Market Overview

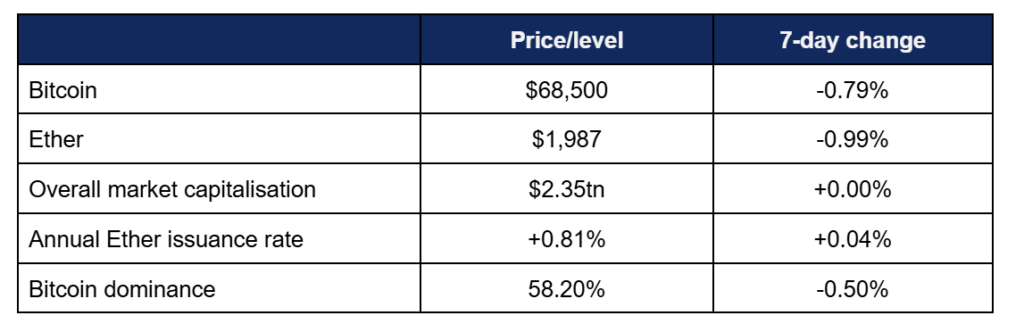

Digital assets steadied after weeks of declines, hinting at shifting momentum as markets begin to recalibrate.

- Bitcoin performed weakly in early trading, before recovering across the second half of the week to end on near-parity with last week’s values

- Bitcoin declined consistently before hitting a low of $65,260 on Thursday, leading on to a sharp recovery on Friday before a Sunday peak of $70,780

- However, Bitcoin was unable to sustain a run above the $70,000 mark, spending the majority of the week trading below $69,000

- Ether charts strongly resembled Bitcoin’s, rising from a Thursday low of $1,903 to a Saturday high of $2,098

- Overall market capitalisation experienced a $2.25tn intraweek low

- Despite minor declines in Bitcoin and Ether, a healthy rebound of the altcoin sector helped the week close out net neutral

- According to industry monitoring site DeFi Llama, total value locked in DeFi was nearly unchanged, at $96.8bn

Digital assets stabilised after several dramatic weeks, as ETF outflows continued to slow and Bitcoin whales demonstrated ongoing conviction in the asset. HSBC was selected by the UK government to potentially issue the first sovereign bond of a G7 nation on the blockchain, Hong Kong hosted the consensus conference and reaffirmed its commitment to crypto, Aviva Investors partnered with Ripple on tokenisation, Apollo Global teamed up with Morpho on DeFi lending, and much more.

ETF News

What Happened?

- Digital asset investment products reduced outflows once more, but couldn’t stem the tide completely as more capital left investment funds

- According to Coinshares data published on Monday, the trading week ending Friday the 13th experienced $173m total outflows, down from $187m the week prior and $1.7bn a fortnight ago

- Once again, Coinshares noted a strong geographic split in performance, as US funds logged $403m outflows, whilst Canadian and European products registered $230m inflows

- Additionally, altcoin ETFs for Chainlink, Solana, and XRP all managed overall inflows despite Bitcoin and Ether losing out

- Spot Bitcoin ETFs logged mixed performance; starting the week off with two days of nine-figure inflows, before two days of nine-figure outflows and modest $15m inflows on Friday

- Inflows ranged between $145m and $167m, whilst outflows stood between $276m and $410m

- The week’s top performer was – perhaps for the first time since ETFs launched – ARK Invest’s ARKB, which added $68m on Monday

- Uncharacteristically, BlackRock’s market-leading IBIT only posted the third-highest inflows of the week ($27m on Monday), trailing behind FBTC ($59m the same day)

- The largest outflows did however originate from IBIT, which lost $158m on Thursday, followed by FBTC at $104m

- Spot Ether ETFs mirrored the performance of Bitcoin products; opening the week with inflows, two days of nine-figure outflows, and then back to modest inflows on Friday

- Fidelity’s FETH accounted for the majority of the week’s inflows, adding $67m on Monday

- Next-best was Grayscale’s 0.15% fee mini-ETF, which opened the week with $44m inflows

- FETH also led the way in outflows, with $67m on Wednesday, followed by BlackRock’s ETHA at $45m on Monday

- The majority of funds registered net zero flows, including Franklin Templeton and Invesco’s products returning zero on every trading day

- In other ETF news, US President Trump’s Truth Social filed for Bitcoin and Ether ETFs, in addition to an altcoin ETF based on the native token of digital asset exchange crypto.com

- Bloomberg noted continued filings for crypto ETFs despite the current bear market conditions in the sector

- ETF strategist Todd Sohn commented “Issuers – particularly 21Shares and Bitwise – are committed to the longer-term case for allocating to crypto. The challenge will be if performance stalls for a prolonged run. That would challenge how much flows can be generated going forward”

Crypto Treasury news

What happened?

- CEO of Leading Bitcoin treasury firm Strategy (formerly MicroStrategy), Michael Saylor, confirms the firm has no intention of selling Bitcoin holdings any time soon

- Saylor also indicated that the firm would likely have new weekly purchases to announce when markets reopened, and noted that blockchains remain open even when markets are closed

- Leading Japanese crypto treasury firm Metaplanet reported a $619m loss in the last fiscal year, driven by valuation loss on its Bitcoin holdings

- However, the company counts these as a non-operating expense with no impact on cashflows, and claims it can survive an 86% drawdown in Bitcoin price

What happened: Bitcoin “whales” increase holdings as smaller buyers retreat

How is this significant?

- Amidst the continued Bearish Bitcoin performance, large-scale holders have continued their commitment to the asset, increasing holdings even as smaller scale retail investor withdraw

- The so-called “whales” (wallets holding 1,000 Bitcoin or more) added 53,000 Bitcoin over the last week, helping to stabilise prices after the recent run of declines

- This represents over $3.6bn in Bitcoin buys at current prices

- Brett Singer of analytics firm Glassnode noted “It does slow down any downfall. But we still need to see more money coming into the market”

- Some industry figures noted that many big players are still sitting on comfortable profits from previous sells to increase their overall stash; investor Bruno Ver told Bloomberg “When the storm clears, we’ll be buying again, as we sold some before the end of last year. But we’re still in the storm now”

- One large player that definitely added to its Bitcoin holdings recently is leading exchange Binance, which converted $1bn worth of stablecoins into Bitcoin since January 30th, as part of its “SAFU” fund for user protection

- Binance’s Bitcoin holdings now sit at around 15,000 Bitcoin, with the commitment to add more if total value falls below $800m

What happened: HSBC tokenises UK bonds

How is this significant?

- Following on from last week’s reports that UBS is adopting a “fast follower” policy on tokenisation, fellow global banking giant HSBC this week also made moves in the space – with governmental endorsement

- The UK Treasury officially decided to award HSBC’s Orion blockchain platform with the mandate for the government’s first digital gilt instrument, known as DIGIT

- Law firm Ashurst will lead the issuance alongside HSBC, which the Financial Times notes would be the first blockchain-based sovereign bond issued by a G7 nation

- City minister Lucy Rigby told the FT “This is exactly the kind of financial innovation we need to keep the UK at the forefront of global capital markets. We want to attract investment and make the UK the best place to do business. How the UK can capitalise on this technology, deliver efficiencies and reduce costs for firms”

- In an October tender offer, the FCA said it wished to provide a regulated testing environment for the issuance of digital instruments

- Utilising blockchain for the issuance of gilt instruments is believed to make the market for such products both faster and cheaper

- Orion currently issues $3.5bn in digital bonds annually, but is very much a proprietary platform rather than public blockchain Ethereum, which remains the most popular blockchain for tokenisation

What happened: Standard Chartered revises Bitcoin price target

How is this significant?

- After the bearish market movements of Q4 2025 and beyond, banking giant Standard Chartered pulled back on its previous price predictions for Bitcoin in 2026

- In a new research note from Thursday, analysts predicted a $100,000 year-end price, down from former forecasts of $150,000

- Standard Chartered’s Head of Digital Asset Research, Geoff Kendrick, cautioned that although year-end predictions are up from current figures, the market may get worse before it gets better

- He said “We expect further price capitulation in the next few months… the macro risk backdrop is also becoming more challenging – the US economy may be softening, but markets expect no further rate cuts”

- However, he added that despite short-term pain, the market appears to be maturing compared to previous downturns; “This selloff has been less extreme than previous ones and has not seen the collapse of any digital asset platforms”

- The bank’s prognostications for Ether are somewhat more positive, with a $4,000 year-end prediction and forecast $1,400 intrayear bottom

- Many other analysts also chimed in with their predictions and prognostications

- IG Australia analyst Tony Sycamore wrote “Technically, as long as Bitcoin holds above the 200-week moving average near $58,000, a level it successfully bounced from last Friday, there remains scope for a recovery toward resistance at $73,000–$75,000. However, a sustained break below the critical $60,000/$58,000 zone would likely open the door to a deeper pullback towards the next support level in the high $40,000s”

- Bloomberg’s Mike McGlone was far more bearish, arguing that if a US recession lies ahead, Bitcoin could fall as low as $10,000

- However, Jason Fernandes of AdLunam argues the above case relies on false equivalences and “implies recession plus financial stress, not just slower growth. Absent a credit shock or policy mistake that drains global liquidity, that kind of collapse remains a low-probability tail risk”

- The majority of industry followers appear far more optimistic than Mr McGlone, as analytics firm CryptoQuant posited the “ultimate” bear market bottom may lie at around $55,000

- They argued that over 55% of supply remains in profit (rather than usual cycle lows of 45%-50%) and “Monthly cumulative realised losses in Bitcoin terms are still much lower than the levels associated with bear market bottoms, 0.3 million Bitcoin today, compared to 1.1 million Bitcoin at the end of the 2022 bear market”

What Happened: Harvard University cuts Bitcoin exposure, adds Ether position

How is this significant?

- Ivy League powerhouse Harvard University decreased the Bitcoin allocation within its $56.9bn endowment; but signalled further faith in the digital asset sector by adding Ether exposure for the first time

- According to new 13F SEC filings, Harvard Management Company now holds around 5.35 million shares of BlackRock’s IBIT spot Bitcoin ETF; an approximate 21% reduction in the 6.81 million shares held during the previous reporting period

- However in the same timeframe, the endowment also invested in Ether to the tune of $87m, via BlackRock’s ETHA ETF

- The perceived volatility of digital assets has drawn some criticism from academics, as reported within the university’s Harvard Crimson newspaper

- Some analysts commented that the reduction in Bitcoin exposure may not have been the result of any negative sentiment, but rather market dynamics

- Andy Constan of Damped Spring Advisors believes that such investments could have been a means of extracting alpha on Digital Asset Treasury firms that previously traded at large premiums to underlying Bitcoin holdings

- “The sale could reflect the unwinding of a trade that meant to capitalise on Bitcoin treasury companies trading at premiums to the value of their Bitcoin holdings, as measured by the multiple of net asset value, or mNAV, which compares enterprise value to Bitcoin value”

What Happened: Aviva Investors partners with Ripple to launch tokenised funds

How is this significant?

- Aviva Investors, the asset management arm of Aviva plc, announced a partnership with Ripple to explore the tokenisation of investment funds using the XRP Ledger.

- The collaboration is focused on enabling the issuance and servicing of tokenised fund shares on blockchain infrastructure.

- The initiative forms part of Aviva’s broader exploration of distributed ledger technology within asset management operations.

- Ripple stated that the XRP Ledger would be used as the underlying blockchain infrastructure for the project.

What Happened: Apollo Global Management partners with DeFi Protocol Morpho

How is this significant?

- Apollo Global Management (asset managers with more than $900bn AUM) entered into a strategic agreement with the Morpho Association, the entity supporting the Morpho decentralised lending protocol.

- Under the agreement, Apollo and its affiliates may acquire up to 90 million MORPHO governance tokens over a four-year period.

- The potential allocation represents approximately 9% of the token’s total supply if fully acquired.

- The acquisition structure includes staged purchases and transfer restrictions.

- The parties stated they intend to collaborate in support of on-chain lending markets and decentralised credit infrastructure.

- The MORPHO token recorded a price increase following public reporting of the agreement.

What Happened: Hong Kong reaffirms commitment to digital assets

How is this significant?

- Hong Kong recently hosted Consensus, one of the largest crypto conferences in the world, and the city confirmed its aim to become a key Asian crypto hub

- A key theme of the conference was adopting a long-term perspective for the industry; Binance CEO Richard Teng urged attendees to remain calm during current bearish conditions, as part of the “cyclical” nature of markets

- He also argued that “crypto remains tied to geopolitical and interest-rate uncertainty, and institutional and corporate participation continues to grow even as retail demand has cooled”

- As an example, he cited that during last year’s 10th October mass liquidation event (now known colloquially in crypto circles as “10/10”), markets were following tariff-driven uncertainty, rather than plunging based on internal issues

- He said “The U.S. equity market alone saw $150bn of liquidation. The crypto market [liquidation was] much smaller. It was about $19bn”

- Venture capitalists on a panel at the conference advised a “flight to quality”, and moving towards “15-year timelines” rather than “18-month cycles”

- Speaking at the conference, China National Committee member Johnny Ng said Hong Kong was committed to digital assets, but faced “aggressive” competition from Korea and the UAE

- He stated “The UAE is really aggressive… I think Hong Kong’s legislative council can recommend that the government do more, particularly by creating one position to oversee all those things. As a lawmaker, I will actually help the government to connect with congressmen from other countries, for example, Korea”

- Following the conference, Hong Kong regulators approved their first new crypto licence since June

- Victory Fintech is now officially licenced to operate a digital asset trading platform in the city

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.