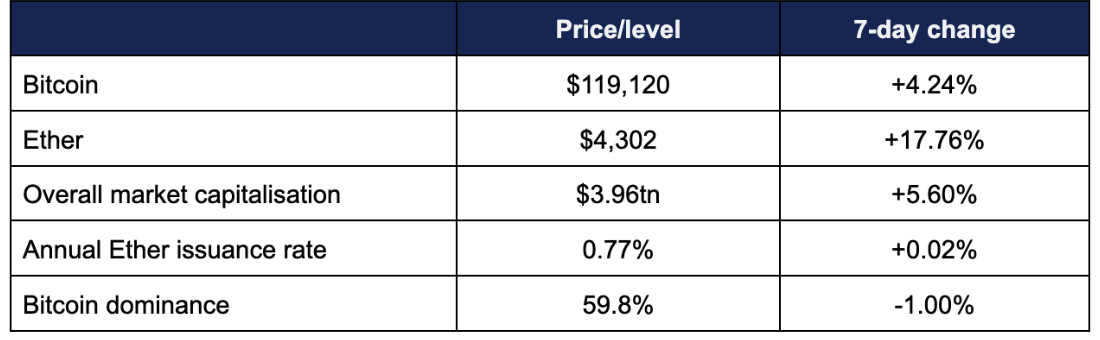

Market Overview

- Bitcoin recovered from its recent slump, briefly approaching last month’s record highs

- Bitcoin rose steadily throughout the week, bolstered by executive orders on Thursday that made crypto more accessible across US retirement plans

- The leading digital asset rose from a weekly low of $112,750 on Tuesday to a high of $122,320 on Monday; within $800 of the asset’s mid-July all-time high

- Ether continued its recent outperformance of Bitcoin in one of its best weeks ever, surpassing it in year-to-date growth thanks to strong institutional flows

- Growth since the year’s lows in April has been particularly explosive, with Ether up over 190%

- Ether topped $4,000 for the first time since last December; and continued the bullish momentum to breach $4,300 for the first time since November 2021

- Ether also exhibited a steady upward trajectory throughout the week, rising from a Tuesday low of $3,560 to a Monday peak of $4,351

- Overall industry market capitalisation grew by over $200bn to $3.96tn, after briefly topping $4tn for the first time ever

- According to industry monitoring site DeFi Llama, total value locked in DeFi appreciated in accordance with Ether’s strong performance, to $149.3bn

Digital assets returned to growth as the market hit new record highs following a Bitcoin recovery and Ether’s best performance since 2021. The sector was boosted by more regulatory support in the US as an executive order assisted crypto in pension plan allocations, whilst ETFs returned to growth. Banking giant BBVA teamed up with crypto titan Binance for off-exchange settlement, liquid staking was cleared by the SEC, stablecoin adoption continued globally, Bolivia illustrated the benefits of the asset class, and digital asset treasury strategies branched out further.

What happened: New executive order opens 401(k) retirement plans to crypto investments

How is this significant?

- President Trump signed a new executive order on Thursday, opening the door to America’s $9tn retirement plan market to private equity, real estate, gold, and crucially; crypto

- As per the executive order, the US Labour Department must now reevaluate guidance around alternative asset investments in retirement plans within the next six months

- Analysts called the order “a win for the private-asset industry”, arguing that it provides retirement savers with more portfolio diversification and potentially greater returns

- According to a survey by the American Retirement Association, private assets are currently very limited in retirement plans; “fewer than one in ten retirement plans offer any kind of alternative investment option, and only 2.4% make private equity available”

- Meanwhile, a June report from BlackRock predicted that “adding private-market assets to a defined contribution retirement account using diversified target-date funds could bump up returns by about 0.5% a year and lead to 15% more money in an account over 40 years”

- Financial advisors such as Ric Edelman have argued against the traditional 60/40 portfolio switch, and argue that including crypto could create outsized returns necessary to finance retirement plans in an age of increased longevity

- The amount of Bitcoin exposure recommended by analysts and financial advisors varies wildly; Edelman wants investors with high risk tolerance to seek 40% exposure, whilst financial planner Bob Wolfe cites no more than 5% for young investors, and fellow planner Kevin Feig recommends an 8% to 15% range

- Crypto advocates greeted the executive order positively, saying that the long-term horizon of retirement plans can mitigate the asset class’ perceived volatility – often cited as its biggest drawback

- White House A.I. and Crypto Czar David Sacks commented “Democratising Access to Alternative Assets for 401(k) Investors will allow more than 90 million American workers, whose retirement accounts are currently limited, to access the same range of alternative assets (including digital assets) that are available to government workers, for better returns and diversification”

- Nevertheless, many from more traditional asset classes remain wary; Brookings Institute senior fellow Mark Iwry told Bloomberg “A portion of the private markets industry was concerned about being lumped in with crypto in the executive order. Some have been wary of the speculative nature of crypto, the difficulty most investors have understanding it, and high-profile conflicts of interest”

- The executive order does still require particular structures around digital asset exposure, allowing “holdings in actively managed investment vehicles that are investing in digital assets”, rather than directly-custodied exposure

- Coinbase Asset Management president Anthony Bassili supported this move;“Active management brings an extra layer of fiduciary responsibility and curation to crypto. Digital assets will be less volatile as it continues to be internalised into the global finance system”

- Additionally, Trump signed another executive order aimed to prevent “debanking”, citing perceived historic bias between the banking industry and conservatives and crypto companies

- A fact sheet from the White House stated “The digital assets industry has also been the target of unfair debanking initiatives… These practices erode public trust in banking institutions and regulators, harm livelihoods, freeze payrolls, and impose significant financial burdens on law-abiding Americans”

- Meanwhile, banking committee Democrats criticised Senate Republicans’ draft of the market structure CLARITY Act (passed by the House last month) as a potential “superhighway” for dodging regulatory oversight, fearing abuse of tokenisation as a legislative loophole

What happened: ETF News

How is this significant?

- Digital asset investment products returned to growth after last week’s outflows, marking positive movement in 17 of the last 18 weeks

- According to Coinshares data published on Monday, crypto asset funds gained $572m in fresh capital during the trading week ending Friday the 8th of August

- This performance featured a strong late-week rally after early losses, spurred by the new executive order facilitating crypto inclusion in 401(k) plans

- CoinShares Head of Research James Butterfill explained “Early in the week, outflows reached $1bn, which we believe were driven by growth concerns stemming from weak US payroll figures. In the latter half of the week, however, we saw $1.57bn of inflows, likely spurred by the government’s executive order”

- Spot Bitcoin ETFs logged a third and fourth consecutive day of nine-figure outflows in early trading, losing $324m and $196m on Monday and Tuesday, before turning the ship around and recovering losses thanks to the prospect of Bitcoin in retirement plans

- The largest losses came from the largest fund; BlackRock’s IBIT experienced $292m outflows on Monday, followed by $77m on Tuesday

- Fidelity’s FBTC narrowly missed the ignominity of nine-figure outflows, as it shed $99m on Tuesday

- Thankfully for investors, the funds returned to growth on Wednesday ($96m total inflows), before accelerating on Thursday ($277m) and Friday ($404m)

- IBIT cancelled out its earlier losses, accounting for the majority of the late inflows at $157m and $360m respectively

- Spot Ether ETFs once again performed the rare feat of eclipsing their Bitcoin brethren, featuring four consecutive inflow days, including $461m on Friday (beating Bitcoin funds by over $50m)

- BlackRock’s ETHA and Fidelity’s FETH led the way in flows, adding $255m and $132m respectively during Friday’s rally as Ethereum exceeded $4,000 for the first time in eight months

- Early (but incomplete) trading data for Monday suggested more healthy Ether inflows, with over $2.5bn in trading volume logged before markets closed

- Elsewhere in ETFs, the SEC issued a new judgement last week expressing that liquid staking activities do not constitute securities

- New SEC chair Paul Atkins made the statement as part of the agency’s recent “Project Crypto” focus, and declared it “a significant step forward in clarifying the staff’s view about crypto asset activities that do not fall within the SEC’s jurisdiction”

- He added “It also is the Division’s view that the offer and sale of Staking Receipt Tokens, in the manner and under the circumstances described in this statement, do not involve the offer and sale of securities”

- This news was greeted enthusiastically across the crypto sphere, particularly amongst Ethereum enthusiasts, as it appeared to open the doors for the largest proof-of-stake network to add staking (and hence rewards) to existing ETFs

- Some issuers already anticipated this judgement; BlackRock filed to allow staking on its ETHA fund three weeks ago

- Ether’s price rallied considerably on the news, and network transaction activity hit record levels

- In other crypto ETF news, USDC issuer Circle became the latest to be honoured with a 2x daily returns ETF, Truth Social amended its Bitcoin ETF filing, NEOS filed for a high-income Ether ETF

- New records revealed that Harvard University’s endowment now owns over $116m in Bitcoin exposure via BlackRock’s IBIT ETF; news which Bloomberg chief ETF analyst Eric Balchunas deemed “significant” as “endowments are the hardest institutions to hook”, describing it as a “portfolio completion” move

What happened: Spanish banking giant BBVA joins forces with crypto exchange Binance

How is this significant?

- The Financial Times reported on Friday that digital asset exchange Binance has teamed up with Spanish bank BBVA in order to offer customers off-exchange settlement

- According to the FT’s report, Binance recruited BBVA for custody services, in a bid to improve customer protections

- Under the new custody arrangement, “trading activities [will be separated] from the funds backing the transactions by parking client assets in US Treasuries held by BBVA [and accepted by Binance]”

- Reuters reported that this makes BBVA one of a select few independent custodians for the world’s largest crypto exchange

- This deal encapsulates a maturing industry, moving Binance away from the typical crypto exchange “one stop shop” structure where exchanges handle every leg of the customer journey—a practice which led to widespread losses and outcry when FTX collapsed in 2022

- Crypto industry executive Pauline Shangett told industry publication Decrypt “This is one of the clearest signs yet that crypto market infrastructure is maturing to TradFi standards… In an industry where counterparty blowups have erased billions overnight, that’s a non-trivial improvement in trust”

- It also marks the latest step into the digital asset market for BBVA, which already offers crypto custody services to clients in Switzerland and Turkey

- In other banking news, Swiss crypto bank Sygnum added custody and trading support for the SUI blockchain, alongside upcoming plans for SUI Lombard loans

What happened: Mutual funds warm up to Bitcoin exposure

How is this significant?

- Bloomberg notes that mutual equity funds have been languishing against alternatives for years and bleeding money; but a small subset embracing Bitcoin have bucked the trend

- According to Bloomberg Intelligence analyst David Cohne, “Of the ten funds invested in Bitcoin via exchange-traded funds, seven beat their benchmarks by an eye-popping average of 22 percentage points in the 12-month period through July… Bitcoin beefed up returns and provided some an outsize bump”

- This included outperforming the S&P 500 index by 23% for Kinetics Internet Fund, which placed 50% of its assets in Grayscale ETFs

- This stellar performance came despite the fact that the vast majority of its Bitcoin allocation was placed in Grayscale’s larger GBTC fund, which carries a notorious 1.5% management fee; at least six times as much as any other fund (and thus benchmarks could have been beaten even further with lower-cost Bitcoin ETFs)

- Cohne wrote that “Bitcoin’s stupefying gains year after year—even when accounting for brutal drawdowns—have become too hard to ignore. Equity mutual-fund managers looking for an edge over the multi-year uptrend in stocks have come to see the digital coin as a high-risk, high-reward tool”

- A recent report from Bitcoin ETF issuer Bitwise suggests that “if a traditional portfolio of 60% stocks and 40% bonds were readjusted to include a 5% allocation to Bitcoin, it would have returned more than 200% in the 10 years ending 2024. That compares with a roughly 96% gain clocked by the 60-40 strategy”

What happened: Digital asset IPO news

How is this significant?

- Following last week’s reports of Peter Thiel-backed digital asset firm Bullish’s IPO filing, news emerged this week that it has “upsized” its proposed raise by over 50%

- Initially, Bullish sought $629m in funding, but in a press release, the firm stated “it has upsized its initial public offering from 20,300,000 ordinary shares to 30,000,000 ordinary shares and increased the expected price range from $28.00-$31.00 to $32.00-$33.00 per ordinary share”

- This works out to a maximum raise of $990m at a potential $4.8bn valuation

- Additionally, Bullish “intends to grant the underwriters [including JP Morgan and Jefferies] a 30-day option to purchase up to 4,500,000 additional ordinary shares, at the initial public offering price, less underwriting discounts and commissions”

- According to its updated filing, both ARK Invest and BlackRock have expressed interest in up to $200m of stock

What happened: “Ancient” dormant Bitcoin addresses attract attention from banks

How is this significant?

- Industry publication Coindesk this week published reports about revived investment bank Salomon Brothers, and its controversial plans to secure “ancient” Bitcoin on long-dormant addresses

- According to a press release, a client of Salomon “completed the process of inserting notices into digital wallets in connection with its initiative to address the risks posed by abandoned wallets”, in order to prevent rogue actors claiming ownership at a later date

- The notices were issued directly on the Bitcoin blockchain, via OP_Return notices issuing a 90 day deadline to claim ownership of the wallet addresses by either performing a transaction from the wallet, or filling out a form with Salomon Brothers

- Salomon argues that prolonged periods of inactivity could render wallet addresses “legally abandoned” under “Doctrine of Abandonment” laws, thus leaving them open for repossession

- Of course, the addresses targeted include some of the most valuable dormant addresses from the earliest days of Bitcoin, such as the famous “1Feex” blockchain address holding 80,000 Bitcoin

- A Salomon Brothers representative noted that some wallets have already responded to the notices by transferring funds to new addresses; “Securing wallets protects the millions of wallets that are not abandoned… risks to all digital wallet holders include government-imposed regulatory limits on crypto holdings in an effort to protect the integrity of crypto markets. All wallet holders therefore have an interest in supporting the resolution of this problem”

- Back in 2018, the Wall Street Journal estimated that a fifth of all Bitcoin was held in abandoned wallets (due to owner death or private key loss), the value of which has since increased exponentially over the last seven years

- However, recent events proved that long-term inactivity doesn’t necessarily equal abandonment; in July, Galaxy Digital completed the OTC sale of 80,000 Bitcoin from a Satoshi-era investor, worth $9bn

What happened: Stablecoin news

How is this significant?

- Recent US stablecoin regulation has boosted the sector; and led to companies across multiple industries seeking an entrance

- The GENIUS Act allows companies to issue stablecoins if they hold dollar-for-dollar reserves, creating potential conflicts between established banks, and crypto-native firms entering the broader banking space

- Custodia Bank founder Caitlin Long told Bloomberg “There’s a huge fight brewing between the banks and the nonbank stablecoin issuers… If the OCC gives these [crypto firms] trust charters rather than full bank charters, these banks will have ten to 15% of the capital requirements of being a fully-fledged bank and are not subject to all the regulations that apply to banks”

- She added “If the OCC [Office of the Comptroller of Currency] is basically back door slashing the capital requirements and the regulations on banks, why wouldn’t the banks convert to trust companies instead of being a bank as well”

- Paxos became the latest digital asset firm (following Ripple and Circle) to seek a national trust charter, converting its New York licence into a national one

- CEO Charles Cascarilla stated “By applying for a national trust bank charter, we are continuing to offer enterprise partners and consumers the safest, most trusted infrastructure available. This is rooted in our belief in the transformative power of blockchain as a force for financial freedom”

- Ripple recently revealed the acquisition of stablecoin payments platform Rail, in a bid to boost its own RLUSD stablecoin

- The $200m deal will likely close in Q4, and marks the second major acquisition of the year for Ripple, following the record $1.25bn buy of prime brokerage Hidden Road in April

- Hong Kong-based OSL secured $300m in funding to expand its global crypto operations, with a focus on stablecoins

- CFO Ivan Wong stated “funding will accelerate our global buildout—particularly in regulated stablecoin infrastructure and compliant payment rails”

- A new stablecoin licencing regime rolled out across the city at the beginning of August, as Hong Kong continues positioning itself as an Asian crypto hub

- Meanwhile, mainland China displayed mixed messages vis-a-vis stablecoins; the FT reported it plans to “allow the launch of its first stablecoins in a bid to internationalise the Renminbi and compete against the Dollar” despite concerns over capital flight

- It noted that People’s Bank governor Pan Gongsheng recently praised how stablecoins have “fundamentally reshaped the traditional payment landscape”

- However, Reuters reported that the central government demanded “local brokers and other bodies to stop publishing research or hold seminars to promote stablecoins”, in order to “rein in” the asset class

- Christopher Wong, currency specialist at Singapore’s OCBC commented “Chinese policymakers don’t favor too much fanfare… to any particular asset class. There’s still a worry that not everyone knows adequately about crypto and policymakers being pragmatic don’t want herd mentality when investors buy into something that they do not know what the risks are”

- $200bn asset manager PineBridge flipped bullish on the US Dollar, citing recent stablecoin regulation as the reason

- PineBridge’s Michael Kelly commented “It does potentially change one’s view on the currency. It’s going to happen [demand for stablecoins], I think, pretty quickly and it’s going to be a propellant for the dollar”

What happened: Coinbase undertakes $2bn funding drive

How is this significant?

- Leading publicly-traded digital asset exchange Coinbase became the latest industry firm to raise funds via a private offering of convertible bonds, to the tune of over $2bn

- In a press release, the firm announced that $1bn worth of the notes will be due 2029, and another $1bn mature in 2032

- These notes are only available to institutional investors, and “will be convertible into cash, shares of Coinbase’s Class A common stock, or a combination thereof, at Coinbase’s election”

- Additionally, each tranche offers up to $150m in additional bonds, for a potential total of $2.3bn

- JP Morgan will lead the drive, designed for repurchasing stock and redeeming outstanding debt

- In other Coinbase news, Bernstein analysts identified it as a key beneficiary of Ether’s recent resurgence, due to its alignment with the Ethereum blockchain, including its own Layer-2 scaling solution, the Base blockchain

- Analyst Gautam Chhugani wrote “We believe the alt rally has commenced (reflected in recent ETH outperformance) and Coinbase will be the biggest beneficiary… given its long list of 250+ tokens listed and now the long-tail of Base chain tokens integrated in the Coinbase App”

What happened: Digital assets continue gaining inflation hedge appeal in Latin America

How is this significant?

- Some of the key cornerstones of crypto assets are their borderless nature and code-driven issuance; both factors that have proven crucial in their adoption within countries afflicted by hyperinflation, particularly in Latin America

- Last week, institutional broker FalconX called Latin America “one of the fastest-growing regions for crypto adoption… with forward-thinking institutions and real economic drivers [such as hyperinflation] driving digital asset adoption”

- Bolivia currently suffers 25% inflation, and as a corollary has seen a drastic increase in digital asset use

- As Bloomberg writes “Bolivia is a major test case for a belief held by many crypto diehards: digital assets aren’t merely for speculation, they’re a better way to do commerce”

- Transaction volumes have increased fivefold over the last year, ranging from airport vendors selling candy priced in stablecoins, to university faculties paying professors in Bitcoin

- In the first six months of 2025, digital payments reached $300m, “in large part driven by necessity” due to economic stress, foreign currency debt, and 11 years of budget shortfalls

- One small business owner described crypto’s appeal as both practical and ideological; “For me, it’s a way to preserve the value of my savings, but also a way to go against the system, against bureaucracy”

- Currency shortages due to central bank policy are also a major factor according to a local business leader; “Among importers, crypto use is high. When they can’t access hard currency and need to make urgent payments, crypto becomes a viable alternative”

What happened: Crypto Treasury news

How is this significant?

- Adoption of digital asset treasuries continued across a variety of different firms and tokens

- In treasury firsts, TON Strategy Co (TSC), pivoting from Verb Technology Co, closed its PIPE financing and creating a treasury solely focused on TON. The strategy aims to leverage The Open Network’s deep integration with the Telegram messaging app and its 1 billion+ user base.

- Leading Bitcoin treasury firm Strategy (formerly MicroStrategy) celebrated the fifth anniversary of its first Bitcoin buy with another purchase

- The relatively-modest $18m buy took its total holdings to 628,946 Bitcoin; equal to nearly 3% of the coin’s total supply

- Digital asset firm Bakkt expanded its Bitcoin treasury strategy via a 30% stake in Japanese trading firm Marusho Hotta

- As the new majority shareholder, it will rename the firm to Bitcoin.jp, signalling a shift in strategic direction

- Bitmine took the head of the table for corporate Ether holdings, surpassing 1.15 million Ether thanks to $2bn of buys over the last week

- As further evidence of Ether’s recent resurgence, Bitmine stock (BMNR) was amongst the top 25 most traded US-listed shares last week, with $2.2bn daily volumes exceeding the likes of JP Morgan

- SharpLink Gaming followed suit, raising another $200m in order to bring total Ether holdings to $2bn

- Insurance firm Fundamental Global (or rather, its digital asset arm) also declared itself on “the Ethereum Standard”, acquiring 47,331 Ether for around $200m, with an eventual end goal of a 10% network stake

- Heritage Distilling became the first to adopt an IP Token treasury strategy, acquiring the native token of Story, a blockchain designed for intellectual property attribution in the age of A.I. generation

- The firm expects to acquire $340m worth of the token, financed by a16z crypto and PIPE financing

- In another treasury first, former pharmaceutical firm Alt5 announced a pivot into a WLFI treasury strategy, aiming to tie its fortune to the proprietary token of Trump-linked DeFi platform World Liberty Financial

- It seeks to raise up to $1.5bn to finance WLFI buys, causing additional unease in some political circles as the platform’s close links to the Trump family have “blurred the line between presidential power and private profit” (the Bloomberg Billionaires Index now attributes $620m of Trump’s fortune to digital assets)

- The scale of digital asset treasury (DAT) adoption is now causing some concerns amongst crypto loyalists; they currently plan to raise $79bn this year for Bitcoin purchases alone, but Maelstrom family office head Akshat Vaidya opined “I think the collapse of a major DAT is going to set the dominoes in motion for this bull cycle to end”