Market Overview

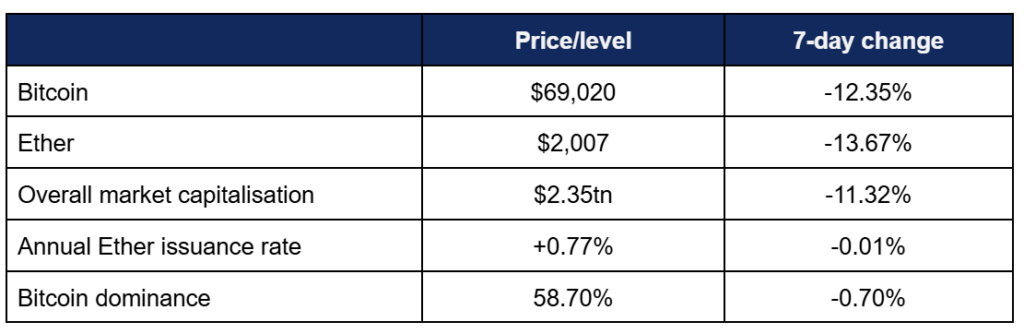

Digital assets faced turbulence as Bitcoin hit 2022 lows, yet institutional adoption and strategic activity continued to build momentum.

- The leading digital asset logged its largest single-day decline since the collapse of FTX exchange in 2022, losing even more value than during last year’s October 10th liquidation spiral

- Bitcoin peaked at $78,690 on Tuesday, before declining throughout the rest of the trading week, bottoming out on Friday at just over $60,000

- After that, Bitcoin did stage a rally, rising almost 20% from the lows to hit a post-crash high of $71,880 on Monday

- Ether followed Bitcoin’s patterns, peaking early on Wednesday at $2,325, before a steep decline towards a Friday low of $1,751

- Overall market capitalisation hit an intraweek low of $2.17tn on Friday, before recovering somewhat to current levels

- According to industry monitoring site DeFi Llama, total value locked in DeFi fell back below $100bn to $98.4bn

Digital assets faced a challenging week, with Bitcoin hitting its lowest value since 2024 and recording its biggest single-day drop, before rallying to recover some losses. Despite market volatility, adoption momentum continued: ETFs saw record volumes, UBS moved into tokenised deposits, Tether expanded in the US and tokenised gold, and Russia’s largest banks launched crypto-backed loans.

ETF News

What Happened?

- Digital asset investment products experienced a very varied week, cutting down outflows significantly despite wider market pullbacks

- According to Coinshares data published on Monday, the trading week ending Friday the 6th experienced $187m total outflows, just over a tenth of the previous week’s figure, indicating possible seller exhaustion

- Of particular note were the trading volumes, which reached a new weekly record of $63.1bn

- Coinshares’ Head of Research, James Butterfill, wrote that “While flows are typically coincident with crypto price movements, changes in the pace of outflows have historically been more informative, often signalling inflection points in investor sentiment. The recent deceleration in outflows therefore suggests that a potential market nadir may have been reached”

- He added that Bitcoin was the only asset to post outflows, whilst XRP achieved enough to stand as the most successful (ETF) crypto, with $109m year-to-date inflows

- Additionally, he noted that major global markets outside of the US, including Germany, Switzerland, and Canada, returned positive performance this week with eight-figure inflows

- Spot Bitcoin ETFs showcased the market’s erratic mood this week; five days of nine-figure flows, with three days of outflows sandwiched between two positive days

- Inflows ranged between $371m and $562m, whilst outflows stood between $272m and $545m

- BlackRock’s IBIT posted the best daily performance at $231m on Friday, followed by Fidelity’s FBTC which gained $153m on Monday

- Positive performances were spread throughout a variety of funds; Bitwise’s BITB gained $97m on Monday, whilst ARK Invest’s ARKB and Grayscale’s mini-ETF both registered daily flows above $65m

- The largest outflows once again (and understandably) came from the largest funds, as IBIT faced maximum daily outflows of $373m and FBTC hit $149m

- These IBIT outflows were marked by a new record of $10bn in daily trading volume

- Bloomberg’s chief ETF analyst Eric Balchunas reflected on recent market routs, stating “more than 90% of (post-launch) AUM hanging tough, forced to weather what feels like a Cat 5 hurricane”

- He added “Here’s the inconvenient truth for bears/haters/alarmist headline writers re both stocks and Bitcoin: Both have a 100% perfect record of coming back from beatdowns to hit new ATHs. Maybe this time is different but for now it is an indisputable fact and why I tend to avoid piling on during downturns”

- Spot Ether ETFs showcased a more lethargic performance, with no nine-figure flows amidst four trading negative days and one positive

- However, Ether funds did still experience three days of outflows, topping out at $253m on Friday

- Fidelity’s FETH once again logged the largest inflows of the week at $67m on Monday, followed by BlackRock’s ETHA at $43m the day after

- The two funds reversed positions in terms of highest outflows, where ETHA shed $82m on Monday whilst FETH lost $56m on Thursday

- The majority of funds registered net zero flows, but a few other notable performances included eight-figure inflows for Bitwise’s ETHW and Grayscale’s ETH

- In other ETF news, Bitwise filed for a Uniswap ETF, based on the proprietary token of Uniswap, the most popular decentralised exchange (DEX) in the Ethereum blockchain ecosystem

Crypto Treasury news

What happened?

- It was another tough week for digital asset treasury firms as prices plummeted, but the category leaders continued adding to their coffers

- Leading Bitcoin treasury firm Strategy (formerly MicroStrategy) acquired 1,142 Bitcoin for $90.0 million at $78,815 per Bitcoin

- This brings its total holdings to 714,644 Bitcoin acquired at an average unit cost of just over $76,050

- Despite currently being underwater on its investments, Chairman Michael Saylor said on a recent earnings call that the company would only face mortal balance sheet stress if Bitcoin dropped to (and remained at) around $8,000

- Leading Ether treasury firm BitMine meanwhile spent $84m acquiring 40,613 Ether over the last week

- Company Chairman Thomas Lee wrote that “The best investment opportunities in crypto have presented themselves after declines. BitMine has been steadily buying Ethereum, as we view this pullback as attractive, given the strengthening fundamentals. In our view, the price of ETH is not reflective of the high utility of ETH and its role as the future of finance”

- However, not all companies were in acquisition mode; mining firm Cango sold over 4,450 Bitcoin to strengthen its balance sheet, whilst the nation of Bhutan reportedly also sold off some ($22m) of its sovereign holdings

What happened: Digital asset market experiences significant losses and increased volatility

How is this significant?

- The week’s most major news was in the markets, as major volatility returned amidst a series of cascading liquidations and subsequent short squeezes

- Bitcoin fell down to $60,000 (or as low as $55,000 on a South Korean exchange), as large-scale sell-offs and heightened volatility heightened concern amongst traders.

- This marked Bitcoin’s lowest levels since Trump took office, and its 13% drop was the worst single-day performance since the FTX crash in 2022

- As the market bellwether, Bitcoin’s decline naturally led to sell-offs across the wider crypto complex, with double-digit declines common across altcoins

- Analysts provided several theories and explanations for this performance, with heightened geopolitical tensions (particularly regarding the US and Iran) proposed as a key catalyst for widespread risk-off investor behaviour

- Another belief is that Bitcoin’s history of four-year cycles has led to a self-fulfilling prophecy, where investors anticipating a bear market in 2026 showcase more selling behaviour in an attempt to front-run the expected market decline

- They also pointed towards the long shadow of last year’s October 10th liquidation event, when Trump tariff threats against China caused market panic and widespread sell-offs, reducing overall liquidity and allegedly wiping out some market makers

- Major exchanges reported significant inflows during Bitcoin’s fall as traders rushed to sell, with Binance alone adding $1.8bn in user deposits over seven days

- Regarding derisking, it should be noted that digital assets were far from the only market to suffer this week; the Nasdaq returned its worst run since April as tech stocks were routed, and gold and silver struggled after a sharp fall from recent records – leading some to declare “a high volatility regime” for precious metals

- Analyst Angelo Kourkafas of Edward Jones told Bloomberg “We view the weakness as part of a valuation reset across growth sectors, one that, given tech’s substantial index weight, is dragging on broader market performance”

- Blofin Head of Research Griffin Ardern argued the same, saying “All the market makers I know are currently maintaining strict delta neutrality and the most sensitive risk management parameters”

- Federal Reserve governor Christopher Waller meanwhile noted that initial market enthusiasm after the Republican victory may just have petered out as more election promises require conversion into action

- He said “some of the euphoria that came into the crypto world with the current administration, some of that’s kind of fading… I think there was a lot of selloff just because firms that got into it from the mainstream finance had to adjust their risk positions, sell, lots of other things”

- Digital asset treasury firms have particularly suffered in light of market declines; down 62% over the last year, significantly underperforming Bitcoin in the same timeframe

- After hitting lows around $60,000, Bitcoin has rallied, up around 17% from its weekly (and annual) lows at the time of writing

- Some analysts maintain optimism even in the wake of this week’s weakness, theorising that whilst further falls are possible, the current bear may go into hibernation quicker than in previous four-year cycles

- Bitwise Chief Investment Officer Matt Hougan wrote “Markets are complex, and there are always multiple factors at work… With crypto market sentiment near historic lows – and around the levels where crypto bottomed in 2018 and 2022 – it feels like much of the bad news is already priced in”

- He added “Crypto bear markets tend to end in exhaustion, not excitement”

- Gautam Chhugani and other analysts at Bernstein meanwhile called the current market downturn “the weakest bear case in history”, arguing that the current cycle differs from previous bear markets due to greater institutional participation

- JP Morgan analysts meanwhile believe that Bitcoin’s current price may grant opportunities to investors with longer horizons

- In a new report, JP Morgan’s Managing Director, Nikolaos Panigirtzoglou said that the Bitcoin-to-gold volatility ratio recently fell to a record low of 1.5, and “the large outperformance of gold vs. Bitcoin since last October coupled with the sharp rise in gold volatility has led to Bitcoin looking even more attractive compared to gold over the long term”

What happened: UBS adopts “fast follower” approach for tokenisation

How is this significant?

- During a recent earnings call, UBS CEO Sergio Ermotti said that the Swiss banking giant won’t be a “front runner” in digital asset integration; but it does aim to be a “fast follower”

- In January, reports emerged that UBS will offer private banking clients access to Bitcoin and Ethereum trading, and now it appears the bank may go even further

- Ermotti told listeners “We are building out the core infrastructure and exploring targeted offerings from crypto access for individual clients to tokenised deposit solutions for corporates”

- The self-proclaimed “fast follower” status isn’t wasting much time in moving towards tokenised deposits, as fellow global banking giants BNY Mellon, JP Morgan, and Singapore’s DBS have all announced development efforts for such an offering since November

- In other tokenisation news, Chinese authorities explicitly targeted tokenised assets, saying that real-world asset (RWA) tokenisation in China is prohibited “unless it is conducted on specific financial infrastructure with the approval of competent authorities”

What happened: Tether invests $100m in Anchorage Bank

How is this significant?

- Following its most recent financial attestations with $6.3bn excess reserves, leading stablecoin issuer Tether moved this week to spend some of its spare cash; to the tune of around $100m and $150m in separate deals

- The $100m price secures a stake in Anchorage Digital Bank, a federally-chartered bank noted for its ties to the crypto industry in the US, at a valuation of $4.2bn

- According to industry publication Coindesk, this capital injection will help Anchorage “expand custody, staking, settlement and stablecoin issuance services for institutional clients, including support for Tether products”

- A Tether stake in Anchorage would further formalise existing relations between the two heavyweights; the bank is involved in the issuance of USAT, Tether’s new GENIUS-compliant stablecoin for the US market

- As its market-leading USDT stablecoin does not comply with US regulations, securing a greater foothold in the country is seen as crucial for the El Salvador-based Tether

- A spokesperson stated “Tether’s investment reflects its view that Anchorage Digital plays a critical role in supporting the growing integration of digital assets into mainstream financial systems”

- Meanwhile, the $150m investment gives Tether a 12% stake in Gold.com, a platform used to sell both physical and tokenised gold

- As part of the deal, Tether’s gold-backed XAUT token will be integrated into the platform to widen its reach

- In other Tether news, the firm pushed back on Financial Times reports that investors were retreating from raising funds at a $500bn valuation, with CEO Paolo Ardoino telling Reuters the figure was regarded “as a maximum in hypothetical scenarios, not as a target and not as a capital raising plan”

- Tether also announced plans to add 150 staff over the next year and a half (whilst other industry firms are reducing headcount)

- Finally, Turkish prosecutors confirmed that the firm froze over $500m in assets of a suspected criminal at their request

- Ardoino told Bloomberg “Law enforcement came to us, they provided some information, we looked at the information and we acted in respect of the laws of the country. And that’s what we do when we work with the DOJ, when we work with the FBI, you name it”

What happened: Russia’s largest banks launch crypto-backed loans

How is this significant?

- Reuters reported Russia’s largest bank, Sberbank, “is preparing to issue crypto‑backed loans, citing strong interest from corporate clients”

- This follows on from a pilot program in December, where the bank offered a Bitcoin-backed loan to a local mining company, and crypto custody services introduced in mid-2025

- However, Sberbank’s ambitions to introduce the service to Russia appear to have been dashed, as a rival institution, Sovcombank, effectively front-ran them and introduced crypto loans of their own

- Sovcombank Compliance Director, Marina Burdonova stated “Specifically, we offer Bitcoin-secured lending, allowing our clients to raise financing for business development without having to sell their assets”

- Sberbank’s entry into the space will nonetheless be significant, whether first or second; the state-owned revealed last week that the total value of digital financial assets issued on its proprietary platform reached $5.3bn last year, with January 2026 issuance alone hitting $3bn

What happened: Jump Trading seeks shares in crypto-based prediction markets

How is this significant?

- TradFi market making giant Jump Trading appears poised to expand its services to the new frontier of prediction markets; in a liquidity-for-equity deal

- Jump will secure stakes in both of the market leaders; blockchain-based Polymarket, and crypto-accepting Kalshi

- According to Bloomberg sources, Kalshi’s equity is fixed, whilst “the size of the stake in Polymarket will grow over time depending on how much trading capacity Jump provides to the exchange’s operation in the US”

- Prediction markets have exhibited considerable growth since coming to prominence during the last US election cycle, when Polymarket bettors proved more accurate than national polls

- This isn’t the first case of a company courting both prediction powerhouses; industry publication TheBlock notes that Google Finance and the NHL both structured multi-year deals with both Kalshi and Polymarket

What happened: South Korea to tighten digital asset market oversight

How is this significant?

- South Korean regulators moved to tighten crypto oversight this week, according to reports from the local Yonhap news agency

- The country’s Financial Supervisory Service (FSS) published its policy agenda on Monday, including planned investigations into high-risk behaviours within the local crypto market

- This followed on from a recent blunder in which Korean exchange Bithumb accidentally credited users’ accounts with Bitcoin instead of Won as part of a trading rewards campaign – although it was quickly remedied and no mass withdrawals took place, it nonetheless momentarily sent Bitcoin’s price on the exchange significantly lower than global averages

- Additionally, the FSS formed a task force to enforce the country’s upcoming Digital Asset Basic Act legislation

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.