Market Overview

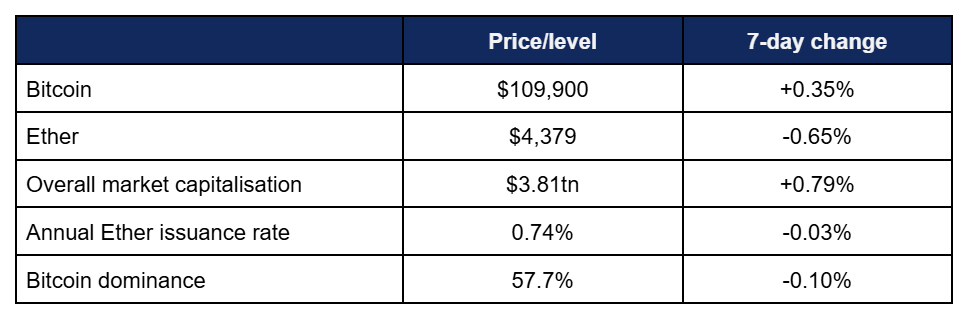

- Bitcoin fell to its lowest levels in seven weeks as investors increasingly allocated towards Ether, but managed to mount a modest recovery to finish the week positively

- Bitcoin reached a weekly high of $113,340 on Thursday, before dropping over the weekend and hitting a low of $107,360 on Monday

- Ether lost momentum after last week’s record highs, as concerns over Trump’s approach to the Federal Reserve and the legality of US tariff policies led to increased investor caution heading into September

- Ether peaked at $4,653 on Wednesday, before dropping to a weekly low of $4,245 on Monday

- Despite broader market uncertainty, overall market capitalisation actually increased over the course of the week, rising to $3.81tn at the time of writing

- According to industry monitoring site DeFi Llama, total value locked in DeFi remained virtually unchanged at $151.3bn

Digital assets navigated market uncertainty to finish slightly up on last week’s overall capitalisation, thanks to modest growth from Bitcoin. Tokenisation efforts continued, led by one of Japan’s largest banks. Franklin Templeton’s CEO outlined her vision of opportunities in the digital asset space, the US Secretary of Commerce announced government data on the blockchain, stablecoins experienced both adoption and resistance, and the Trump family grew their crypto fortune to record levels.

What happened: ETF News

How is this significant?

- Despite overall market declines over the last week, digital asset investment products moved back into inflow mode

- According to Coinshares data published on Monday, crypto asset funds logged $2.48bn inflows during the trading week ending Friday the 29th; marking an 18th week of positive flows over the last 20 weeks

- Once again, these flows were dominated by Ether products, continuing the recent trend of institutional interest in the market’s second-largest asset

- Overall August inflows reached $4.37bn, bringing year-to-date flows to $35.5bn

- CoinShares Head of Research James Butterfill noted the evolution of capital allocation across assets as smaller projects gained attention following Bitcoin’s recent record run, writing “For August, Ethereum has accumulated US$3.95bn in inflows, while Bitcoin recorded outflows of US$301m. Meanwhile, Solana and XRP continued to benefit from optimism surrounding potential US ETF launches, with inflows of US$177m and US$134m respectively”

- Spot Bitcoin ETFs recovered from last week’s string of outflows, registering positive returns on four of five trading days—albeit at more modest levels than Ether equivalents

- Daily inflows ranged from $81m to $219m, with the week closing on outflows as funds shed $127m on Friday as investors derisked ahead of September

- No single ETF achieved nine-figure daily inflows, with the best performance on Monday, as $219m total flows included three funds (BlackRock’s IBIT, Fidelity’s FBTC, and ARK Invest’s ARKB) accruing more than $60m each

- Atypically, the market-leading IBIT only returned the third-best daily performance during the week, following Friday’s $80m ARKB inflows, and Monday’s $66m FBTC inflows

- The largest outflows of the week also came from ARKB and FBTC, which suffered $72m and $66m capital flight respectively on Friday

- Spot Ether ETFs meanwhile exhibited far stronger volumes and trading, as daily inflows between Monday and Wednesday ranged from $301m to $455m

- This more than counteracted the Friday outflows of $165m, as investors sold off in anticipation of a bearish September

- Inflows were dominated by BlackRock’s ETHA, which posted increases of $263 to $323m from Monday to Wednesday, accounting for the vast majority of total flows

- Bloomberg ETF analyst James Seyffart commented that “Ether ETFs are on an absolute tear. They’ve taken in nearly $10bn since the start of July. Here’s what their flows look like since launch—nearly $14bn”

- He also revealed that there are currently over 90 filings for crypto ETFs and ETPs in the United States

- This includes filings for numerous digital asset ETFs beyond the Bitcoin and Ether complex, including altcoins such as SEI, XRP, Cardano (ADA), DOT, and a slew of Solana funds

- Speaking to industry publication Coindesk, Seyffart and ETF Store CEO Nate Geraci predicted potentially “hundreds of crypto ETP launches” within the next year and a half

What happened: Tokenisation news

How is this significant?

- Tokenisation efforts continued this week, including a potential major initiative by one of Japan’s largest financial institutions

- Following on from last week’s news that Japanese financial conglomerate SBI Holdings is building a RWA (real world asset) tokenisation project, the Nikkei news agency reported this week that Japan’s Post Bank may be going a step further

- According to Nikkei, the bank is considering tokenisation of deposits worth $1.3tn for its 120m accounts, via a Yen-backed DCJPY token

- The DCJPY token is redeemable across a network of partner banks, and was developed by Japanese firm DeCurret DCP, with backing from local finance giant MUFG

- The report adds that tokenised savings would roll out in the next fiscal year, and could be used to purchase tokenised securities with planned returns between 3% and 5%

- This news also follows on from recent disclosure that the country’s Financial Services Authority is expected to approve the first Yen-denominated stablecoin this autumn, backed by cash deposits and government bonds

- Canadian digital bank VersaBank is running a pilot scheme through its American subsidiary to test out tokenised deposits for business customers as “a safer and more compliant alternative to stablecoins”

- Under the bank’s Digital Deposit Receipts technology, USDVB tokens each represent one dollar held in deposit on a US VersaBank account

- According to industry publication Coindesk, “Tokens will be managed through the bank’s digital vault and e-wallet platforms” and issued on a variety of public blockchains, including Ethereum, Algorand, and Stellar

- It plans to conclude the pilot this year, and will seek OOC approval before a public rollout of the scheme

- Chinese construction group Seazen plans to issue tokenised private debt this year as a means of fundraising within the sector-friendly confines of Hong Kong

- The Shanghai-based developer “expects to establish a digital asset management unit and launch non-fungible token products related to its Wuyue Plaza investment properties by the end of the year” according to Bloomberg sources

- Executive Wang Yifeng told Hong Kong media “Our first attempt will focus on the tokenisation of financial assets, specifically private and convertible bonds, into RWAs… We have met a small scale of intentional investors and discussed our first RWA private debt”

What happened: Franklin Templeton CEO outlines crypto investment thesis

How is this significant?

- Franklin Templeton CEO and president Jenny Johnson recently provided her assessment of the digital asset space, when speaking at the SALT conference in Jackson Hole, Wyoming

- Johnson outlined opportunities in the space, identifying Bitcoin as a “fear currency”—a decentralised refuge for people in restrictive/failing economies or uncertain times—whilst promoting infrastructure over single projects elsewhere

- She said capital should be focused in the systems supporting digital assets, rather than specific assets themselves, likening it to the old analogy about selling picks and shovels rather than sifting for gold in a gold rush

- “The picks and shovels are the baseline of the strong, layered apps… I like the rails [blockchain networks such as Ethereum] as a starting point. Then there are some great consumer apps that are coming out that I think are really exciting”

- She also identified active participation in blockchain networks (such as running validator nodes on Ethereum) as a “game changer” for active investment managers; “Just imagine seeing on public equity all the transactions that go in and out of that company and how much information that gives you”

What happened: US government to publish economic data on-chain

How is this significant?

- In a White House cabinet meeting this week, Commerce Secretary Howard Lutnick revealed that the US government will begin publishing economic data on blockchain

- He told president Trump that “The Department of Commerce is going to start issuing its statistics on the blockchain, because you are the crypto president”, referring to Trump’s campaign promise to make the US “the crypto capital of the world”

- Lutnick said the Department of Commerce will begin by publishing GDP data on the blockchain, potentially “allowing broader use for data and distribution” as per analysis from industry publication TheBlock

- The Secretary of Commerce had previously written that “This Administration is going to use bitcoin, digital assets, and blockchain to drive America forward and remain the leader in the global economy”

- Further economic indicators could follow on blockchain, which is cited as a compelling platform for government data due to its transparent and immutable nature

- Ethereum-based oracle project Chainlink, and Pyth Network were selected to ensure the veracity and integrity of data placed on-chain

- In a blog post, Chainlink hypothesised potential utilisation for such data in DeFi applications, writing “Bringing US government data on-chain unlocks innovative use cases for blockchain markets, such as automated trading strategies, increased composability of tokenised assets, the issuance of new types of digital assets, real-time prediction markets for crowdsourced intelligence, transparent dashboards powered by immutable data, and DeFi protocol risk management based on macroeconomic factors”

- In other government news, the CFTC issued an advisory making it easier for offshore exchanges to offer crypto derivatives to US customers

- As long as exchanges hold licences in jurisdictions deemed “comparable” to US oversight, they can access the US market as so-called “foreign boards of trade”

- Acting CFTC chair Caroline Pham stated “American companies that were forced to set up shop in foreign jurisdictions to facilitate crypto asset trading now have a path back to US markets”

What happened: Trump family increases digital asset involvement and activity

How is this significant?

- After last week’s news of an eastward-facing “crypto push” by president Trump’s sons Eric and Donald Jr, the “first family” increased its involvement and championing of the asset class yet further this week

- Eric Trump confirmed in an interview with Nikkei that the Trump-linked World Liberty Financial project is looking for partners in Asia, including potential stablecoin issuers in Hong Kong

- Speaking at the Bitcoin Asia conference in Hong Kong, he opined that China is a “Bitcoin superpower” alongside the US; despite an official mainland ban on crypto trading

- The younger Trump said “There’s no question that China is a hell of a power when it comes to this world”

- He added “I give the same credit to the Middle East. I mean, the Middle East has really embraced crypto in a massive way, and they are running and they are running fast in that endeavour”

- However, he was unable to leverage the event for any government discussions, as Hong Kong’s South China Morning Post newspaper reported that local lawmakers and officials “skipped the event” in order to avoid interacting with the presidential scion

- He subsequently continued the eastern tour and headed to Tokyo, planning to attend a shareholder meeting of Japan’s leading crypto treasury firm, Metaplanet

- In other Trump-adjacent news, World Liberty Financial’s WLFI token opened for trading following a recent community i.e., token holder vote

- Initial trading valued the token at a fully-diluted value of $30bn, although prices have since retreated significantly in line with broader market uncertainty

- The Wall Street Journal reported late on Monday that digital assets now account for the largest portion of the Trump family’s personal wealth portfolio, with token holdings valued at over $5bn

- However, some analysts cautioned that the initial liquidity float is low, making it “easier to pump”, rather than reflecting true market dynamics based on total token supply

- Donald Trump Jr joined blockchain-based prediction platform Polymarket as an advisor, with his associated 1789 Capital investment fund securing a significant stake in the company via a “double digit millions” investment

- Trump Media and Technology partnered with Crypto Dot Com to create a new crypto treasury firm—focused on the latter’s proprietary CRO token—via a blank-cheque vehicle, according to a Tuesday SEC filing

- In other news from East Asia, Bloomberg noted Tesla as a key casualty of Korean appetite for digital assets, as investors reallocate from the stock market to crypto

- According to calculations, “Individual investors in Korea sold a net $657m of Tesla stock in August, the largest outflow since at least early 2019… Investors have instead favoured even more volatile bets such as Bitmine, seen as a proxy for Ether, which drew $253m of net inflows”

- Meanwhile however, Korea’s FSC chief nominee courted controversy in the crypto-enthused nation by criticising the asset class (except for stablecoins), claiming that they have no intrinsic value

What happened: Stablecoin news

How is this significant?

- London-based banking fintech provider Finastra teamed up with USDC stablecoin issuer Circle this week in order to bolster the integration of stablecoins into cross-border payments

- According to a press release, integration will launch on Finastra’s Global PAYplus (GPP), which processes more than $5tn in daily cross-border flows

- Circle and Finastra said that settling in USDC whilst maintaining instruction via fiat currencies can reduce their reliance on correspondent networks; a potential source of friction due to high fees and slow processing times

- Circle and fellow stablecoin issuer Paxos partnered in a pilot with blockchain fintech Bluprynt, which provides “issuer verification when stablecoins are released by a company… [and] a way to trace back a token to the verified issuer”

- This addresses a risk of the rise of stablecoins; businesses being duped by illicit copycat tokens issued by bad actors using the same token name and ticker

- Former PBoC chair Zhou Xiaochuan denied recent reports that China is considering a Yuan-pegged stablecoin alongside existing CBDC efforts

- According to think tank meeting minutes, he argues that stablecoins could “undermine financial stability”, and that complaints over cross-border payment costs in legacy systems are exaggerated

- Nobel-winning economist Jean Tirole also voiced caution over stablecoins, claiming weak oversight of the assets “could force governments into multibillion-dollar bailouts”

- Stablecoin startup M0 raised $40m in Series B capital, bringing its total raise thus far to $100m

What happened: Crypto Treasury news

How is this significant?

- Japanese Bitcoin treasury firm Metaplanet boosted its total holdings to 20,000 Bitcoin this week, thanks to $112m of purchases over the last seven days

- This milestone came less than three months after it reached 10,000 Bitcoin in its corporate treasury

- Additionally, a Wednesday statement revealed plans to sell $880m in shares overseas, as a means to raise capital for additional Bitcoin purchases over the next two months

- Solana treasury firm DeFi Development Corp expanded its international footprint into the UK, becoming the first US crypto treasury firm to enter British markets via a subsidiary

- The nation of El Salvador split its existing Bitcoin holdings across 14 different addresses, as a means of enhancing security and quantum-resistance

- Finally, a report in Fortune claimed that Elon Musk’s personal lawyer is establishing a treasury firm dedicated to Musk’s favourite meme token; the infamous Dogecoin

- According to the article, the firm aims to raise “at least $200m” for the treasury, potentially marking the first corporate treasury dedicated to a memecoin rather than a broader utility token

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.