Market Overview

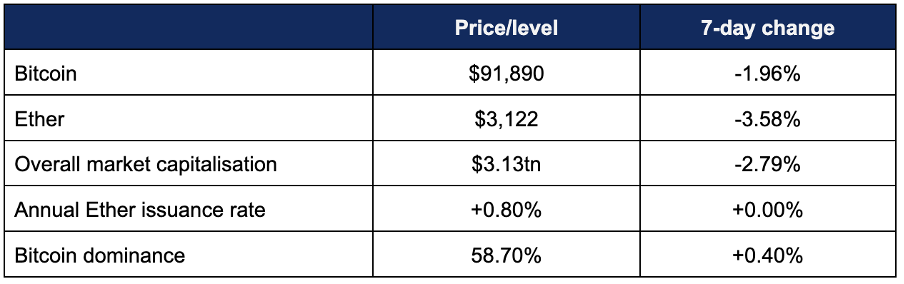

Digital assets cooled off after their explosive start to the year, as caution around Fed policy tempered enthusiasm around several major banks embracing crypto.

- Bitcoin retraced some of last week’s gains, but still remained more than $4,000 above the year’s opening bell of $87,500

- The market leader peaked at $94,280 on Tuesday, before declining throughout the week to hit a low of $89,340 on Thursday as continued tensions between the US government and Federal Reserve reduced hopes for significant rate cuts in the next round

- Except for two brief dips, Bitcoin managed to sustain a run above $90,000 for the entire week

- Ether showcased similar patterns, remaining above $3,000 as a weekly high of $3,296 on Tuesday gave way to a Friday bottom of $3,062

- According to industry monitoring site DeFi Llama, total value locked in DeFi dropped nearly $3bn to $124.4bn

Digital assets stalled slightly after last week’s explosive start to the year, as economic uncertainty in the US continued to affect trader confidence. However, it was a big week for the confluence of crypto and banking, as the institutions which once universally shunned the asset class are now racing to embrace it. Big banking names including Morgan Stanley, Standard Chartered, JP Morgan, BNY, and Lloyds all featured, alongside heavy activity in the stablecoin space.

What happened: ETF News

How is this significant?

- Digital asset investment products shifted into outflows this week, with analysts citing concerns over Federal Reserve policies

- According to Coinshares data published on Monday, the trading week ending Friday the 7th experienced $454m total outflows

- Coinshares head of research James Butterfill noted that although larger assets posted outflows, altcoin ETFs actually made gains over the week; “Positive sentiment persisted for XRP, Solana, and Sui, drawing inflows of US$45.8m, US$32.8m, and US$7.6m, respectively”

- Spot Bitcoin ETFs started the week strongly with $697m inflows, before four consecutive days of outflows (ranging from $243m to $486m)

- BlackRock’s IBIT fund featured the week’s two best performances, adding $373m and $229m on Monday and Tuesday, before three days of outflows between $130m and $252m

- Fidelity’s FBTC was the only other fund to cross the nine-figure inflows threshold, with $191m inflows on Monday—but it also featured the week’s largest losses, shedding $312m on Tuesday

- According to late-breaking Monday trading data, spot Bitcoin ETFs started this week positively, with $187m inflows before any IBIT data was reported

- Spot Ether ETFs exhibited mixed performance, beginning the week with two days of healthy inflows ($168m and $115m), before three days of outflows between $94m and $159m

- BlackRock’s ETHA dominated positive performances, logging inflows of $103m and $199m, whilst no other funds crossed $23m in inflows

- ETHA’s dominance also extended to outflows, posting the largest weekly capital flight of $108m and $84m

- According to data from Sosovalue, XRP spot ETFs doubled their previous week’s volume, and set a new record, logging $219m of trade with strong inflows

What happened: Morgan Stanley deepens digital asset exposure

How is this significant?

- Global banking giant Morgan Stanley made some major moves in the digital asset field, filing for a slew of major ETFs as well as unveiling its own storage solution

- The institution became the first major bank to file for crypto ETF issuances, applying to create spot Bitcoin, Solana, and Ether ETFs

- These filings follow on from Morgan Stanley guidelines last October, recommending up to 4% crypto allocation amongst “opportunistic” portfolio, after it announced crypto trading for ETrade clients in 2026, dropped restrictions on digital asset access for wealth clients, and participated in the $104m Series D round of crypto infrastructure firm ZeroHash

- Although it has lagged behind other issuers in the field, Morgan Stanley looks to make up for lost time, as its Ether ETF filing includes plans to stake the underlying assets, a relatively recent regulatory development

- In addition, the filings all carry the Morgan Stanley brand on the proposed ETFs’ names; a policy only followed on a tenth of ETFs issued by the bank

- Industry observers and analysts were caught off-guard by Morgan Stanley’s unexpected entry into the burgeoning crypto ETF field; Bloomberg ETF analyst James Seyffart wrote “Can honestly say that I am very surprised by these. Didn’t see this coming. I’ve been saying for literal years that most of these firms will change their tune on crypto”

- His colleague Eric Balchunas dubbed it a “smart move” and a possible means of kickstarting a “Bring Your Own Assets” strategy to keep clients away from competing funds; “This could nudge a couple others to launch in house branded btc etfs as well, we’ll see”

- Analysts at industry publication TheBlock saw this as a commitment to crypto from the bank, spurred by regulatory support; “[the filings] suggest Morgan Stanley is positioning itself to meet growing client demand for regulated, exchange-traded exposure to digital assets as crypto markets mature and institutional participation continues to expand”

- Matt Hougan, CIO of crypto ETF issuer Bitwise, commented “Consensus View: Institutions are slowly warming up to crypto. Accurate View: Institutions are charging at crypto full-speed and see it as a key business priority”

- Following a few days after the filings, Morgan Stanley also announced plans for its own branded digital wallet to store client crypto assets

- Speaking to Barrons, head of wealth management Jedd Finn told the publication “This is really a recognition that the way that financial service infrastructure works is going to change. Over time, as our infrastructure develops, we’ll be able to do more with the blending of the traditional finance, or TradFi, and decentralised finance, or DeFi, ecosystems”

- He added that the firm’s crypto shift “all fits together in a broader strategy of adapting to the change in the industry and in some cases driving the change in the industry”

What happened: Standard Chartered setting up crypto prime brokerage

How is this significant?

- Global bank Standard Chartered is another major institution to deepen its crypto involvement this week, as Bloomberg sources reported it is setting up a crypto prime brokerage

- Those with knowledge of the plans told Bloomberg that the new business will be run by VC subsidiary SC Ventures, following on from previously-announced plans for a “light financing and [digital asset] markets platform”

- Bloomberg analysts believe that “setting up the new business within SC Ventures may help Standard Chartered avoid having to absorb strict capital requirements for digital assets in its corporate and investment bank”

- Basel III guidelines currently require three times greater risk charges for “permissionless” crypto assets than other perceived risk assets, making such alternatives a viable strategy until (or if) Basel capital crypto rules are revised

- Additionally, the bank’s head of digital asset research Geoff Kendrick made several bullish predictions for the asset class in a new report

- He declared that “I think 2026 will be the year of Ethereum, much like 2021 was”, citing several factors including “growing adoption of stablecoins, real-world assets and decentralized finance, areas where Ethereum remains the dominant settlement layer”

- The bank also revised its Ether price targets, increasing predictions for 2029 and 2030 levels (to $30,000 and $40,000 respectively), whilst reducing nearer-term estimates in light of weak Q4 Bitcoin performance, and predicted a $2tn market for stablecoins and real-world assets by 2028

What happened: Stablecoin news

How is this significant?

- The stablecoin sector continued its broad growth trends, as numerous significant developments were reported this week—although it remains the bone of some political contention

- According to data by Artemis Analytics, stablecoin transactions reached a new record of $33tn last year, led by Circle’s GENIUS-compliant USDC coin

- This appeared due to Circle’s favoured status across DeFi applications, where traders can frequently move in and out of positions, as Artemis co-founder Yim stated the rise in total flows “signal[s] mass adoption of digital US dollars especially in an increasingly unstable geopolitical landscape”

- Tether’s USDT remains by far the largest coin by overall market capitalisation, with Tether CEO Paolo Ardoino responding that “USDT’s volume is more evenly distributed across simple transfers that resemble real-world payment behavior and trading settlement. When isolating transactions where a user sends only stablecoins to a single counterparty, USDT accounted for roughly 70% of total stablecoin volume in 2025, across all stablecoins”

- Stablecoin infrastructure firm Rain closed a $250m Series C round led by Iconiq, and including Dragonfly, Bessemer Venture Partners, and Galaxy Ventures amongst others

- The round valued the firm at $1.95bn

- Rain CEO Farooq Malik stated “Stablecoins are quickly becoming the way money moves in the 21st century, but adoption by users worldwide requires cards and apps that just work. In the last year, our active card base has increased 30x and our annualised payment volume has increased 38x, but we’re still in the early innings”

- Iconiq partner Kamran Zaki commented “We believe we’re witnessing a shift from legacy payment networks to programmable digital-asset infrastructure, and there is a brief window to help define the default platform enterprises will rely on”

- Trump family-founded DeFi project World Liberty Financial filed for a federal bank charter

- The Wall Street Journal broke this news, which would enable the expansion of World Liberty’s existing proprietary USD1 stablecoin services

- World Liberty co-founder Zach Witkoff stated “A national trust charter provides a clear federal framework for custody, reserve management, and fiduciary oversight… that can enable more direct institutional participation, stronger consumer protections, and broader use in regulated payment and settlement flows—always subject to supervisory approval”

- The firm also rolled out a new web app (World Liberty Markets) for USD1 borrowing and lending services

- Bernstein analysts noted that rewards on stablecoins (offered by crypto exchanges) remain a key sticking point in debates on the CLARITY market structure bill within the US Senate

- Banks generally oppose any possibility of yield on stablecoins, threatening crypto firms like Coinbase, which may withdraw its support for the bill if politicians yield (no pun intended) to banking industry demands

- Leading Brazilian exchange Mercado Bitcoin released its predictions for 2026, including growth of the stablecoin sector to $500bn

- This prediction includes substantial non-dollar stablecoins, as other markets potentially adopt them as a direct payment method, rather than a means of hedging against local inflation

- In Brazil, former central bank director Tony Volpon announced a new Real-pegged stablecoin, designed to allow foreign investors access to high yield

- The BRD coin is backed by national treasury bonds, offering exposure to 15% interest rates

- Speaking on CNN, he said “The ability to remunerate stablecoin holders with the interest rates offered by Brazil will obviously be a major draw, especially for institutional investors”

What happened: BNY launches tokenised deposits

How is this significant?

- BNY Mellon, the largest custodial bank in the world, became the latest to move into the tokenised deposit space, following the likes of JP Morgan, HSBC, and Singapore’s DBS to name just a few within banking

- The service allows institutional clients to transfer funds via blockchain as the bank moves towards a 24/7 service model

- Cited benefits of the tokenised deposit system (beyond 24/7 operability) include programmable transactions (automating the transfer of funds when certain conditions are met), and use in margin transactions and collateral

- BNY released a roll-call of major institutions interested in the new service, including NYSE parent company Intercontinental Exchange, Citadel Securities, DRW Holdings, crypto prime brokerage Ripple Prime, asset manager Baillie Gifford, and USDC stablecoin issuer Circle

- Chief product officer Carolyn Weinberg told Bloomberg “This is very much about connecting traditional banking infrastructure and traditional banking institutions with emerging digital rails and digital ecosystem participants in a way that institutions trust”

- Elsewhere in the tokenisation and banking confluence, Lloyds Bank completed the UK’s first gilt purchase via tokenised deposits

- It worked alongside Archax and the finance-focused Canton blockchain to execute the transaction

- Lloyds head of transaction banking products Surath Sengupta stated “This transaction offers a glimpse into the future of finance; faster, smarter, and more efficient. Tokenisation allows us to bring real-world assets onto blockchain infrastructure, creating opportunities for businesses to transact with greater speed, transparency, and flexibility”

What happened: Acquisition and IPO news

How is this significant?

- Multiple industry firms executed nine-figure deals this week, as they either strengthened their position through acquisitions, or raised funds for planned public floats

- Barclays Bank secured a stake in stablecoin settlement startup Ubyx, although details of the deal remained undisclosed

- Reuters reported that Barclays and Ubyx will develop “tokenised money within the regulatory perimeter” as the bank explores new forms of digital money

- Crypto wallet firm BitGo became the first to advance IPO plans in 2026, seeking just over $200m funding at a $1.96bn valuation

- According to its SEC filing, it is offering 11.8 million shares between $15 and $17 (expected to price on January 21st)

- Institutional custody specialists Fireblocks bought accounting and reporting specialists TRES Finance for a reported $130m

- Fireblocks stated that TRES will continue operating under its current branding, with Fireblocks “supporting its growth and integrating it more deeply into institutional workflows”

- Developers Babylon Labs secured a $15m investment from VC specialists Andreessen Horowitz (a16z) to expand its BTCVaults product

- This allows native Bitcoin (rather than wrapped Bitcoin on smart contract blockchains such as Ethereum) to be used as onchain collateral

- An affiliate of crypto exchange Kraken sponsored the creation of KRAKacquisition Corp; a blank-cheque SPAC designed to effect a merger with a (as-yet undetermined) existing business

- According to its S-1 registration filing, its IPO would involve 25 million shares priced at $10 each, meaning a $250m public offering for a firm without a specific takeover target yet

What happened: JP Morgan goes multi-chain

How is this significant?

- Global banking giant JP Morgan increased its recent digital asset push yet further this week, moving its JPM Coin tokenised deposit product further beyond its own proprietary Kinexys blockchain

- JPM Coin was previously rolled out onto Coinbase’s Ethereum layer-2 blockchain Base, and is now launching natively onto the finance-centric privacy-focused Canton blockchain

- A JP Morgan spokesperson told industry publication Coindesk “As part of the firm’s broader plan to issue JPM Coin on multiple blockchain networks, in bringing JPM Coin natively to Canton, this lays the foundation for regulated, interoperable digital money. With native availability of JPM Coin, institutions using Canton will be able to receive, transfer and redeem JPMD near-instantly within a secure and synchronised ecosystem”

- The spokesperson also outlined the benefits of the tokenised deposit program, using an existing client; “For example, Siemens leverages its Blockchain Deposit Accounts in Frankfurt and New York to make near-instant USD-to-EUR FX cross-border payments on Kinexys Digital Payments. This enables Siemens’ global business to overcome limited settlement windows, further enhancing the efficiency and reliability of multi-currency, cross-border payments and liquidity management within its treasury platform”

What happened: Crypto Treasury news

How is this significant?

- Leading Bitcoin treasury firm [Micro]Strategy increased its previous purchase over ten-fold this week, marking its biggest Bitcoin buy since July

- The enterprise software firm acquired 13,627 Bitcoin between the 5th and 12th of January, spending almost $1.25bn

- This brings Strategy’s total holdings to 673,783 Bitcoin

- As last week, these buys were funded primarily via at-the-market sales of its Class A common stock

- The firm also received some positive news when it emerged that MSCI will not delist crypto-related firms from its indexes (for the time being), despite previous concerns to the contrary

- Leading Ether treasury firm BitMine added 24,000 Ether to its coffers over the last week, but warned that the recent rate of acquisition could slow

- Chairman Thomas Lee noted that shareholders need to approve new equity issuance if they wish to continue building out the Ether treasury, which now stands at over 4,167,600 tokens

- He wrote “We need to pursue this increase now as Bitmine is soon to exhaust its current 500 million authorization. And when that happens, our ETH accumulation will slow”

- Meanwhile, South Korean authorities are seeking a 5% cap on corporate crypto exposure, according to reports in the local press

- Under the proposed guidelines, “corporations and professional investors would be permitted to allocate up to 5% of their equity capital annually to the top 20 crypto assets by market capitalisation”; although whether this includes stablecoins within the top 20 remains a point of discussion

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.