Market Overview

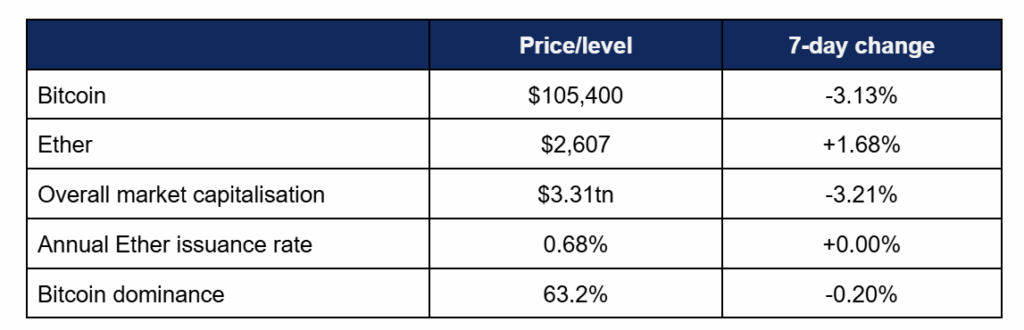

- Bitcoin pulled back slightly from last week’s new record high, as profit-taking combined with broader investor caution following renewed Trump tariff tensions

- Bitcoin spent the week in broad decline, falling from a high of $110,490 on Tuesday to a weekend low of $103,320 on Saturday, before rallying slightly to current levels

- Ether outperformed Bitcoin, posting a week of (modest) growth buoyed by the strongest run of ETF performance this year

- Ether peaked on Thursday at $2,772, declining to $2,479 on Monday before recovering to current levels

- Altcoins pulled back as more speculative investments during the heightened macroeconomic uncertainty, with the vast majority of projects within the top 100 for market capitalisation returning red weekly candles

- Industry sentiment on the Fear & Greed index reflected the increased investor caution, dropping down ten percentage points and shifting the overall mood from “greed” to “neutral”

- Overall industry market capitalisation fell to $3.31tn, after an intraweek high of $3.47tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi declined slightly in line with wider market performance, dropping by almost $3bn to $113.7bn

Digital assets experienced mixed performance, as Ether showcased growth whilst Bitcoin pulled back from last week’s record highs amidst profit-taking and tariff-driven economic uncertainty. Stablecoin development continued as USDC issuer Circle geared up for its IPO, the US vice president spoke at a crypto conference, several firms (including Trump media) advanced their Bitcoin treasury strategies, New Jersey moved towards real estate tokenisation, and much more.

What happened: ETF News

How is this significant?

- Digital asset investment products continued their positive run despite some large outflows from Bitcoin ETFs, as Ether products managed to compensate

- In total, digital asset investment products added $286m, with Ether ETFs experiencing their best run since 2024

- According to Coinshares data published on Monday, Ether products experienced $321m in total inflows, indicating a “decisive improvement in sentiment” according to lead researcher James Buitterfill

- Crypto funds have now experienced net inflows for seven consecutive weeks, despite $8m in outflows from Bitcoin products as investors cashed in on the asset’s new record highs

- Spot Bitcoin ETFs split their performance during a truncated trading week, as a combination of record prices and tariff tensions tempted investors into selling off during the latter half of the week

- Tuesday and Wednesday saw strong nine-figure inflows as ETFs added $385m and $433m respectively (predictably led by BlackRock’s IBIT), before reversing into outflows of $347m and $616m on Thursday and Friday

- These large outflows on Friday were particularly influenced by $430m in outflows from IBIT; a performance which broke its longest run of inflows since launch (34 days)

- Regarding that run, ETF Store president Nate Geraci commented “What a run over [the] past 30+ days though. IBIT now pushing $70bn in assets [less than] 17 months since launch…Not sure I have words to describe how ridiculous this is”

- Bloomberg chief ETF analyst Eric Balchunas opined that IBIT’s stellar run was driven by big business; “The IBIT vs Everyone Else flow disparity is interesting. Normally IBIT takes in 70% of the net inflows but lately it’s over 100%. My theory: the latest rally was more an institutional buying spree than retail”

- Coinpanel’s Kirill Kretov agreed, telling Bloomberg “The surge in demand appears to come primarily from institutional investors seeking regulated exposure to Bitcoin amid economic uncertainty and inflation concerns. Notably, some of this demand is internal as BlackRock’s own Strategic Income Opportunities Portfolio, a diversified fixed income mutual fund, has increased its IBIT holdings”

- Indeed, IBIT achieved record net inflows in May, adding $6.35bn

- Bitcoin ETFs strongly outperformed gold over the last month, with $9bn net inflows versus $2.8bn outflows for gold-backed funds

- Pepperstone research strategist Dilin Wu argues “Over the past month, Bitcoin’s intraday correlation with Nasdaq, the dollar, and even gold, has been remarkably low. These shifts suggest Bitcoin may increasingly be viewed as a hedge—or even a non-correlated asset class—rather than just a speculative trade”

- Late on Monday, Reuters reported that ARK Invest will offer a 3 for 1 share split of its ARKB Bitcoin ETF within two weeks, in order to make the fund more accessible

- Spot Ether ETFs continued their recent bullish behaviour, with strong eight-figure inflows every trading day last week; their best performance year-to-date

- Inflows were dominated by BlackRock’s ETHA and Fidelity’s FETH, boasting best performances of $70m on Friday for the former, and $38m on Thursday for the latter

- According to early Monday trading data, spot Ether ETFs continued their run of eight-figure inflows by adding $78m, but spot Bitcoin funds suffered further declines after $268m outflows

- Elsewhere in ETFs, digital asset funds offering Ether and Solana staking were granted effective registration by the SEC this week

- However, some regulatory doubts remain, so the debut date of such ETFs remains uncertain

- Bloomberg ETF analyst James Seyffart commented “This is a big deal because it’s the first variation of providing access to spot crypto assets with staking in the US. Owning an asset in crypto that has a staking yield but not staking the asset is kind of like keeping cash under your mattress”

- Across the whole ETF complex, Balchunas noted “Since April 8th, no category has taken in more cash than spot crypto, with cash and value close behind”

What happened: Stablecoin news

How is this significant?

- Stablecoin reporting this week primarily focused on USDC issuer Circle, and its plans for an IPO this year

- Circle “upsized” its valuation for going public, offering shares at around $27.50 each for a fully-diluted valuation of $7.2bn

- According to Bloomberg sources, “the IPO has drawn orders for stock in double digit multiples of the shares available”

- This indicates strong demand for the shares, with orders set to close at 16:00 New York Time on Tuesday

- According to a filing on Monday, ARK Investment is interested in buying $150m of stock, whilst BlackRock is reportedly aiming to secure 10% of all shares

- Shares will trade under the ticker CRCL, and could potentially help “entrench stablecoins in the broader financial system”

- Expectations of stablecoin regulation have boosted the sector, lifting its market capitalisation above $250bn for the first time

- American vice-president JD Vance described stablecoins as a “force multiplier of US economic might”, promoting current legislative efforts like the GENIUS act

- Representative Brian Steil told CNBC “Stablecoin issuers will be purchasing US Treasuries at a period of time where that is incredibly essential. It enshrines the U.S. dollar in our dominant role as the world’s reserve currency”

- Spanish banking giant Santander followed on from last week’s reports about banks joining forces to create their own stablecoin, considering its own issuance

- According to sources, its online banking unit Openbank “has applied for licenses to offer retail crypto services under the European Union’s new regulatory regime”

- Alongside stablecoins, Santander is reportedly also planning crypto trading services for retail customers “as soon as this year”

- Payment processor Stripe is currently in discussions with several banks regarding stablecoins, following its recent $1.1bn acquisition of stablecoin platform Bridge

- Stripe founder John Collison told Bloomberg “In the conversations we have with them, they’re very interested. This is not something that banks are just kind of brushing away or treating as a fad. Banks are very interested in how they should be integrated with stablecoins into their product offerings as well”

- He added “A lot of our future payment volume is going to be in stablecoins”, citing FX fees and processing times as current points of friction for payments within legacy banking infrastructure

- The UK’s Financial Conduct Authority invited comments regarding its proposed stablecoin and crypto custody plans

What happened: Vice president JD Vance speaks at Bitcoin conference

How is this significant?

- Just under a year after Donald Trump famously spoke at a Bitcoin conference during the presidential campaign trail, his second-in-command JD Vance followed suit, delivering the keynote speech at Bitcoin 2025

- He declared “with President Trump, crypto finally has a champion and an ally in the White House… We want our fellow Americans to know that crypto and digital assets and particularly Bitcoin, are part of the mainstream economy, and are here to stay”

- Vance argued that crypto has transformative potential and the administration “have a once in a generation opportunity to unleash innovation and use it to improve the lives of countless American citizens”

- The vice-president identified the asset class as a key diversifier; “Crypto is a hedge against bad policymaking from Washington, no matter what party’s in control. It’s a hedge against skyrocketing inflation, which has eroded the real savings rates of Americans over the last four years… it’s a hedge against a private sector that’s increasingly willing to discriminate against consumers on the basis of their basic beliefs, including their politics”

- He also echoed Trump’s sentiments that the asset class is too important to ignore on the international stage in the economic battle with China

- “The People’s Republic of China doesn’t like Bitcoin. Well, we should be asking ourselves, why is that? Why is our biggest adversary such an opponent of Bitcoin, and if the communist Republic of China is leaning away from Bitcoin, then maybe the United States ought to be leaning into Bitcoin”

- In other news from the current administration, the SEC dropped its long-running enforcement action against digital asset exchange Binance

- The exchange dubbed it “a huge win for crypto” and praised the ending of “regulation by enforcement”

- In international politics, we may have witnessed the first resignation spurred by crypto, as Czech justice minister Pavel Blazek resigned over an alleged gift of Bitcoin sold for $45m

What happened: New Jersey county agrees $240bn real estate tokenisation plan

How is this significant?

- Bergen County, an affluent suburb of New York (situated just across the Hudson in New Jersey), agreed “the largest property deed digitisation project in the US” this week, putting its properties on the immutable ledger of blockchain

- According to a press release, Bergen County will cooperate with property blockchain firm Balcony to put 370,000 property records on the Avalanche (AVAX) blockchain within the next five years

- This represents a current $240bn in property values in New Jersey’s most populous county, with one million residents across 70 municipalities

- County Clerk John Hogan commented “This initiative is about improving the lives of our residents. By digitising property records, we are making the process simpler, faster, and more secure for homeowners, businesses, and future generations”

- Balcony said that blockchain records can cut deed processing times by 90%, boost municipal revenue, and prevent fraud and record discrepancies through transparency and searchability

- A recent Boston Consulting Group report estimated that tokenised real estate could be worth nearly $19tn by 2023

- Luigi D’Onorio DeMeo, chief strategy officer at Avalanche developers Ava Labs stated “Blockchain is continuing to solve complex, real-world problems… infrastructure built to handle large amounts of data quickly and securely; exactly what’s needed to modernise how property records are managed and transform how public institutions operate”

What happened: Trump Media officially confirms $2.44bn Bitcoin acquisition strategy

How is this significant?

- After brusquely denying reports of a $3bn crypto acquisition plan in a Financial Times article last week, Trump Media and Technology Group (TMTG) confirmed it had funded a Bitcoin acquisition plan—of just under $2.5bn

- TMTG raised a total of $2.44bn for its Bitcoin treasury plan, financed through a combination of share sales and $1bn in convertible bonds

- According to a Friday press release, the 0% convertible bonds mature in 2028, and the “strategy will make Trump Media one of the top Bitcoin holders among publicly-traded U.S. firms with one of the most comprehensive Bitcoin treasury strategies”

- Net proceeds of $2.32bn will be used to fund Bitcoin acquisition for the firm’s treasury

- TMTG CEO Devin Nunes stated “Trump Media is focused on acquiring great assets, and this deal will give us the financial freedom to implement the rest of our strategies”

- He added that further digital asset developments were likely, stating “This investment will help defend our Company against harassment and discrimination by financial institutions… and will create synergies for subscription payments, a utility token, and other planned transactions across Truth Social and Truth+”

- Around 50 institutional investors participated in the funding round, with Cantor Fitzgerald acting as financial advisor

What happened: IG Group becomes first publicly-listed UK firm to offer retail crypto trading

How is this significant?

- Trading and investment platform IG Group became the first firm publicly-listed in the UK to provide direct digital asset trading and custody for the retail market

- Created in conjunction with American fintech firm Uphold, the service allows UK traders to buy, sell, or hold major crypto assets like Bitcoin and Ether

- Uphold CEO Simon McLoughlin stated “We want to give people better access to this asset class so they can participate in the evolving financial world. Partnerships like this are so important in helping us achieve that goal”

- IG managing director Michael Healy meanwhile called it “a huge moment for IG and a major milestone in the UK’s crypto journey”

- Previously, the company only offered digital asset derivatives via the contracts for difference (CfD) format

- The move follows growing crypto clarity within the United Kingdom, after the government published two consultation papers for draft legislation back in April

What happened: Russia’s largest bank launches Bitcoin-based bonds

How is this significant?

- Sberbank—the largest bank in Russia—introduced a new structured bond this week, tracking the price of Bitcoin alongside the dollar-to-ruble exchange rate

- According to reports in industry publication Coindesk, the bonds are limited to qualified investors, and allows investors to earn based on either the USD price of Bitcoin, or the dollar-ruble exchange rate

- Investors don’t need to self-custody any Bitcoin, and Sberbank stated that “All transactions [are] processed in rubles within Russia’s legal and infrastructure systems”

- A Sberbank announcement also indicated similar crypto-based structured products will soon debut on the Moscow exchange

- The bank will also launch a Bitcoin futures product on its investment platform on the 4th of June

- These moves follow a recent lightening of the nation’s digital asset policy, after the Bank of Russia declared qualified investors could access (cash-settled) digital asset derivatives

- Alongside this, a Russian Agricultural Bank executive speaking at a recent national grain forum stated that they may use digital assets to settle exports

What happened: US removes restrictive guidance on digital assets in 401(k) plans

How is this significant?

- In another sign of the Republican White House’s support for digital assets, it rescinded restrictive retirement plan guidelines from the Biden era this week

- The Department of Labor previously advised companies to exercise “extreme care” when considering crypto assets for retirement plans, but is now taking a more neutral stance on the matter

- The Trump administration noted that the department had no previous precedent of flagging up particular investment types and strategies, and that “the standard of ‘extreme care’ cited by the Biden administration is not found in the Employee Retirement Income Security Act, or ERISA”

- Secretary of Labor Lori Chavez-DeRemer stated “We’re rolling back this overreach and making it clear that investment decisions should be made by fiduciaries, not DC bureaucrats”

- The new guidelines (or lack thereof) should facilitate inclusion of digital assets within retirement plans such as the 401(k), according to the Economic Policy Institute

- This shift follows recent removal of an IRS rule that would have forced digital asset brokers to provide tax information on transactions conducted within their platforms

What happened: Crypto Treasury news

How is this significant?

- Bitcoin treasury specialists Strategy (formerly MicroStrategy) once again added a to its Bitcoin holdings, spending just over $75m to buy 705 Bitcoin

- This brings its total treasury to 580,955 Bitcoin (and counting)

- Japan’s leading Bitcoin balance sheet advocate, Metaplanet, actually outspent Strategy this week, acquiring 1,088 Bitcoin for around $118m

- Crucially, its total holdings now stand at 8,888 Bitcoin; reflecting the most auspicious number in several East Asian cultures

- New American Bitcoin treasury firm Twenty One—backed by Cantor Fitzgerald and Tether—raised further capital for Bitcoin acquisition this week, selling an additional $100m of convertible notes according to its latest SEC filing

- Twenty One’s current raise is $685m, or which $485m has already been deployed for Bitcoin acquisition

- Gamestop executed its first Bitcoin buy since a change to its investment policy in March, acquiring 4,710 Bitcoin for around $512m

- Investors reacted warily to the news, with some analysts stating that the perceived volatility of digital assets raised concerns

- One institution which shan’t be joining any of the above is Facebook parent company Meta; its shareholders voted against investing in Bitcoin by a near-unanimous margin

- This week also saw one of the first instances of an Ether treasury policy; publicly-listed Sharplink Gaming raised $425m to acquire Ether as a reserve asset

- The funding round was led by Ethereum ecosystem developers Consensys, and will make Sharplink the largest publicly-traded Ether reserve firm in the world

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.