Market Overview

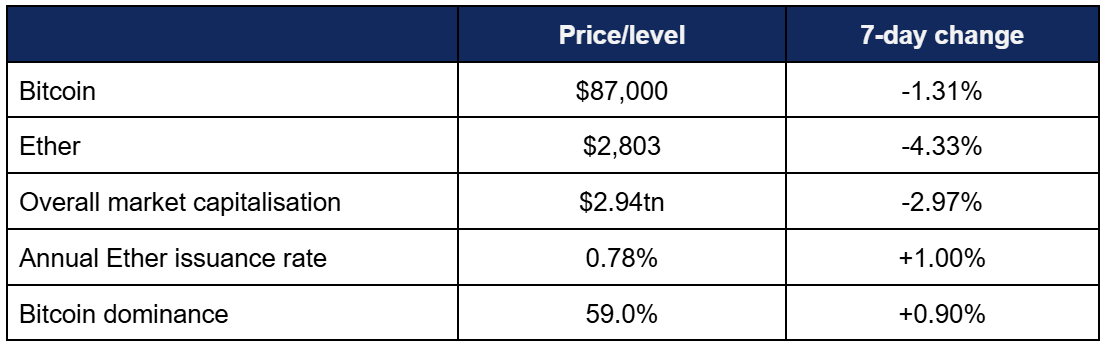

- Bitcoin fared well for most of the week, before experiencing its worst day since March 2025, as markets moved sharply into risk-off mode following news around increased interest rates on Japanese bonds

- Overall, Bitcoin fell around 17% in November, marking the year’s second-worst month after February

- However, Bitcoin’s performance in the latter stages of the month appeared positive; it hit a weekly high of $92,610 on Wednesday (26/11), spending the majority of the week trading above the $90,000 mark

- It dropped as low as $84,290 on Monday (01/12) in the aftermath of the macroeconomic fallout

- Ether performed similarly, climbing back above $3,000 for a Friday (28/11) peak of $3,093, before falling to $2,725 on Monday (01/12)

- Overall market capitalisation dropped below $3tn, but remained above the lows from a fortnight ago

- According to industry monitoring site DeFi Llama, total value locked in DeFi decreased $3bn to $114.5bn

Digital assets suffered from a late macro-driven reversal after performing positively throughout the majority of the week. Vanguard announced its arrival in the crypto space after previously dismissing the asset class, BlackRock disclosed record Bitcoin revenues and touted tokenisation, numerous companies including Klarna joined the stablecoin wave, and much more.

What happened: ETF News

How is this significant?

- Digital asset investment products broke their recent streak of outflows, attracting fresh capital for the first time in five weeks

- According to Coinshares data published on Monday, net outflows across all crypto asset funds amounted to $1.09bn in the trading week ending Friday the 28th – despite truncated US trading thanks to the holiday

- This market pause led to lower overall trading volumes around $24bn; a steep drop from last week’s record $56bn

- Coinshares Head of Research James Butterfill spotlighted a “turnaround in sentiment following FOMC member John Williams comments stating monetary policy remains restrictive, raising hopes for an interest rate cut this month”

- Spot Bitcoin ETFs registered three days of inflows (of which one hit nine figures) versus one day of outflows, flipping recent momentum

- Despite this, BlackRock’s market-leading IBIT fund once again netted overall losses, registering two days of (low) nine-figure outflows, whilst posting a maximum daily gain of $83mn

- The week’s best performer was thus Fidelity’s FBTC, which added $171mn on Tuesday (25/11); counteracting outflows across other funds to give the spot Bitcoin complex a daily gain of $128mn

- The next-best performer was ARK Invest’s ARKB, which added $88mn when markets reopened on Friday

- Spot Ether ETFs posted a clean four-day streak of inflows last week, bucking the trend of a negative November

- Inflows approached (but didn’t quite hit) nine figures, with BlackRock’s ETHA accounting for the vast majority of fresh capital, followed by Fidelity’s FETH (which marginally outperformed ETHA on Tuesday)

- Most other funds posted net zero flows throughout the week, except for Grayscale’s 0.15% fee mini-ETF which posted consistent modest daily gains

- In other ETF news, Nasdaq filed to raise the position limits for IBIT options to 1,000,000 contracts – up from a tenfold rise to 250,000 contracts in July

- This makes IBIT “the biggest Bitcoin options market in the world by open interest” according to Bloomberg Chief ETF analyst Eric Balchunas

- Bloomberg believes “Institutional behaviour is driving the transition” as large investors stick to regulated products over direct personal holdings

- JP Morgan filed a prospectus for a new structured note product, based on BlackRock’s successful IBIT ETF

- This “essentially allows investors to wager on the future price of Bitcoin… using IBIT as the vehicle” rather than directly holding the underlying asset themselves

- The notes will set a specific price level for IBIT next month. After a year, if IBIT trades above or at parity to those levels, “notes will be automatically called, and investors will receive a guaranteed minimum return of 16%”

- On the flipside, if IBIT trades lower, investors ride it out until 2028; with a potential bonus if it exceeds the new set price by the end of that timeframe

- Additionally, Grayscale moved to launch the first spot ETFs for Chainlink; a major blockchain oracle project (i.e. a service ensuring that data feeding into smart contract executions correctly reflects real-world conditions and events)

- The fund will trade on NYSE Arca, tied to the performance of the LINK token

- Issuer Bitwise amended its filing for a spot Avalanche ETF (tied to the AVAX token), in order to integrate staking

What happened: Vanguard opens up access to digital asset investments

How is this significant?

- In some ETF news significant enough to stand aside from the regular roundup, $11tn asset management goliath Vanguard reversed course and approved crypto asset trading (via regulated funds) on its platform

- Vanguard currently boasts around 50 million brokerage accounts, indicating the potential scope of this development

- This follows rumours from September that the company was considering a revision to its crypto position

- When spot Bitcoin ETFs began trading last January, they were a notable absentee from Vanguard’s trading platform, as they believed Bitcoin “has no place in a long-term portfolio and doesn’t represent a store of value”

- On Monday however, Vanguard’s Head of Brokerage and Investment Andrew Kadjeski stated that “Crypto asset ETFs and mutual funds have been tested through periods of market volatility, performing as designed while maintaining liquidity. The administrative processes to service these types of funds have matured; and investor preferences continue to evolve”

- Indeed, Bloomberg believes that “Persistent demand – retail and institutional – has spurred Vanguard’s about-face”, as rival BlackRock’s IBIT fund broke numerous records for performance and AUM over the last two years

- Beginning today, Vanguard will open up access to ETFs and mutual funds dedicated to digital assets “including Bitcoin, Ether, XRP, and Solana”

- Whilst Vanguard is opening up access to existing funds, it confirmed once again that it has no plans to launch any crypto products of its own

- As the world’s second-largest asset manager (first in mutual funds and second in ETFs after BlackRock), the word of Vanguard carries a lot of weight in institutional investment; and the reversal marks the latest financial heavyweight to reassess digital assets after prior criticism, following the likes of JP Morgan

What happened: Bitnomial launches first CFTC-regulated spot crypto trading

How is this significant?

- Chicago-based derivatives exchange Bitnomial will soon roll out the first spot crypto trading platform regulated by the CFTC, following approval last Friday

- According to analysts, this means that “investors can trade leveraged spot products on a CFTC-regulated exchange without waiting for Congress to expand the agency’s authority over spot commodities”

- The move capitalises on the CFTC’s “crypto sprint” initiative, and will allow the exchange to trade non-leveraged assets as well as leveraged

- Industry publication Coindesk said “the approval opens the door for customers to buy, sell and finance digital assets directly on a federally regulated commodities exchange – a first in the US market”

- It added that the move “could pave the way for other exchanges that hold designated contract market (DCM) status, including Coinbase and prediction market venues like Kalshi and Polymarket”

What happened: Predictions market news

How is this significant?

- Top predictions markets Kalshi and Polymarket both featured in reporting this week concerning their blockchain and digital asset integrations

- Despite the negative November across the wider digital asset space, prediction markets posted record months with $10bn total volume

- Kalshi posted $5.8bn volume (up 32% from the previous month), whilst Polymarket $3.74bn (up 24%) according to data from industry platform TheBlock

- This concluded a month of multi-billion fundraising for the industry leaders, which included Kalshi doubling its valuation within weeks

- On Monday, CNBC reported that Kalshi is increasing its blockchain integration via tokenised wagers, as part of a concerted effort to court crypto traders

- It will do so on popular smart contract blockchain Solana, unlike its rival Polymarket which (as its name suggests) lives on Ethereum layer-2 scaling solution Polygon

- The company’s head of crypto, John Wang, told CNBC “There’s a lot of power users in crypto. This is about tapping into the billions of dollars of liquidity that crypto has, and then also enabling developers to build third party front ends that utilise Kalshi’s liquidity”

- According to the report, “Decentralised finance protocols DFlow and Jupiter will serve as institutional clients, bridging the exchange’s off-chain orderbook to Solana’s liquidity”

- Kalshi needs to act quickly in order to secure mindshare within the US; a press release last week confirmed that Polymarket secured CFTC approval for a return to the country, “to operate in a way that reflects the maturity and transparency that the US regulatory framework demands”

What happened: BlackRock executive reveals Bitcoin as top revenue source

How is this significant?

- According to a BlackRock executive speaking at a recent blockchain conference in Brazil, the company’s crypto ETFs aren’t just a big success; they are its greatest success

- BlackRock Brazil business development director Cristiano Castro confirmed that its Bitcoin ETFs “have become the firm’s most profitable product line”

- Its market-leading IBIT fund reached around $100bn AUM in October before a sharp pullback to nearer $70bn as macro conditions soured after president Trump unsettled global markets with new tariff threats

- BlackRock manages over $13.4bn and 1,400 ETFs, making the scale of this achievement all the more remarkable

- Castro commented “When we launched, we were optimistic… but we didn’t expect this scale”

- Although the US-based IBIT fund is its most famous ETF, Castro stressed that the revenues also included the firm’s other Bitcoin ETPs, such as Brazil’s IBIT39

- BlackRock is backing its own funds with action; its in-house mutual fund boosted its IBIT exposure by 14% since June, according to its latest SEC filings

What happened: Tokenisation news

How is this significant?

- Writing in The Economist this week, BlackRock CEO Larry Fink and COO Rob Goldstein praised tokenisation as “the next major evolution in market infrastructure”

- This continues a long-running endorsement from Fink, a vocal proponent of blockchain tokenisation for the last few years

- In their guest editorial, the executives wrote that tokenisation “makes it possible for almost any asset, from real estate to corporate debt or currency, to exist on a single digital record that participants can independently verify”

- They admitted that “At first it was hard for the financial world – including us – to see the big idea… But in recent years traditional finance has seen what was hiding beneath the hype: tokenisation can greatly expand the world of investable assets beyond the listed stocks and bonds that dominate markets today”

- Whilst singing the praises of tokenisation throughout, both Fink and Goldstein urged the development of new regulatory guardrails in order to encourage adoption of the technology

- They identified two key benefits; instant processing, and reduced friction (replacing cumbersome paper bookkeeping, and enabling fractionalised ownership); thus “broadening participation in markets long dominated by large institutions”

- Fink believes that there remains significant room for growth; “If history is any guide, tokenisation today is roughly where the internet was in 1996 – when Amazon had sold just $16mn-worth of books, and three of the rest of today’s “Magnificent Seven” tech giants hadn’t even been founded”

- Backing up this perception of potential, Securitize – BlackRock’s tokenisation partner on its successful BUIDL fund – received full EU regulatory approval to launch a digital trading and settlement system this week

- Following this regulatory endorsement, Securitize is now “the only firm authorised to operate licensed tokenised securities infrastructure in both the EU and the United States” according to Coindesk

- The new platform will be built on the Avalanche blockchain, tokenising TradFi assets such as funds, equity, and debt

- Securitize CEO Carlos Domingo commented “This approval connects two of the world’s biggest financial markets. Now, issuers and investors on both sides of the Atlantic can engage in digital finance under one compliant framework”

What happened: Stablecoin news

How is this significant?

- The stablecoin sector saw a flurry of activity and reporting over the past week, as it continued its standout success performance this year against the backdrop of other crypto assets dropping

- In its new State of Crypto 2025 report, VC giant Andreessen Horowitz (a16z) wrote that “stablecoins went mainstream” this year and are now a global macroeconomic force”

- Numerous reasons were cited for this assessment, including “More than 1% of all US Dollars now exist as tokenized stablecoins on public blockchains, and stablecoins are now the #17 holder of US Treasuries, up from #20 last year – ahead of Saudi Arabia, South Korea, Israel, and Germany”

- It noted that “On an adjusted basis – a measure of organic activity that attempts to filter out bots and other artificially inflationary activity – stablecoins have done $9tn in the last 12 months, up 87% from a year ago. This is more than five times PayPal’s throughput, and more than half of Visa’s”

- A16z identified stablecoins as a means of strengthening dollar dominance despite rising US national debt

- Internet payment giant Klarna announced the development of its own stablecoin, to be deployed on the Tempo blockchain

- In a press release, Klarna CEO Sebastian Siemiatkowski stated “we can challenge old networks and make payments faster and cheaper for everyone. Crypto is finally at a stage where it is fast, low-cost, secure and built for scale. This is the beginning of Klarna in crypto, and I’m excited to work with Stripe and Tempo to continue to shape the future of payments”

- It appears that Klarna will deepen its digital asset involvement, as the release added “This is the beginning of Klarna publicly sharing crypto initiatives. We will reveal our next partner in the coming weeks”

- Japan’s Nikkei press agency reported that Sony (via its banking subsidiary) is launching its own stablecoin for payments related to gaming and entertainment services

- The coin will be pegged to the US Dollar, and aimed at US consumers of Japanese pop culture, “replacing or supplementing credit-card payments and reducing associated transaction fees”

- Stablecoin issuer Paxos acquired digital wallet startup Fordefi in a $100mn deal, bolstering its DeFi presence

- Paxos CEO Charles Cascarilla told Fortune “We have customers that want to be able to access DeFi and have the right capacity to do that… We certainly hear it all the time”

- Reversing the previous paradigm, crypto wallet firm Exodus bought payment firms Baanx and Monavate for $175mn

- Coindesk reported that “the deal allows Exodus to become one of the few self-custodial wallets to control the end-to-end payments experience”, and will enhance its power in the stablecoin-payment space

- In the regulatory sphere, the Federal Reserve’s Michelle Bowman told the House Financial Services Committee that the Fed is establishing new rules for banks and stablecoins

- She also highlighted inter-agency efforts to “develop capital and diversification regulations for stablecoin issuers as required by the GENIUS Act”

- US Bancorp (via US Bank) is looking to leverage the aforementioned GENIUS Act, and began testing its own stablecoin on the finance-centric Stellar blockchain

- US Bank SVP Mike Villano told Bloomberg “Out-of-the-box stablecoins provide faster, cheaper, 24/7 payment… But for bank customers, we had to think about other protections around know-your-customers, the ability for online transactions, the ability to claw back transactions”

- Meanwhile in South Africa, the central bank flagged crypto and stablecoins as an emerging financial risk due to “the lack of a complementary and full regulatory framework, which is not possible at the moment… [until we progress on regulatory efforts] we do not have sufficient oversight”

What happened: Binance launches “bespoke” service for UHNW customers

How is this significant?

- Leading digital asset exchange Binance is capitalising on growing digital asset allocation amongst the ultra-wealthy; by launching a new bespoke service dubbed “Binance Prestige”

- According to a press release, “Binance Prestige addresses the friction encountered by TradFi sophisticated clients after they have made the strategic decision to allocate to crypto”

- The service is aimed at family offices, private funds, and other asset allocators, according to Binance Institutional head Catherine Chen

- She said “We see family offices and investors with a more traditional background that are very curious about crypto… A repeated pain-point for wealthy yet cautious investors is having to jump through multiple hoops to become a crypto client, rather than being guided directly with the type of hand-holding these sort of investors expect”

- Chen also highlighted areas like inheritance planning as possible additions to the Binance Prestige offering

- She added that helping the wealthy access crypto is one of the sector’s strongest areas of growth, particularly in the Middle East and Asia; indeed, a recent survey by Avaloq found that over half of wealth management professionals identity digital assets as a key source of client engagement, up from around 44% last year

What happened: Crypto Treasury news

How is this significant?

- Leading Bitcoin treasury firm [Micro]Strategy—currently under pressure due to Bitcoin’s recent bearish performance—announced further Bitcoin purchases this week, alongside a new $1.44bn US Dollar reserve

- The US Dollar reserve supports interest on debt and dividends on preferred stocks, according to a regulatory filing

- Weekly Bitcoin purchases amounted to 130 Bitcoin for $11.7m; an amount engineered to bring its holdings to exactly 650,000 Bitcoin

- The firm said the cash reserve covers at least 21 months of dividends, but shares fell sharply on Monday in line with Bitcoin decline

- Leading Ether treasury firm BitMine added around 97,000 Ether to its holdings over the last week, as it likewise continues to suffer in the stock market due to recent declines in underlying treasury asset values

- These acquisitions represented an increase on last week’s, as chairman Tom Lee identified a forthcoming Ethereum network upgrade and predicted macroeconomic shifts as potential cause for optimism

- Lee believes in an imminent end to quantitative tightening, whilst Ethereum’s December 3rd Fusaka Upgrade is expected to increase scalability and security on the blockchain

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.