Market Overview

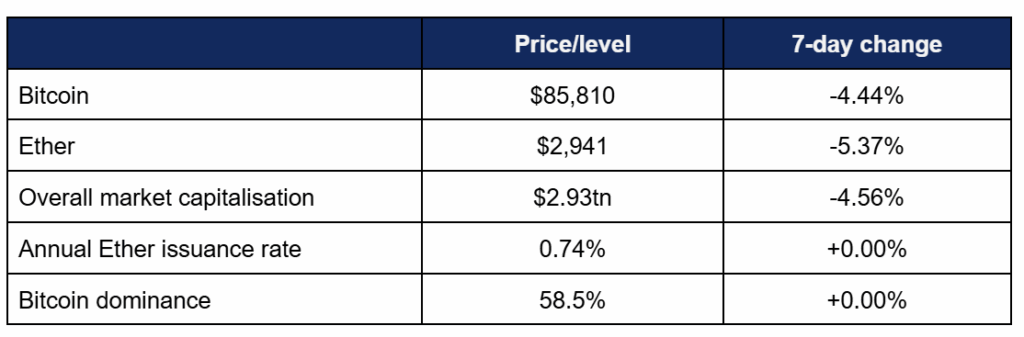

Digital assets experienced a mixed week of trading, with strong early trading before a sharp pullback on Monday (15/12) led to weekly losses.

- Bitcoin spent majority of the week trading around the $90,000 mark, with a couple of early breaks to the upside before a sharp break in Monday (15/12) trading led to overall weekly losses

- Bitcoin declined from a Tuesday (09/12) peak of $92,270 to a low of $85,600 in the early hours this morning (16/12)

- The recent downturn in performance could lead to Bitcoin’s first split from stocks in a decade, leading analysts at Standard Chartered and Bernstein to revise timeframes on their previous price predictions

- Ether exhibited more momentum than Bitcoin in early trading, before similarly pulling back and experiencing a significant reversal on Monday

- Ether achieved a weekly high of $3,428 on Wednesday (10/12), before lows of $2,910 early today

- Overall market capitalisation fell below $3tn once again, from an intraweek high of $3.22tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi fell slightly to $118.3bn

Digital assets exhibited mixed performance, as strong early trading gave way to a late pullback after a significant slide on Monday. Despite a return to bearish momentum, news of adoption remained strong; JP Morgan launched its own tokenised money market fund on the public Ethereum blockchain, Interactive Brokers integrated stablecoins for customers, and global adoption and expansion continued as the tokenisation and stablecoin sectors in particular were abuzz with activity.

ETF News

What happened?

- Digital asset investment products logged their third consecutive week of inflows, as investor optimism grew cautiously

- According to Coinshares data published on Monday, net inflows reached $864m in the trading week ending Friday the 12th, up from last week’s $716m

- Coinshares Head of Research James Butterfill noted that the trend was positive, but not yet indicative of a return to full bullishness; “Despite the recent interest rate cut by the US Federal Reserve, price performance has been subdued, with trading days following the cut showing mixed sentiment and uneven flows”

- Spot Bitcoin ETFs showcased this mixed sentiment by returning three days of inflows and two days of outflows; but positivity prevailed as two inflow days exceeded nine figures

- Fidelity’s FBTC led the way for daily inflows, adding $199m on Tuesday (09/12), with BlackRock’s IBIT a close second at $193m the day after

- IBIT however led in overall weekly flows, with four positive days, of which three accrued more than $50m

- These two funds dominated the weekly figured, as no other fund added more than $34m in a day

- Spot Ether ETFs also registered three days of inflows (including one day at nine figures), from Monday through Wednesday

- BlackRock’s ETHA, Fidelity’s FETH, and Grayscale’s 0.15% fee mini-ETF were the best performers, each managing daily inflows above $45m, when no other funds managed more than $18m

- Although inflows were comparatively modest, outflows were even more so as most funds stayed net neutral – the only ETFs to register more than $10m in daily outflows were Grayscale’s 2.5% and 0.15% fee products

- In other ETF news, issuer Bitwise filed an amendment to its Hyperliquid token ETF, leading analysts to interpret it as a signal of likely future approval

Tokenisation News

What Happened?

- Tokenisation efforts continued to accelerate globally with several new developments, including some at nation-state level

- Reuters reported a new Memorandum of Understanding between Pakistan’s finance ministry and leading crypto exchange Binance, to explore tokenising up to $2bn of state assets

- According to the report, potential areas for tokenisation include “Pakistan’s sovereign bonds, treasury bills, and commodity reserves including oil, gas, and metals”

- Finance minister Muhammad Aurangzeb spoke of “long-term partnership” with Binance and said “the next step for us is execution, and we are fully committed to delivering results with speed and quality”

- Binance Founder (and Pakistan’s national crypto advisor) Changpeng Zhao called it “a great signal for the global blockchain industry and for Pakistan”

- The news came just one day after the country’s Virtual Asset Regulatory Authority Chairman Bilal Bin Saqib told industry publication Coindesk that Pakistan plans to accelerate adoption, increase Bitcoin mining and issue a national stablecoin

- Nearby nation Bhutan launched a tokenised gold token (TER) on the Solana blockchain, issued by Gelephu Mindfulness City and custodied by DK Bank

- The move is supported by government policy (Bhutan was early to leverage surplus electricity production for Bitcoin mining), and preceded news of an MoU with Cumberland DRW “to build a responsible digital asset ecosystem” including stablecoin issuance

- Meanwhile, global exchange Coinbase plans to launch tokenised equities, alongside an entry into predictions markets

- According to Bloomberg sources, tokenised stocks will be created and issued in-house, rather than through any third-party partnerships

Stablecoin news

What Happened?

- The stablecoin space once again featured numerous news stories, as the category continues its run as one of crypto’s big winners of the year

- Malaysian stablecoin plans emerged from multiple sources, including a royal family and one of the country’s best-known businessmen

- Ismail Ibrahim, son of the Sultan of Johor, unveiled a Malaysian Ringgit-pegged stablecoin called RMJDT, issued by his firm Bullish Aim, and backed by cash deposits and short-term government bonds

- Bullish Aim chair Leon Peh stated “Our vision is for this stablecoin to become the standard for crypto-based payments in Malaysia – empowering businesses, consumers, and innovators with a faster, safer and more efficient way to transact”

- Bullish Aim will issue the coin on the Malaysian-developed Zetrix blockchain, and stated plans to develop a digital asset treasury with an initial $121m investment in Zetrix tokens

- Meanwhile, local billionaire businessman and AirAsia founder Tony Fernandes signed a letter of intent with global bank Standard Chartered to develop a separate Ringgit-pegged stablecoin

- Fernandes said the move “marks a significant milestone in our transformation from an aviation-centric group into a trusted, technology-led ecosystem”

- Elsewhere in Asia, Kyrgyzstan launched a gold-backed stablecoin (USKDG) with an initial $50m issuance

- Pegged to the US Dollar and active on the Tron blockchain, the tokens are issued by state-owned entity OJSC, according to Reuters reports

- Kyrgyz president Sadyr Japarov attended the launch ceremony, which was noted for the KYC/AML compliance of the new asset, designed to “increase financial inclusion”

- Reuters wrote that “the company responsible for managing USDKG’s gold reserves has outlined plans to expand the backing to $500m in the next phase, with a long-term target of $2bn”

- On Monday, payments giant Visa announced a Stablecoin Advisory Practice aimed at assisting banks and businesses in implementing stablecoin strategies

- Early clients include several credit unions, and Visa’s Head of Consulting & Analytics Carl Rutstein commented “Having a comprehensive stablecoins strategy is critical in today’s digital landscape. We are proud to help our clients stay agile and competitive as this space evolves at an unprecedented pace”

- Meanwhile, Moody’s proposed a stablecoin ratings framework akin to other finance writings, enabling consumers to assess the relative “quality” of competing coins

- According to the proposal, Moody’s “first evaluates each eligible type of asset in the pool of reserves backing a stablecoin, and [then] assesses the asset’s credit quality by using the rating of the asset and of associated counterparties”

- Additionally, Moody’s would “address market value considerations by estimating the market value risk of each eligible reserve asset depending on its type and maturity… [and] consider a stablecoin’s operational risk, liquidity risk, technology risk and other considerations to arrive at the assigned rating”

- Payment processor Stripe opened its stablecoin-centric Tempo blockchain for public trial, with VC partner Paradigm

- New participants include UBS, Kalshi and Cross River Bank, alongside existing trialists Deutsche Bank, Open AI and Anthropic

- Swedish fintech Klarna followed up its recent stablecoin development plans by revealing a partnership with Stripe-backed crypto wallet Privy

- The companies will collaborate to “power a new generation of crypto products for Klarna users”, including payments with stablecoins and other digital assets

- Japanese financial conglomerate SBI Holdings partnered with blockchain firm Startale Group to create a Yen-denominated stablecoin

- SBI chairman Yoshitaka Kitao commented “The transition to a ‘token economy’ is now an irreversible societal trend. By circulating it both domestically and globally, we aim to dramatically accelerate the movement toward providing digital financial services that are fully integrated with traditional finance”

- Startale CEO Sota Watanabe stated “In particular, we see enormous potential in enabling payments between AI agents and powering distributions for tokenised assets, both of which will soon become reality”

- In stablecoin-adjacent news, Norway’s central bank shelved plans for a CBDC, “cementing the conservative stance of Nordic authorities” as per analysts

- Governor Ida Walden Bache determined that existing systems were sufficiently efficient and secure, ruling out the need for any CBDC in the near future

- The UK Financial Conduct Authority is prioritising stablecoin payments as an area of focus in 2026, according to Chief Executive Nikhil Rathi

- The Guardian reported treasury plans to enact wider crypto regulation by 2027, after the government recently recognised digital assets as a third form of property

Crypto Treasury news

What Happened?

- Leading Bitcoin treasury firm [Micro]Strategy made another major Bitcoin buy this week, marking its largest acquisition since July with a $980m purchase

- This added 10,645 Bitcoin to its total holdings of 671,268 Bitcoin

- Strategy retained its place within the Nasdaq 100, but founder and chairman Michael Saylor publicly criticised MSCI’s potential plans to exclude firms with more than 50% digital asset-exposure from indexes as “misguided and harmful”

- Reports revealed that the Norwegian central bank now owns $1.18bn worth of Strategy shares, effectively using it as a proxy for Bitcoin exposure

- Leading Ether treasury firm BitMine added $320m worth of Ether to its coffers as chairman Tom Lee claimed “2025 saw many positive developments in digital assets… These strengthen our conviction that the best days for crypto are ahead and why we continue to accumulate Ether”

- Vivek Ramaswamy’s Strive outlined a new sales agreement for up to $500m of stock to further increase its holdings as a Bitcoin treasury company

What happened: JP Morgan joins tokenised fund race

How is this significant?

- Banking giant JP Morgan became the latest major institution to enter the tokenised fund space this week, joining the likes of BlackRock and Franklin Templeton

- The new My OnChain Net Yield Fund (MONY) is a tokenised money market fund and – despite JP Morgan running its own proprietary Kinexys blockchain – issued on the public Ethereum blockchain

- In a press release, JP Morgan declared it was the largest global bank to launch such a product on a public blockchain

- MONY will be seeded with $100m from the bank’s asset management division, before opening to qualified investors next week

- Investors will be able to redeem their investment in either cash, or in stablecoin form via Circle’s USDC

- JP Morgan Asset Management Head of Liquidity John Donohue told the WSJ “There is a massive amount of interest from clients around tokenisation. We expect to be a leader in this space and work with clients to make sure that we have a product lineup that allows them to have the choices that we have in traditional money-market funds on blockchain”

- He added that “Tokenisation can fundamentally change the speed and efficiency of transactions, adding new capabilities to traditional products”

- According to monitoring platform rwa.xyz, tokenised funds have grown from about $3bn AUM to $9bn over the last year

- The money market fund was the highlight of major activity from the bank within the space last week, spanning both TradFi and DeFi clientele

- JP Morgan arranged a bond issuance for Galaxy on the Solana blockchain, tokenising $50m of commercial papers to be redeemed in USDC

- Other participants in the deal included Franklin Templeton and Coinbase, who invested in the short-term debt instrument

- Scott Lucas, JPMorgan’s Head of Markets Digital Assets, told Bloomberg “It becomes less of a theoretical conversation. You really learn about what the benefit is of putting a bond on blockchain”

- Whilst the previous two items dealt with activity on the public blockchains, JP Morgan also secured activity on its proprietary (and privately-permissioned) Kinexys blockchain

- Specifically, BMW is now using Kinexys “to automatically transfer euros from its Frankfurt accounts when dollar balances in New York drop below a certain threshold”

- Stefan Richmann, Head of BMW Group Treasury, commented on the benefit of smart contracts, allowing transactions to be executed “based on predefined conditions without manual intervention”

What happened: Interactive Brokers allows funding via stablecoins

How is this significant?

- Speaking at a Goldman Sachs conference on Wednesday, Interactive Brokers Chairman Thomas Peterffy revealed that it will allow retail investors to fund their brokerage accounts with stablecoins, marking growing acceptance of digital assets

- The feature will be rolled out gradually according to a spokesperson, enabling clients to directly fund their accounts through crypto wallets, rather than via bank accounts

- Analysts identified the move as an attempt to remain competitive in an evolving market, competing with the likes of Robinhood (already a supporter of digital assets) and Charles Schwab (indicating spot crypto integration next year)

- Interactive Brokers indicated more details would be released as the feature rolls out to more users

- The company has ramped up its digital asset activity this year, entering predictions markets, leading a $104m investment round for ZeroHash, and exploring issuance of its own stablecoin

What happened: Brazil’s largest bank recommends Bitcoin allocation

How is this significant?

- In a recent research note, the investment arm of Itaú Unibanco (the largest private bank in South America) recommended Bitcoin allocation within portfolios for the “dual opportunity” of diversification and currency protection

- Itaú Asset Management Head of Beta Strategies, Renato Eid, wrote that “The idea is not to make crypto assets the core of the portfolio, but rather to integrate them as a complementary component. The goal is to capture returns uncorrelated with domestic cycles, partially protect against currency devaluation, and add potential for long-term appreciation”

- The analyst recommended up to a 3% allocation, highlighting a lack of correlation with local assets enhancing Bitcoin’s role as a diversification tool

- This sits right between some other recent recommendations by major institutions

- Eid highlighted Bitcoin as a long-term investment opportunity, writing “It calls for moderation and discipline: set a strategic slice (for example, 1%–3% of the total portfolio), keep a long-term horizon and resist the temptation to react to short-term noise”

What happened: Andreessen Horowitz (a16z) expands crypto VC efforts into Asia

How is this significant?

- Andreessen Horowitz (a16z), one of the most significant venture capital players within the digital asset space, is expanding its global footprint with a new Asian headquarters in South Korea

- a16z Crypto CEO Anthony Albanese revealed that the continent “now represents a significant share of global crypto activity”, and that “over the coming years, we plan to grow our presence in Asia, [and] add new capabilities to support our crypto companies operating there”

- He identified South Korea as the second-largest crypto market (behind the US), with nearly a third of adults owning digital assets

- The new Seoul office recruited industry veteran SungMo Park as the new APAC lead, and “will work with founders by building partnerships, strengthening distribution channels, and accelerating community growth across the region”

- South Korea was also viewed as a hub of crypto development, helping it gain the edge over fellow Asian crypto hubs Singapore and Hong Kong, which focus more on banking and regulation

What happened: PNC opens digital asset trading for customers

How is this significant?

- PNC Bank launched Bitcoin trading services for its private banking clients, through a partnership with Coinbase

- High-net-worth clients can now buy Bitcoin via their investment accounts, making it “the first major [US] bank to launch direct Bitcoin access for clients” according to their own press release

- The bank will roll the service out further to institutional investors in early 2026, including endowments, foundations, and non-profits

- Chief investment officer Amanda Agati commented “It is not so much about our client base being big investors today, but they’re looking to us for an understanding of what these things are, how it works, and does it make sense in the longer term”

- This follows a series of European banks to introduce crypto trading services to clients, including BBVA, Santander, and Raiffeisenbank

- In other banking news, Standard Chartered and Coinbase expanded a partnership for crypto prime services, increasing Coinbase’s profile amongst Tradfi institutions

- Standard Chartered’s global head of financing Margaret Harwood-Jones said “We aim to explore how the two organisations can support secure, transparent and interoperable solutions that meet the highest standards of security and compliance”

- e-Bank Revolut partnered with crypto wallet provider Trust to enable self-custody for instant (zero fee) crypto buys via the bank’s app

- According to a press release, Trust Wallet users can “buy crypto using RevolutPay, debit or credit cards and bank transfers”, without having to transfer funds onto any centralised exchanges

- Five digital asset firms secured OCC approval to become National Trust Banks and perform bank functions, including BitGo, Ripple, Circle, Paxos, and Fidelity

- Banking industry executives met with legislators in Washington to provide input on the proposed CLARITY crypto market structure bill, which has now been delayed for debate until 2026

- Payment of interest on stablecoins is understood to be a particular sticking point for banks, as it could threaten their business models

- A new report from the OCC found that nine large US banks did indeed engage in “inappropriate action” akin to debanking between 2020 and 2023, for firms across a variety of sectors including crypto

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.