Market Overview

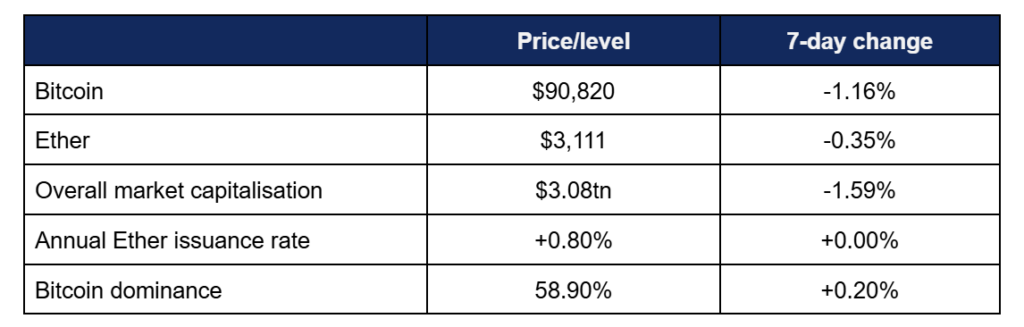

Digital assets performed strongly in early trading, with Bitcoin approaching $100,000 before retreating after a fresh set of tariff tensions.

- Bitcoin started strongly this week and appeared on course for a run back towards $100,000, before a new set of tariff (and potential conquest) threats from the Trump administration regarding Greenland led to widespread caution across markets and flight to “risk-off” assets

- It peaked at $97,670 on Wednesday, before falling sharply on Monday as global markets and traders reacted to the tariff tensions, front-running US markets which were closed for a public holiday

- Bitcoin eventually fell below $92,000, as the geopolitical uncertainty hit perceived risk-on assets, including the crypto industry, hitting a weekly low of $90,700 early on Tuesday

- Ether followed suit, peaking at $3,389 on Wednesday before a steep drop on Monday leading to an early Tuesday low of $3,109

- The Ethereum blockchain achieved record daily transaction volumes this week, boosted by recent improvements to its infrastructure that have lowered average transaction costs to the lowest levels since its public breakthrough

- Increase in stablecoin transactions was touted as a key factor behind these volumes, as Ethereum remains the number one platform for stablecoin issuance

- According to industry monitoring site DeFi Llama, total value locked in DeFi increased by over $2bn bn to $126.6bn

Digital assets began the week on a positive footing, with Bitcoin advancing toward $100k before renewed tariff threats and geopolitical tensions triggered a risk-off reversal. Despite this shift, institutional momentum continued to accelerate: crypto ETFs saw their strongest inflows in months, Ethereum hit record transaction volumes, and firms like State Street, NYSE and Goldman Sachs deepened their adoption of digital assets.

ETF News

What Happened?

- Digital asset investment products achieved (by far) their best inflows since October, although renewed tariff tensions led to some investor caution in late trading

- According to Coinshares data published on Monday, the trading week ending Friday the 16th recorded over $2.2bn in weekly inflows

- Coinshares’ Head of Research, James Butterfill, stressed that late outflows were primarily driven by diplomatic and macroeconomic concerns over US President Trump’s new Greenland threats, rather than any real shift in underlying demand for crypto assets

- Spot Bitcoin ETFs logged their best performance in nearly four months, as they added a cumulative $1.4bn between Monday and Friday

- This included four days of nine-figure inflows (between $117m and $841m), from Monday to Thursday, before a rapid reversal into outflows ($395m) on Friday as President Trump renewed claims around Greenland annexation and threatened a raft of new tariffs against European economies

- BlackRock’s market-leading IBIT dominated inflows, with three days featuring nine-figure flows, ranging between $126m and $648m

- Even when the market shifted strongly into outflow mode over the renewed Greenland threats, IBIT still managed to log modest inflows of $15m on Friday

- Fidelity’s FBTC also performed strongly, adding $351m on Tuesday and $125m on Wednesday, before shifting into outflows during the tail end of trading

- Other notable positive performances featured Bitwise’s BITB ($159m) and ARK Invest’s ARKB ($85m) on Tuesday

- Outflows on Friday were led by FBTC ($205m), BITB ($90m), and ARKB ($69m), as most other funds returned net zero flows

- Spot Ether ETFs returned five straight days of inflows, including three in the nine-figure range (between $130m and $175m)

- BlackRock’s ETHA led the week for inflows, but actually opened the week with $80m outflows – only just counteracted by strong performances from Grayscale’s two Ether funds

- ETHA hit a weekly high of $149m inflows on Thursday for the only nine-figure gain by a single fund, as gains were spread out amongst the wider fund complex

- Ether ETFs logged eight-figure gains at various points throughout the week including Grayscale’s ETHE and ETH (highs of $51m and $44m), Bitwise’s ETHW ($23m), and Fidelity’s FETH ($14m)

- In other ETF news, Bloomberg’s chief ETF analyst Eric Balchunas noted the filing of several new crypto-based products, including a variety of “stocks & Bitcoin” and “gold & Bitcoin” ETFs, alongside “Bitcoin & Bitcoin Treasury mNAV Harvester” and “Crypto & Crypto Treasury mNAV Harvester ETF” from IncomeQ

Investment and IPO news

What happened?

- Several companies in the crypto sector either secured or made major investments this week, as the industry continues to build for the future

- Anchorage Digital, the first federally-chartered digital asset bank, is raising up to $400m ahead of a potential IPO, according to Bloomberg reports

- Following passage of the GENIUS Act, Anchorage is approved to issue stablecoins, and has partnered with Tether on the latter’s new US-compliant USAT token

- The anonymous source told Bloomberg the bank is raising between $200m- $400m, and would mark its first funding round at this scale since a $350m Series D in 2021 led by KKR

- Post-quantum startup Project Eleven raised $20m in a Series A round led by Castle Island Ventures and Coinbase

- Quantum computing could vastly increase the computational power of hardware, and thus has caused concerns that it could break existing cryptography methods used to keep blockchains secure

- Project Eleven says it is “building the tools to make complex, multi-year migrations practical for networks and institutions, including readiness assessments, migration test environments and deployment sequencing”

- Brighty App founder Nikolay Denisenko revealed that wealthy individuals are increasingly using digital assets to purchase European real estate

- Denisenko says that his Lithuanian-based platform has brokered over a hundred deals, ranging from Cyprus and Malta, to the UK and France

- He said that blockchain analytics can perform the due diligence of property deals, and “Recently, we have started seeing our customers using euro stablecoins where previously they might have used USDC… if you deposit in USDC and you are buying something in Europe, you have a conversion cost. So, it’s more convenient to use EURC because you remove any exchange rate”

- Finally, leading Ether treasury company Bitmine Technologies made a substantial investment into Beast Industries, the company of social media influencer MrBeast

- Bitmine is investing $200m for a stake in the MrBeast empire, although the size of the stake was not disclosed

- In a press release, Bitmine chairman Thomas Lee stated “Beast Industries is the largest and most innovative creator-based platform in the world, and our corporate and personal values are strongly aligned”

Crypto Treasury news

What happened?

- Reporting on digital asset treasury firms was limited this week, as US markets were closed on Monday for the Martin Luther King Jr. Day public holiday

- Michael Saylor, chair of Bitcoin treasury firm Strategy (formerly MicroStrategy) suggested over the weekend that the firm would report more Bitcoin accumulation when markets reopened, and according to a recent survey, Strategy is “expected to stack 1 million Bitcoin” this year

- At a shareholder meeting, Bitmine chairman Thomas Lee said that the Ether treasury firm “anticipates generating over $400m in annual pre-tax income on its $13bn Ether (ETH) holdings”, and says it also “probably saved $400m” on Ether purchases over the last few months

What happened: State Street enters tokenisation space

How is this significant?

- One week after Morgan Stanley intensified its digital asset activity, multi-trillion dollar custody banking giant State Street also increased its footprint in the sector, with a focus on tokenisation

- In a Thursday press release, State Street announced the launch of its Digital Asset Platform; “a secure, scalable infrastructure for tokenised assets”

- Speaking on an earnings call the next day, State Street’s CEO, Ronald O’ Hanley, said “We are strategically positioning State Street to be the bridge between traditional and digital finance, and the connection point between digital asset platforms”

- According to the release, tokenised assets available on the platform will include money market funds, ETFs, “and cash products including tokenised deposits and stablecoins”

- Tokenised deposits are a particular area of interest among major banks at the moment, including JP Morgan and BNY Mellon, which recently extended its system onto the Canton blockchain

- Industry publication Coindesk confirmed that State Street is integrating with the wider blockchain ecosystem, rather than building a walled garden; “the platform includes wallet management, custodial services and digital cash capabilities, and is designed to operate across both public and permissioned blockchains”

- State Street’s Head of Investment Services, Joerg Ambrosius, stated that “This launch marks a significant step in State Street’s digital asset strategy… we’re enabling institutions to confidently embrace tokenisation as part of their core strategy with an organization like us that they can trust”

- Chief Product Officer, Donna Milrod, added “This platform… is secure, interoperable and integrated so institutions can scale with confidence, built on a client partnership model that ensures ongoing evolution in line with market needs and regulatory expectations”

- The move isn’t State Street’s first in the crypto space; Bloomberg notes it “already provides administration and accounting services for clients holding cryptocurrencies as well as for crypto ETFs. The new platform is a departure from merely providing such back-office support”

- In other news of banks and tokenisation, Société Générale’s SG-FORGE arm confirmed its collaboration with interbank messaging system SWIFT to “exchange and settle tokenised bonds using both fiat and digital assets”

- It carried out such a transaction using its own EURCV stablecoin, making it “the first MiCA (EU Markets in Crypto Assets regulation)-compliant stablecoin natively compatible with Swift”

- The interoperability trial (which also included participation from BNP Paribas Securities Services and Intesa Sanpaolo) “focused on key processes such as delivery-versus-payment (DvP) settlement, interest payouts and redemption of tokenised bonds with roles including paying agent, custodian and registrar”

- Thomas Dugauquier, Tokenised Assets Product Lead at Swift, commented “This milestone demonstrates how collaboration and interoperability will shape the future of capital markets… we’re paving the way for our customers to adopt digital assets with confidence, and at scale, creating a bridge between existing finance and emerging technologies”

What happened: Goldman Sachs confirms continued crypto asset interest

How is this significant?

- Speaking to investors around the bank’s recent fourth-quarter earnings call, Goldman Sachs CEO David Solomon confirmed ongoing research and development from the bank in the field of digital assets and blockchain

- On the call, he said the banking titan is “ramping up its research and internal discussions around crypto-adjacent technologies, including tokenisation and prediction markets”, according to Coindesk

- He was enthusiastic about the sector, telling investors “They’re both things that we have an enormous number of people at the firm extremely focused on: tokenisation, stablecoins”

- Blockchain-based and crypto-friendly prediction markets Polymarket and Kalshi were also (indirectly) mentioned, as Solomon said “I’ve personally met with the two big prediction companies and their leadership… We have a team of people here that are spending time with them… I can certainly see opportunities where they cross into our business, and we’re very focused on understanding that”

- He also confirmed Goldman was actively consulting on the CLARITY crypto market structure bill in Washington, as interest and yield on stablecoins proves a bone of contention between traditional banks and digital asset firms

- Although Solomon cautioned that greater adoption of crypto assets and stablecoins would take time, he concluded “I think they’re important, real, and we’re spending a lot of time [on them]”

What happened: Stablecoin issues delay Market Structure bill as Coinbase withdraws support

How is this significant?

- The long-awaited CLARITY crypto market structure bill may need to wait a while longer, as leading American digital asset exchange Coinbase withdrew its support, leading to the bill being delayed by the Senate Banking Committee

- Committee chair Tim Scott framed it as a delay to work out more details, rather than scrapping the bill (though some analysts are unconvinced) “I’ve spoken with leaders across the crypto industry, the financial sector, and my Democratic and Republican colleagues, and everyone remains at the table working in good faith… to deliver clear rules of the road that protect consumers, strengthen our national security, and ensure the future of finance is built in the US”

- As some analysts predicted, disagreement between banks and crypto companies regarding interest and yield on stablecoins (with the TradFi institutions favouring none whatsoever) led Coinbase CEO Brian Armstrong to deem the bill untenable

- Armstrong tweeted several perceived issues with the bill, including “A defacto ban on tokenised equities, DeFi prohibitions, Erosion of the CFTC’s authority, and draft amendments that would kill rewards on stablecoins, allowing banks to ban their competition”

- He added “this version would be materially worse than the current status quo. We’d rather have no bill than a bad bill”

- According to Bloomberg, Armstrong spent the day after the delay lobbying legislators, letting them know Coinbase is capable of continuing its stablecoin rewards payment program

- He confirmed that the stablecoin stance was the industry’s biggest issue with the bill, saying “We do think that Americans should be able to earn more money on their money, and the banks right now are worried about that – they’re worried they’re going to have to start paying higher rates to customers to compete”

- Banks have certainly been vocal in their opposition to (or at least concern over) stablecoin yields; PNC Bank CEO Bill Demchak stated on a Q4 earnings call that “I think banks are sitting here saying, if you want to be a money market fund, go ahead and be a money market fund. If you want to be a payment mechanism, be a payment mechanism. But money market funds shouldn’t be payment mechanisms, and you should pay interest”

- Meanwhile Bank of America CEO Brian Moynihan (also speaking on an earnings call) predicted that “$6tn in deposits” could move into stablecoins and stablecoin-linked products if they’re allowed to offer “yield-like returns”, putting pressure on the banking industry (though he says BoA “would be fine”)

- In other stablecoin news, payments are rapidly rising; new data revealed that monthly crypto card volume rose from roughly $100m in early 2023 to more than $1.5bn by late 2025, exceeding $18bn on an annualised basis

- Artemis Research noted in its report that “cards remain the dominant bridge for stablecoin spending because they require no new merchant integrations”, and “Visa’s stablecoin-linked card spend reached a $3.5bn annualised run rate in the Q4 2025, representing about 19% of total crypto card volume”

- Meanwhile in the UK, the Bank of England’s deputy governor Dave Ramsden stated that stablecoin holders may be entitled to deposit protections a la bank accounts

- During a speech in London, he said “trust in stablecoins may require some form of insurance scheme analogous to that which applies to bank deposits… To maintain trust in money, we are considering what failure arrangements are necessary for systemic stablecoins”

What happened: NYSE creates platform for tokenised stock trading

How is this significant?

- The New York Stock Exchange embraced the benefits of digital assets this week, confirming that it is building a blockchain-based platform for the 24/7 trading of tokenised stocks and ETFs

- NYSE said it would combine its existing order book technology with private blockchain networks and stablecoin settlements, on a new platform launching this year (pending regulatory approval)

- Company president Lynn Martin stated in a press release “We are leading the industry toward fully on-chain solutions, to marry trust with state-of-the-art technology. Harnessing our expertise to reinvent market infrastructure is how we’ll meet and shape the demands of a digital future”

- Michael Blaugrund, a VP at parent company Intercontinental Exchange (ICE), said “This reflects an evolution of NYSE’s trading capabilities… It allows for new types of investor accessibility, and will create new opportunities for retail to participate in the stablecoin-funded markets that have attracted their attention”

- He added that blockchain brought the benefits of non-stop trading, 365 days a year; “We think it aligns with the retail investor’s emerging desire to be able to trade something at 5:04 p.m. on a Saturday and then use that money to buy something else at 5:05 p.m. on a Saturday. This would facilitate that trade in a way that traditional equity infrastructure cannot”

- Blaugrund also said that the exchange is working with banks to integrate tokenised deposits, as part of “a broader re-platforming, in a longer journey for ICE and for the industry”

- Back in September, Nasdaq approached the SEC to allow trading of tokenised securities on its exchange, potentially giving it a first-mover advantage in the space

What happened: Chinese cross-border CBDC platform exceeds $55bn transaction volume

How is this significant?

- mBridge, a CBDC platform led by the People’s Bank of China, has now “processed over $55bn in cumulative cross-border transactions, a roughly 2,500-fold increase since 2022” according to new Atlantic Council data

- The Digital Yuan CBDC dominates the platform, accounting for approximately 95% of those volumes, alongside central banks from Hong Kong, Saudi Arabia, Thailand, and the UAE

- These volumes are no longer bolstered by the BIS, which exited mBridge trials in 2024 and is now pursuing its own Project Agora cross-border CBDC project

- In other international news, the Bermudan government said that it is working with Coinbase and stablecoin issuer Circle to create a “fully on-chain economy”

- Revealed at the World Economic Forum in Davos, Bermuda plans national-level integration of blockchain-based payments and tools

- Bermuda premier E. David Burt said “This initiative is about creating opportunity, lowering costs, and ensuring Bermudians benefit from the future of finance”

- For relatively small nations like Bermuda, traditional payment rails can come at prohibitive costs, an announcement claimed “the transition to an onchain economy is expected, over time, to deliver tangible benefits for residents and businesses. Benefits include lower transaction costs and providing greater access to global finance through modern digital wallets, and infrastructure that keeps economic value circulating locally”

What happened: Jefferies removes Bitcoin from portfolio over quantum computing concerns

How is this significant?

- Jefferies’ Head of Equity Strategy, Christopher Wood, removed Bitcoin from his advised portfolio allocation this week, over concerns that post-2030 quantum computing could come closer to cracking its cryptography

- In 2021, he recommended a 10% Bitcoin allocation to portfolios, but is now exercising an abundance of caution for “longer-term, pension-style investors” when theorising that quantum computing advancements “could only be a few years away rather than a decade or more”

- However, his namesake Cathie Wood (head of ARK Invest) disagrees, writing in her 2026 outlook that Bitcoin remains a valuable diversification asset

- According to ARK’s data, “since 2020, Bitcoin has shown weaker price correlations with stocks, bonds and even gold than those assets have with each other”

- Despite Jefferies’ removal of Bitcoin from its portfolio, several major banks and financial institutions remain in support of allocating; including Morgan Stanley and Bank of America

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.