial results also showcased a healthy performance, including $411m in Q2 revenue and nearly $80m in post-Ebitda earnings

- Bloomberg sources say that Kraken plans its IPO for early next year, with Goldman Sachs and Morgan Stanley assisting in the process

What happened: Stablecoin news

How is this significant?

- Nine major European banks joined forces this week, announcing a Euro-denominated stablecoin aimed at challenging extant US Dollar-denominated hegemony within the sector

- Whilst the ECB pushes ahead with plans for a digital Euro CBDC, and previously warned that the rise of stablecoins could “dollarise” and undermine Eurozone monetary policy, it appears that the private sector wants to directly challenge USD stablecoins

- According to industry publication Coindesk, the MiCA-compliant stablecoin is expected in the second half of 2026,

- The banks involved span a wide range of European countries, and include:

Unicredit

ING

Banca Sella

DekaBank

CaixaBank

KBC Group

Danske Bank

SEB

Raiffeisen Bank

- Floris Lugt, digital assets lead at ING stated “Digital payments are key for new euro-denominated payments and financial market infrastructure. They offer significant efficiency and transparency, thanks to blockchain technology’s programmability features and 24/7 instant cross-currency settlement. We believe this development requires an industry-wide approach, and it’s imperative that banks adopt the same standards”

- Earlier this week, ECB board member Francois Villeroy de Galhau voiced his concerns that Europe could lag behind the US; “The possible risk for Europe is being confronted with a quasi-currency—a dollar stablecoin—that is private and issued non-European players… The debate is just beginning for now, yet it is essential for the future of European sovereignty”

- According to a new report by Citi analysts, the stablecoin market could grow to between $1.9tn and $4tn by 2030, up from current levels below $300bn

- This prediction revised an earlier forecast from the bank, which placed the range between $1.6tn and $3.7tn

- Citi also predicted a rise in “bank tokens” such as tokenised deposits, and argued that “A small migration of traditional banking rails on-chain… could push bank token turnover beyond $100tn by the end of the decade”

- The Financial Times reported that USDC issuer Circle is examining the possibility of reversible transactions

- Company president Heath Tarbert told the paper they are “thinking through … whether or not there’s the possibility of reversibility of transactions”, arguing that “allowing transactions to be refunded in case of fraud or disputes, similar to what is possible in TradFi, would help push stablecoins into the mainstream”

- Although the move could prove popular with institutions, it would risk alienating a large portion of the crypto-native audience, as immutability and decentralisation are viewed as foundational aspects of blockchain by many

- In stablecoin-adjacent news, Qatar’s QNB Group switched to JP Morgan’s Kinexys (formerly Onyx) blockchain system for US Dollar payments processed by its home bank, “as mainstream adoption of the technology underpinning crypto assets gains steam”

- In a joint statement, the banks said that using blockchain cuts business transaction times down to minutes, as opposed to traditional banking rails limited to weekdays and taking above 24 hours

- QNB transactional banking VP Kamel Moris commented “Now we can have a 24/7 service window, we can guarantee payments as fast as in two minutes. It’s a treasurer’s dream”

- Meanwhile, Bloomberg reported that banking infrastructure firm SWIFT is “building a blockchain-based ledger for financial firms”

- According to the article, SWIFT is working alongside Ethereum-centric developers Consensys, and “has kicked off work to design and build the ledger with more than 30 global financial institutions including JPMorgan, HSBC, Bank of America and Deutsche Bank”

- Federally-chartered bank Anchorage is more than doubling the headcount of its stablecoin division, supporting the launch of Tether’s US-compliant stablecoin USAT

- Anchorage will act as the coin’s official issuer, whilst Cantor Fitzgerald undertakes the custody duties

What happened: Australia proposes rules for crypto industry

How is this significant?

- Australia unveiled its draft legislation for digital assets on Thursday, including rules and regulations to tackle industry misbehaviour

- Under the proposed regime, rule breaches can result in fines up to 10% of annual turnover (not profit), and all crypto exchanges operating in the country must hold an Australian Financial Services Licence

- The Treasury’s draft is open to industry comment for a month, and Coinbase APAC MD John O’Loghlen already commented “Clear, fit-for-purpose regulation will support economic growth, increase choice for consumers, and ensure Australia remains competitive globally. We look forward to working constructively with government and industry as the legislation progresses”

- Other rules are primarily concerned with custody, including exchanges, brokers, and stablecoin issuers

- Over in Turkey, the government may extend powers to its financial watchdog Masak, allowing it to freeze both banking and crypto accounts on suspicion of money laundering

- If the proposed bill passes, Masak “could also impose transaction limits, suspend mobile banking accounts and blacklist cryptocurrency addresses tied to crime”

- In the US, new SEC chief Paul Atkins reaffirmed crypto as his number one priority and declared plans for an “innovation exemption” by year’s end to help the industry launch products with less red tape

- Acting CFTC chair Caroline Pham declared “the turf war is over” between her agency and the SEC, voicing her enthusiasm for cooperation and progress at a joint-roundtable hosted by both regulators

- Under the previous administration, the SEC and CFTC often clashed on classifications, whereas the more pro-crypto Republican-led legislative effort has ushered in collaboration between the two

- Adrienne Harris stepped down from her role as superintendent at the NYDFS, after spending four years working on New York’s oversight and enforcement of digital assets

What happened: Funding news

How is this significant?

- Numerous institutions in the crypto space either raised or dispersed significant funds this week, in a mix of VC and corporate strengthening activity

- Blockchain analytics firm Elliptic this week secured a strategic investment from HSBC, making it the only company in its field with support from four global systemically-important banks (HSBC, JP Morgan, Santander, Wells Fargo)

- HSBC’s Richard May joins Elliptic’s board as part of the deal, and stated “With the rapid evolution of digital assets, mitigating financial crime risks has never been more important. Elliptic’s solution provides HSBC with greater transparency, helping to meet rising regulatory expectations and industry standards”

- Theta Capital Management is raising $200m for a blockchain fund-of-funds focused on early-stage investment

- This marks the company’s sixth blockchain-focused fund, with an investor deck targeting a 25% net internal rate of return across a maximum 15 separate investments

- Theta was founded in 2001, but switched its focus to blockchain and digital assets in 2018, now managing $1.2bn

- British blockchain payments firm Fnality closed a $136m investment round with heavy involvement from financial institutions

- Investors included Bank of America, Citi, KNB, and Singaporean sovereign wealth fund Temasek Holdings

- CEO Michell Neal told Bloomberg the funding would further develop the firm’s payments infrastructure, and “advance regulatory approvals in key markets”

- Morgan Stanley led a $104m round at a unicorn valuation for crypto and stablecoin infrastructure provider ZeroHash

- This aligned with Morgan Stanley’s announcement this week that ZeroHash will serve as technology partner for rolling out crypto trading to the bank’s E*Trade customers

- Morgan Stanley head of wealth management Jed Finn told Bloomberg that trading will launch with Bitcoin, Ether, and Solana; “The underlying technology has been proven and blockchain-based infrastructure is obviously here to stay… Clients should have access to digitised assets, traditional assets and crypto assets, all in the same ecosystem that they’re used to”

- The Series D-2 round also included participation from Apollo, Jump Crypto, and SOFI, amongst others

- Reports from South Korea suggest that leading local exchange Upbit is being acquired by internet and media giant Naver

- The deal would likely be executed via a stock swap, and shares in Naver jumped 7% after the report was first published in crypto-enthused Korea

What happened: Crypto Treasury news

How is this significant?

- New data this week revealed a recent cooling of Bitcoin treasury activity, albeit with September marking a recovery from a stark drop-off in Bitcoin buying during August

- Digital asset treasuries have raised more than $44bn this year, but the Wall Street Journal reported regulatory scrutiny of several firms, regarding suspicious trading ahead of treasury strategy announcements

- Institutional Bitcoin firm NYDIG called for companies to drop the commonly-used mNAV metric (i.e. market cap divided by crypto held) for treasury companies, arguing that it can be disingenuous

- The firm claims the metric often assumes shares outstanding, and “it fails to account for operating businesses or other assets that a digital asset treasury firm may own. Most major Bitcoin treasury firms do, indeed, operate businesses that add value”

- Leading Bitcoin treasury firm Strategy (formerly MicroStrategy) made another of its traditional weekly purchases, adding a comparatively modest $22m worth of Bitcoin to its balance sheet

- Top Ether treasury firm BitMine increased its holdings of the second-largest digital asset to 2.65 million Ether, representing a weekly buy of around $962m

- BitDigital announced a $100m convertible note offering to fund more Ether purchases, following its shift from Bitcoin mining operator to a “pure play Ether staking and treasury company”

- PayPal head of capital markets David Knox made the shift from TradFi to DeFi(ish), joining digital asset treasury firm Hyperion as its new CFO

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.