Market Overview

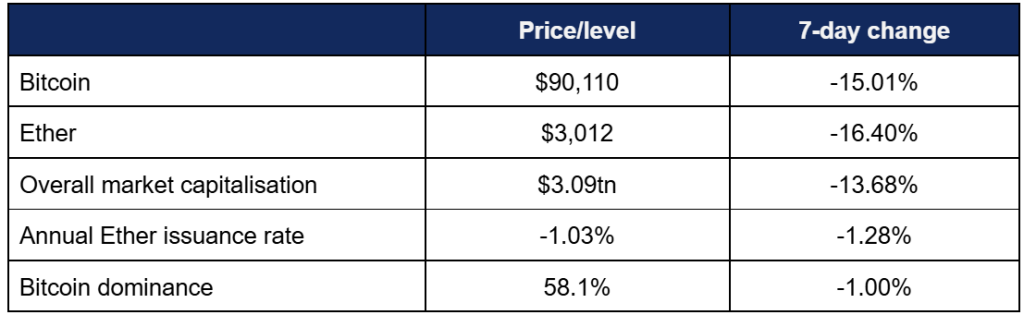

- Bitcoin experienced one of its worst weeks in recent memory, as it broke decisively below $100,000 and traded at those levels for the majority of the week, recording its lowest price point since April

- Unlike the mass liquidations in October that kicked off the recent bearish run, Bitcoin’s performance this week was marked by a consistent decline, as investor sentiment turned extremely fearful amidst ongoing concerns over policy and risk-on investments

- Bitcoin fell to lows of $89,670 in early trading this morning (18/11/25), after peaking at $105,410 last Tuesday (11/11/25)

- Ether suffered similarly, decreasing as the week went on from a high of $3,585 on Wednesday to $2,962 early on Tuesday

- Trading volume across the Ethereum network (including sell-offs of altcoins built on the network) had the corollary effect of mass token burns from transaction fees, moving Ether’s issuance rate (based on the average over the last seven days) back into deflationary territory for the first time since January

- Overall market capitalisation lost nearly half a trillion dollars, as losses amongst most altcoins exceeded those of Bitcoin and Ether

- According to industry monitoring site DeFi Llama, total value locked in DeFi fell over $16bn to $121bn.

Digital assets suffered one of their worst weeks in the last few years as macro sentiment soured over potential Fed policy decisions. Long-term Bitcoin holders contributed by selling to front-run fears of a prolonged bear market, and movements were exacerbated by lowered liquidity following October’s leverage-led crash. However, despite all the doom in market performance, there were positive developments within adoption and development, as BlackRock, Franklin Templeton, and JP Morgan increased their crypto involvement, BNY Mellon launched a new fund especially for stablecoins, a central bank officially announced Bitcoin on its balance sheet, and much more.

What happened: ETF News

How is this significant?

- Digital asset investment products logged a third week of outflows, at the highest levels since February

- According to Coinshares data published on Monday, net outflows across all funds stood at $2bn in the trading week ending Friday the 14th; bringing the three-week figure to $3.2bn

- Coinshares Head of Research James Butterfill once again cited uncertainty over future US interest rate cuts as a potential factor in bearish investor behaviour, alongside “crypto-native whale selling”, as long-term holders secured profits rather than risking further falls or a prolonged bear market

- Recent price declines have dropped AUM across funds by around a quarter from their early October record highs

- Spot Bitcoin ETFs actually opened the week strongly, with two days of inflows, before investors turned sharply bearish and logged three consecutive days of nine-figure outflows

- Thursday proved one of the bloodiest days in Bitcoin ETF history, marked by $867m total outflows

- Monday witnessed one of the quietest trading days since funds launched, with the entire $1.2m inflows deriving from Bitwise’s BITB as all other funds returned net zero flows

- Tuesday saw more activity, with $524m inflows, led by BlackRock’s IBIT ($224m), Fidelity’s FBTC ($166m) and ARK Invest’s ARKB ($103m)

- As the market moved to outflows, BlackRock’s IBIT (as last week) led the losses, including daily declines of $257m and $463m

- The next-worse performances came from Grayscale’s 0.15% fee mini-ETF ($318m) and Fidelity’s FBTC ($133m)

- Bloomberg chief ETF analyst Eric Balchunas urged some perspective after recent negative performance, writing “Did any Bitcoiners complain last year when Bitcoin was up 122%, which was 5x SPY, GLD? Was anyone like ‘wait, Bitcoin’s historical performance relative to risk assets says it shouldn’t be this high, this is bad!’ No, you loved the extra excess, double dip, and so this year you get nothing”

- Spot Ether ETFs couldn’t offer any positive performances, as not a single fund logged any daily inflows, leading to four days of nine-figure outflows

- BlackRock’s market-leading ETHA posted the largest outflows at $172m and $137m, followed by Grayscale’s ETHE ($68m)

- In other ETF news, new funds launched for altcoins such as Solana, alongside filings for the likes of Canton network

- Additionally, Cboe announced the launch of perpetual-style Bitcoin and Ether futures for the 15th of December, pending regulatory review

What happened: Bitcoin erases year’s gains as digital asset market struggles

How is this significant?

- Bitcoin’s steep decline since record highs in October has led to considerable concern amongst investors, with key industry indicators now classifying overall sentiment as “extremely fearful” as fears of a bear market rise

- This has wiped out all of its year-to-date gains, although it still remains meaningfully up since last year’s US election

- Various factors have been cited as causes of this downturn, including negativity over December rate cuts due to the government shutdown, and selling by long-term Bitcoin holders over either ideological opposition to large-scale institutional holdings, or simply pragmatism for locking in gains

- Vetle Lunde, Head of Research at K33 recently explained “Over 319,000 Bitcoin has been reactivated [i.e. moved from wallets] in the past month, mainly from coins held for six to twelve months – suggesting significant profit-taking since mid-July. While some reactivation stems from internal transfers, much reflects real selling”

- Bitwise CIO Matthew Hougan commented “The general market is risk-off. Crypto was the canary in the coal mine for that, it was the first to flinch”

- Bernstein analysts hypothesise that Bitcoin’s novelty within the broader financial space means people look to its past supply halving cycles (approximately once every four years) for precedent, creating a self-fulfilling prophecy

- He added “The sentiment in crypto retail is pretty negative. People are afraid that the four-year cycle might repeat. They don’t want to live through another 50% pullback. People are front-running that by stepping out of the market”

- Jake Kennis of digital asset analytics firm Nansen told Bloomberg “At this point, Bitcoin trades much more like a macro asset embedded in institutional portfolios, responding to liquidity, policy and dollar dynamics more than to mechanically predictable supply shocks”

- Tom Lee, Chairman of Ether treasury firm BitMine, told industry publication Coindesk that the steep October liquidations of leveraged positions (after President Trump frightened markets with renewed tariff concerns) may have led market makers to withdraw liquidity, leading to greater price swings

- “When a market maker has a ‘hole’ on their balance sheet, they are seeking to raise capital and are reducing their liquidity functions in the market [akin to a quantitative tightening” (QT) for crypto assets]… In 2022, this QT effect lasted for 6-8 weeks”

- Caladan research lead Derek Lim agreed, telling industry publication TheBlock “the primary market driver remains liquidity. Liquidity is (and will be) temporarily tight as the US government shutdown has kept the treasury general account elevated”

- MHC Digital Group Head of Markets Edward Carroll pointed out further macro stressors; “Treasury bill spreads, repo markets and other funding indicators are flashing signs reminiscent of late 2018 and 2019. Crypto, being more reactive, has adjusted sooner than traditional markets”

- Additionally, ETFs and digital asset treasuries have seen fewer flows over the last month as macro sentiments dimmed

- Some analysts note an increased demand for downside protection all the way to $80,000 levels, suggesting widespread fears of further falls

- Thomas Perfumo, Global Economist at crypto exchange Kraken explained “[broader] riskoff tone spills into crypto markets, where sentiment remains fragile—the latest drawdown reflects broader macro jitters rather than structural flaws”

- However, some remained optimistic about an imminent recovery; Carroll said “The bottom line is this pullback reflects tight funding conditions and shifting rate expectations, not a break in crypto fundamentals. Once the liquidity cycle turns, we expect digital assets to rebound first, just as they have after every major intervention over the past decade”

What happened: BlackRock tokenised fund accepted as collateral on Binance

How is this significant?

- The world’s largest asset manager and the world’s largest digital asset exchange collaborated this week, furthering the former’s involvement in the crypto sphere

- According to a Friday press release, Binance integrated BlackRock’s tokenised money market fund BUIDL into its institutional collateral framework

- This allows tokens created by BlackRock (representing shares in BUIDL) to be used for off-exchange collateral when trading on Binance, making it one of just three tokenised products possible to use in that way

- According to Bloomberg analysts, “The move signals a broader shift in the architecture of digital-asset markets, as major Wall Street players begin to reshape how risk and liquidity flow through the crypto ecosystem”

- As part of the deal, BUIDL (created in partnership with tokenisation specialists Securitize) will become available on Binance’s own BNB chain, one of the largest smart contract blockchains for DeFi applications

- BUIDL is already the most popular tokenised fund according to analytics site rwa.xyz with around $2.5bn AUM, and this added functionality (and accessibility) could increase its appeal yet further

- Robbie Mitchnick, BlackRock’s global Head of Digital Assets stated “This milestone highlights our continued focus on transforming tokenisation from concept to practical market utility. We’re helping bring foundational elements of traditional finance into the onchain finance arena”

- Binance Head of Institutional Catherine Chen commented on the benefits to the exchange “Our institutional clients have asked for more interest-bearing stable assets they can hold as collateral while actively trading on our exchange”

- In an interview with Fortune, Securitize CEO Carlos Domingo commented that BUIDL’s appeal lies in its status as high-value collateral, alongside the technological advantages of blockchain

- He said “In capital markets, every transaction involves updating a ledger. Right now, the ledgers are built on software from the 1970s, and the process is siloed… blockchains are easy to access and can settle trades almost instantly”

What happened: Tokenisation news

How is this significant?

- Numerous tokenisation stories hit the news this week, ranging from funds, to deposits, to presidential-backed real estate

- JP Morgan began rolling out its JPM Coin as a deposit token for institutional clients this week; “a move that comes as financial institutions continue to broaden their footprint in digital assets”

- Clients will thus be able to send and receive money (JPM Coin represents dollar deposits at the bank) via Coinbase’s public Ethereum layer-2 blockchain Base

- JP Morgan’s blockchain chief Naveen Mallela said the token would expand to more blockchains in future, alongside other currency denominations (pending regulatory approval)

- He added that JPM Coin will be accepted as collateral on Coinbase and said “We think that stablecoins get a lot of buzz, but for institutional clients, deposit-based products offer a compelling alternative. These can be yield-bearing”

- Alibaba President Kuo Zhang told CNBC Alibaba will streamline its cross-border payments through the use of Dollar- and Euro-denominated deposit tokens with JP Morgan’s proprietary JPMD blockchain infrastructure

- He said Alibaba could integrate stablecoins in future, but awaits regulatory clearance and clarity before committing

- Franklin Templeton announced the expansion of its BENJI token—the world’s first tokenised money market fund—onto the Canton blockchain, expanding its reach further

- Canton is a bank-backed blockchain, partially funded by Goldman Sachs, and allows greater privacy than most other public chains, as Franklin Digital Asset Head Sandy Kaul noted some institutions “wanted the ability to have privacy around trades, they didn’t want their trades recorded across public blockchains”

- The Hong Kong Monetary Authority (HKMA) launched a new blockchain pilot, testing real-value transactions with both tokenised deposits and digital assets

- In a press release, the HKMA said the initial focus is “empowering market participants to utilise tokenised deposits in tokenised money market fund transactions, and to manage liquidity and treasury needs in real time”

- Finally, the Trump Organisation is creating “the world’s first tokenised hotel development” in the Maldives, alongside Saudi partner Dar Global Plc

- Trump International Hotel Maldives will feature 80 luxury units, scheduled to open in 2028

- According to a joint statement, the plan “tokenises the development phase itself, offering investors the opportunity to participate in a high-growth, premium real estate project from inception”

What happened: Bybit planning acquisition of Korean competitor

How is this significant?

- According to reports in the Korean press, leading exchange Bybit is looking to consolidate its position within the market by acquiring Korbit, one of the country’s oldest crypto exchanges

- Korbit was founded in 2013, before being acquired by Korean gaming giant Nexon in 2017

- The Maeil Business paper noted that regulators have recently softened restrictions in the country, allowing more foreign firms to buy controlling stakes in Korean crypto companies—a means by which Binance re-entered the market this year through acquiring local exchange Gopax

- However, both companies remained coy on the issue when asked for clarification by industry publication Coindesk, with Bybit commenting “We cannot comment on ongoing matters… Please stay tuned to our official website for any future updates”

What happened: Tether moves to increase commodity trade lending

How is this significant?

- Stablecoin issuance leader Tether revealed this week that it plans to “dramatically” increase its lending activity to commodities traders

- CEO Paolo Ardoino told Bloomberg the firm has already extended $1.5bn of credit to the sector, but “We are going to expand dramatically. The team is super bullish”

- The company is also growing its commodities presence beyond lending, as it is now holds of the world’s leading (non-nation/non-banking) gold hoards

- To this effect, Tether recently hired senior precious metals traders from HSBC

- The Financial Times reported on further diversification efforts from the firm, as it looks to lead a funding round for German robotics AI startup Neura, worth over $1.15bn

- In other stablecoin news, Visa is testing USDC payouts for global transfers, “targeting growing demand for the fiat-backed digital tokens among gig workers and digital creators in emerging markets”

- Mark Nelsen, Head of Product for Visa’s commercial and money movement solutions, said “We’re not trying to pick a winner. We want the senders and the recipients to have as much flexibility and functionality as they want. They can pay out to a card, a bank account and now to a stablecoin wallet”

- He added that many people globally actively choose to be paid in stablecoins “because their local currency isn’t strong enough… Really the push is more around those markets where there is a need for a more stable digital currency”

What happened: BNY Mellon launches money market fund for stablecoin issuers

How is this significant?

- Banking and custody giant BNY Mellon announced a new initiative this week; a money market fund aimed at stablecoin issuers

- The BNY Dreyfus Stablecoin Reserves Fund will allow issuers to generate a return from the reserves they’re required to hold under the recently-passed GENIUS stablecoin act

- GENIUS regulations require reserves as ultra-safe investments with shorter durations than traditional money market funds in case quick redemptions are required

- Stephanie Pierce, Deputy Head of BNY Investments, told Bloomberg that “the new fund is designed to meet the requirements of the law by only holding securities with maturities of 93 days or less”

- Digital asset bank Anchorage Digital is one of the initial investors in the fund, alongside its plans to create a GENIUS-compliant stablecoin with leading issuer Tether

What happened: Regulatory news

How is this significant?

- The EU is looking to increase the power of its markets regulator, potentially transforming the European Securities & Markets Authority (ESMA) into a financial watchdog akin to the United States SEC, and undermining existing Markets in Crypto Assets (MiCA) regulations

- Under new draft legislation, ESMA would get new powers to oversee all crypto businesses in the EU, a move which analysts said “could upend years of work by national watchdogs and businesses to regulate the industry”

- Under current regulations, gaining MiCA approval in one country allows a crypto business to operate across the bloc under that licence; now it could be ESMA that decides licensing approval, rather than national authorities

- Robert Kopitsch, Secretary General of industry lobby group Blockchain for Europe, told Bloomberg “Reopening MiCA at this stage would introduce legal uncertainty, risk delaying the authorisation process, and divert attention and resources from the practical task of consistent implementation”

- Additionally, ESMA could gain “direct oversight of significant clearing houses, depositories and trading venues”, leading to concerns that the agency would require significant staffing upgrades to cope with a new workload currently handled at the national level

- TD Cowen analysts pinpointed the next 12 months as crucial for new SEC chair Paul Atkins if he wishes to firmly establish deregulation in the digital asset market

- In a research note, analyst Jared Seiberg said “The agency needs to start issuing proposals in the coming months in order to be able to finalize them in 2027. That then provides time to defend the rules in court to ensure they become implemented before the end of 2028”

- He added that tokenised equities will likely be a key focus for the agency; “Our expectation is that SEC Chair Paul Atkins will grant online brokers and crypto platforms the exemptive relief needed for them to proceed with tokenised equities”

- Additionally, Atkins outlined plans for a new “token taxonomy” to delineate between securities and non-securities tokens

- The Czech National Bank announced the creation of a $1m “test portfolio”, featuring Bitcoin, stablecoins, and tokenised assets

- This marks the first appearance of Bitcoin specifically on a central bank’s balance sheet, funded outside of the bank’s existing international reserves

- Central bank Governor Ales Michl stated “I came up with the idea of creating a test portfolio in January 2025. The aim was to test decentralised Bitcoin from the central bank’s perspective and to evaluate its potential role in diversifying our reserves”

What happened: Crypto Treasury news

How is this significant?

- Leading treasury firm Strategy (formerly MicroStrategy) made its largest purchase since July in an attempt to take advantage of faltering Bitcoin prices—which have since dropped further still

- Strategy bought 8,178 Bitcoin for $836m, according to its latest SEC filings

- The majority of these purchases were funded by the sale of Euro-denominated preferred stock, worth $715m

- Founder Michael Saylor tweeted that this brings the average purchase price of its (approximately $68bn) Bitcoin holdings to $74,079

- Top Ether treasury firm BitMine also continued buying, adding another 54,000 Ether valued over $170m at the time of purchase

- The majority of digital asset treasury firms currently sit at negative mNAV and returns, leading Bloomberg to comment “some firms built to hoard tokens are selling into weakness—exerting the very pressure they were meant to offset”

- Despite this, TD Cowen analysts foresee considerable potential upside for some leading treasury firms like Strategy, regardless of current share price declines

- Finally, El Salvador made the largest single-day Bitcoin purchase in its history on Monday, adding 1,090 Bitcoin to its national stash for $100m

- President Nayib Bukele tweeted a screenshot of holdings from the country’s National Bitcoin Office, a continued area of support for him since he made El Salvador the first sovereign nation to accept Bitcoin as legal tender

- This represents over a seventh of the country’s current Bitcoin reserve value

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.