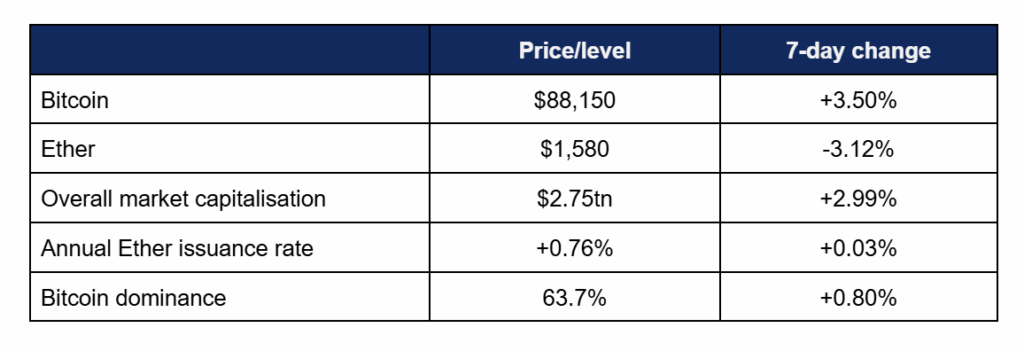

Market Overview

- Bitcoin built on last week’s growth, benefitting from its role as a hedge against monetary policy as Donald Trump’s distaste for the Federal Reserve and Jerome Powell grew increasingly public

- Bitcoin primarily traded between $84,000 and $85,500, before escalating Fed tensions and stock market losses led to a steep rise on Monday when markets reopened

- Bitcoin grew from a Wednesday low of $81,150 to a Monday high of $88,440; its highest level since the beginning of the month

- Ether was however unable to build on last week’s growth, posting losses over the last seven days

- The second-largest digital asset experienced more volatility throughout trading, with several sharp rises and falls punctuating the weekly chart

- Ether fell from a Tuesday high of $1,658 to a Wednesday low of $1,550, before rising and then dropping off sharply as Bitcoin began its rise back above $87,000

- Overall industry market capitalisation increased to $2.75tn

- According to industry monitoring site DeFi Llama, total value locked in DeFi pulled back slightly to $89.5bn, as Bitcoin dominated and Ether lost ground

Digital assets performed strongly as ongoing tensions between US president Donald Trump and Federal Reserve chair Jerome Powell led investors to hedge exposure against the dollar with more decentralised assets. Stablecoin developments continued apace, several significant funding deals were struck, digital asset firms are apparently evolving from “debanked” to “licenced banks”, the CEO of the world’s largest exchange confirmed nation-level interest in crypto reserves, and much more.

What happened: ETF News

How is this significant?

- Digital asset ETFs performed broadly positively during a trading week truncated by the Easter holiday in the US

- Overall ETF flows in the week ending 18th April displayed mixed performance between gains for Bitcoin products, and losses for their Ether counterparts

- Spot Bitcoin ETFs logged inflows on four of the last five trading days, albeit only slightly outpacing the one (large) day of outflows in between

- $76m and $107m inflows on Tuesday and Thursday sandwiched $171m outflows on Wednesday

- Despite the large Wednesday outflows, BlackRock’s market-leading IBIT managed to log its first consistent string of inflows this month, adding at least $30m (and up to $81m) on every trading day last week

- This provided IBIT with the four largest daily inflows of the entire week; Fidelity’s FBTC featured the next-best performance, adding $26m on Thursday

- However, FBTC was also amongst the week’s biggest losers, shedding $114m the day before—just ahead of $113m outflows from ARK Invest’s ARKB

- At the time of writing, all Monday data except for IBIT was reported—and pointed to the best day of the month, with at least (assuming no IBIT outflows) $340m gained

- Spot Ether ETFs on the other hand continued to underperform their Bitcoin brethren, as three days of outflows brought losses (albeit at modest levels) to seven trading days running, before net-zero flows on Thursday halted the streak

- Only two funds notched any daily inflows whatsoever last week; 21Shares’ CETH ($1.8m), and Grayscale’s 0.15% fee mini-ETF

- Bloomberg chief ETF analyst Eric Balchunas pointed out the current gulf between the Bitcoin and Ether ETFs, noting that whilst a 2x short Ether ETF is one of the broader ETF complex’s top performers year-to-date, Bitcoin ETFs still account for over 84% of crypto fund capital

- This share may shift in the future however; Balchunas revealed that there are currently 72 different crypto-linked ETFs filed with the SEC and awaiting approval

- Meanwhile in Hong Kong, HashKey Capital announced the first XRP tracker fund for the Asia-Pacific region, with developer Ripple Labs serving as an anchor investor

- This fund will only be available to professional investors, and offers exposure through both cash investment and in-kind liquidity

What happened: Stablecoin news

How is this significant?

- The stablecoin sector continues to attract attention from across the broader financial sphere, as legislative efforts in the US progress

- Analysts from Standard Chartered forecast that when American legislation does pass, it could lead to tenfold growth for the stablecoin sector, increasing market capitalisation to $2tn

- The bank’s head of digital assets, Geoff Kendrick, believes the US recognises stablecoin growth as a boon to the dollar; “US legislation on stablecoins—typically pegged to a fiat currency like the USD and designed to reduce price volatility and facilitate transaction—would further legitimise the stablecoin industry. This has implications for both US Treasury buying (for reserve purposes) and USD hegemony”

- Under Standard Chartered’s estimates, only money market funds will be larger buyers of US treasuries once stablecoin legislation officially passes

- Reports emerged that on Tuesday, USDC issuer Circle is inviting partners to its New York headquarters to announce a new venture; the launch of a payment and remittance network

- Sources told industry publication Coindesk “Circle is launching a payments network that is initially targeting remittances but is ultimately aiming to rival Mastercard and Visa”

- Bloomberg reported that stablecoin market capitalisation hit a new record high during wider global market uncertainty due to US tariff policy

- Whilst the digital asset market as a whole declined around 7% from early February to mid-April, stablecoin capitalisation actually appreciated 4.5% in the same timeframe

- A new stablecoin designed to provide protection from inflation recently launched, courtesy of USDi partners

- The USDi stablecoin is pegged to the increase in the US consumer price index since December 2024, rather than the US Dollar directly

- USDi cofounder (and banking industry veteran) Michael Ashton stated “The riskless asset doesn’t actually currently exist, and that’s inflation-linked cash. Holding cash is an option on future opportunities, and the cost of that option is inflation. If you create inflation-linked cash, that’s the end of the risk line”

- The Bank of Korea (South Korea’s central bank) published a new report on Monday, confirming it will “actively participate” in national legislative efforts for the asset group

- BoK’s report suggested that around 18.25 million Koreans currently trade digital assets; more than a third of the country’s population

- It stated that “The [Bank of Korea] intends to present its views on the desirable direction of stablecoin regulation from a central bank perspective”

What happened: Binance CEO reveals nation-level interest in crypto reserves

How is this significant?

- According to a recent interview with the Financial Times, Binance CEO Richard Teng is currently advising both nations and sovereign wealth funds on creation of strategic Bitcoin reserves

- He told the paper “We have actually received quite a number of approaches by a few governments and sovereign wealth funds on the establishment of their own crypto reserves”

- Teng added that alongside reserves, the exchange is also advising on specific digital asset policy; “[We’ve] been approached by quite a lot of countries to help them with formulating their regulatory framework to govern crypto”

- He acknowledged that shifts in Washington crypto attitudes provided an impetus for other nations to explore digital asset exposure; “[We] benefited greatly in the past few months from the policies coming out from the US. I think the sentiment has shifted a lot”

- In another revelation, Teng said that friendlier regulatory regimes meant the company is “working very hard” on establishing an international headquarters; “It requires serious deliberation and the board and the senior management are spending a lot of time doing the evaluation”

- Bloomberg recently confirmed his predecessor as CEO, Binance founder Changpeng “CZ” Zhao, is acting as a national advisor on crypto policy to the nations of Pakistan and Kyrgyzstan (amongst other unnamed nations)

What happened: Upexi outlines $100m Solana purchase strategy

How is this significant?

- Supply chain management company Upexi became the latest publicly-listed firm to announce a digital asset acquisition strategy—but whilst most companies have concentrated on Bitcoin, Upexi has highlighted altcoin Solana (the second-largest smart contract blockchain) as the horse it’s backing

- Its planned exposure is far from negligible; before announcing the strategic pivot, Upexi had a market capitalisation of around $3m; yet it plans to invest $100m in the Solana token

- Funding for the acquisition is being led by crypto trading firm GSR, via a private placement sale of nearly 44 million units of Upexi’s common stock

- GSR’s head of research Brian Rudick stated “Solana’s speed, scalability, and vibrant developer ecosystem make it an ideal foundation for long-term growth and we are honored to help accelerate the integration of digital assets into institutional portfolios”

- Markets responded positively to Upexi’s crypto embrace; company stock surged over 600% in the immediate aftermath of the news, although it remains to be seen whether it sustains the majority of those gains

- Former executives of digital asset exchange Kraken recently bought a majority stake in real estate firm Janover Inc., moving swiftly to allocate $10.5m of its corporate treasury to Solana

- In news of a more established crypto treasury firm, corporate Bitcoin holder Strategy (formerly MicroStrategy) purchased another $555.5m worth of Bitcoin last week, bringing its total holdings to 538,200 Bitcoin, purchased at a total cost of $36.47bn (an average price of under $68,000 each)

What happened: Trump-linked World Liberty Financial signs deal with DWF Labs

How is this significant?

- World Liberty Financial (WLF), the DeFi project featuring several members of Donald Trump’s family as advisors, recently closed a $25m deal with digital asset market makers DWF Labs

- According to a statement, DWF will provide liquidity for WLF’s upcoming USD1 stablecoin, and purchased $25m of WLFI tokens in a “strategic private transaction”

- WLF co-founder Zak Folkman commented “As our partner, we expect DWF Labs to help accelerate the next-generation infrastructure we’re actively building and deploying at WLFI”

- The deal deepens the Trump family’s involvement in the crypto space—a trend which has raised concern among some senior Democrats, but wich Eric Trump claims contains no conflicts of interest

What happened: Circle, Coinbase and BitGo reportedly apply for federal bank charters

How is this significant?

- The Wall Street Journal reported this week that several digital asset firms have applied for federal banking charters, in a sign of the industry’s continued rise in profile within the US

- Amongst the crypto companies mentioned were USDC issuer Circle, trust company Bitgo, Coinbase exchange, and stablecoin issuer Paxos

- Some of the licences in question are believed to be very narrow in scope, limited to levels enabling issuance of stablecoins

- Industry publication TheBlock recently reported that major extant banks in the US, such as Bank of America, are trying to prevent non-banks from issuing dollar-pegged stablecoins

- In a twist of fate, crypto firms could now become legitimate banks, after the digital asset industry widely debanked during the previous administration as part of the purported “Operation Chokepoint 2.0”

- Bloomberg columnist Matt Levine noted “Perhaps the future is that crypto will fully recreate normal banking, including bank regulation”

- The article also noted that Deutsche Bank and Standard Chartered aim to expand US crypto operations in anticipation of a more favourable regulatory regime after legislation gets passed

What happened: Auradine raises over $150m for Bitcoin mining push

How is this significant?

- Computing rig manufacturer Auradine confirmed a $153m Series C this week, one of the largest raises in recent recollection

- The Silicon Valley firm confirmed a split strategy on Bitcoin mining and A.I., as its hardware rigs can dedicate computational power to both hashrate-intensive industries

- CEO Rajiv Kemani stated “Our dual focus on Bitcoin and AI infrastructure places Auradine at the intersection of pivotal technologies that will reshape computing and energy utilisation for decades to come”

- Participating investors included mining firm Marathon, Qualcomm Ventures, and Samsung Catalyst Fund

- Auradine could also be a beneficiary of the new tariff regime, as many other mining manufacturers are located overseas and thus liable to face increased costs

- In news of other major raises, tech billionaire Mike Novogratz’s Nasdaq-bound Galaxy Digital this week confirmed an oversubscribed VC funding round, expected to close at $180m in June, up from an initial $150m goal

- The new Galaxy Ventures Fund 1 LP will concentrate primarily on early-stage startups

What happened: Hidden Road receives broker-dealer licence following $1.25bn acquisition

How is this significant?

- Following one of the largest acquisition deals in industry history last week, Ripple Labs’ new prime broker subsidiary Hidden Road extended its services this week, receiving a broker-dealer licence

- Hidden Road president Noel Kimmel said it was part of a move towards full-service brokerage across multiple asset classes; “[it] enables us to transact a much broader universe of customers… it’s a next step as we build out the platform”

- He added that the acquisition by Ripple was a boon to the broker’s capital base, as “We were limited by our size prior to the deal”

- Bloomberg noted that Hidden Road should also boost Ripple’s volumes and presence across markets; it “will use Ripple’s RLUSD stablecoin as collateral for its prime-brokerage products and move its post-trade activity to the XRP Ledger blockchain”

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.