Market Overview

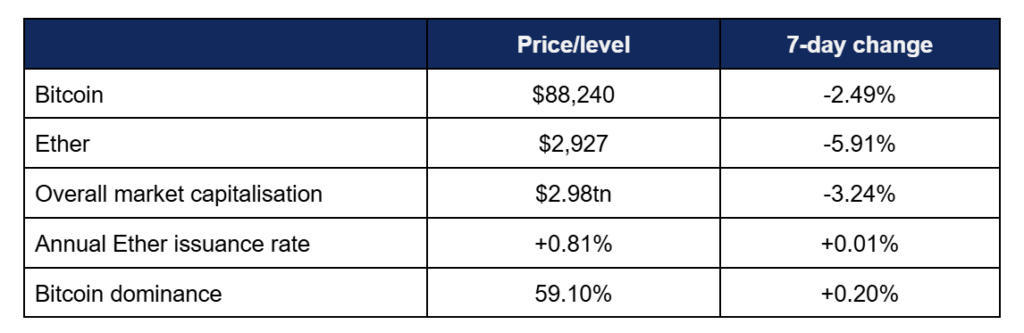

Digital assets faced a bearish week as initial positive response to an apparent breakthrough on Greenland was swiftly followed by widespread risk-off market behaviour amidst escalating tensions within the US and rising concerns over rate cuts.

- Bitcoin peaked early, at $91,150 on Tuesday, gradually declining throughout the rest of the week before dropping sharply on Sunday to a weekly low of $86,250

- Ether exhibited similar patterns, with a Tuesday high of $3,124 giving way to a Sunday bottom of $2,794

- Overall market capitalisation dipped back below the $3tn mark

- According to industry monitoring site DeFi Llama, total value locked in DeFi dropped almost $7bn to $119.8bn

Digital assets faced weekly losses as escalating political tensions in the US pushed investors toward a more cautious stance. Outside the US, momentum continued to build: UBS expanded into crypto trading, tokenisation activity accelerated, BlackRock and PwC published constructive outlooks, and Ethereum developers moved to address emerging quantum computing risks.

ETF News

What happened?

- After achieving their best inflows since October last week, digital asset investment products reversed course and suffered their largest outflows since mid-November

- This was dominated by Bitcoin products, where spot ETFs experienced their worst week since February 2025, with $1.33bn outflows

- According to Coinshares data published on Monday, the trading week ending Friday the 23rd logged around $1.7bn weekly outflows, erasing most of the previous week’s gains

- Coinshares Head of Research James Butterfill noted that outflows were dominated by the US, whereas other markets like Switzerland, Germany, and Canada “saw the recent price weakness as an opportunity to add to long positions”

- Additionally, several members of the altcoin ETF complex (Solana, BNB, and Chainlink) managed to return (minor) inflows despite overall market momentum

- Butterfill offered several reasons for bearishness amongst American traders, claiming “Dwindling expectations for interest rate cuts, negative price momentum, and disappointment that digital assets have not participated in the debasement trade yet have likely fuelled these outflows”

- Spot Bitcoin ETFs logged four consecutive days of outflows, following Monday’s market closure for the Martin Luther King Jr. Day public holiday

- These outflows ranged from $32m to $709m, with three of the trading days in the nine-figure range (bookending the week with $480m outflows on Tuesday and $102m on Friday)

- Only one single fund (VanEck’s HODL) registered any daily inflows at all; at a comparatively modest $6.4m on Wednesday

- The market’s two largest funds – BlackRock’s IBIT and Fidelity’s FBTC – were responsible for the majority of weekly losses, with peak daily outflows of $357m and $288m respectively on Wednesday, as Greenland tensions peaked

- Outflows lessened considerably once President Trump announced the basis of a deal in Greenland, but investor caution remained heightened due to internal tensions within the US and the threat of a government shutdown

- Spot Ether ETFs mirrored the behaviour of their Bitcoin counterparts, at reduced volumes, opening the week with two nine-figure outflow days ($230m and $287m) before dropping to daily outflows of around $42m

- BlackRock’s ETHA dominated outflows, shedding $250m on Wednesday for the week’s largest losses, alongside $92m outflows on Tuesday

- The next-worst performance came from Fidelity’s FETH, which experienced $52m capital flight on Tuesday

- However, unlike Bitcoin ETFs, several spot Ether funds did log minor (i.e. 7 digit) inflows throughout the week, including FETH and both Grayscale funds

Crypto Treasury news

What happened?

- After last week’s public holiday, major crypto treasury firms announced multiple additions to their reserves this week

- Leading Bitcoin treasury firm Strategy (formerly MicroStrategy) bought $2.13bn of Bitcoin between January 12th and 19th, its largest purchase in seven months

- It added another $264m worth last week, funded by issuance of Class A common stock and preferred perpetual stock

- This brought total holdings to 712,647 Bitcoin, according to co-founder Michael Saylor

- Japanese Bitcoin treasury firm Metaplanet forecast $100m revenues for FY2026, almost exclusively from its Bitcoin Income generation business, and this would represent a doubling of its revenue from last year

- Leading Ether treasury firm Bitmine meanwhile made its largest purchase of the year, adding 40,302 Ether for approximately $117m

- At 4.24 million Ether, the company now sits at around 70% of its total Ether acquisition goal

- Bitmine Chairman Thomas Lee wrote that “One of my takeaways from listening to speeches and media reports from Davos, it is clear to me that Wall Street has embraced crypto and blockchain assets and sees the convergence of traditional assets and digital assets. And similarly between crypto and AI convergence”

Tokenisation news

What happened?

- Numerous new tokenisation initiatives hit the news this week, as the emerging technology continues to be embraced by a wide range of institutions

- Tokenisation startup Superstate raised $82.5m in a Series B round, led by Bain Capital Crypto, and including contributions from Galaxy Digital, Haun Ventures, and hedge fund Brevan Howard amongst others

- Superstate currently manages around $1.2bn in tokenised assets, and the new funds will go towards “tools that let firms raise capital and run shareholder processes on public blockchains like Ethereum and Solana”

- Company CEO Robert Leshner commented “This year, tokenisation will catalyse the transformation of capital markets”

- Potential applications of Superstate’s technology include IPOs run directly on blockchains with tokenised share issuances, allowing faster settlement than legacy systems

- Speaking at the World Economic Forum in Davos, Binance founder (and former CEO) Changpeng “CZ” Zhao revealed that he is consulting “probably a dozen governments” about tokenising their assets

- He noted that tokenisation enables fractional ownership, and “this way the government can actually realise their financial gains first, and use that to develop these industries”

- “CZ” has previously disclosed consultations with Kyrgyzstan, Malaysia, and Pakistan but the “dozen” figure he quoted indicates far more wide-ranging interest in the concept

- Zhao’s counterpart, Coinbase founder Brian Armstrong, spoke at a Davos panel titled “Is Tokenisation the Future?”

- During the panel, he contrasted the fully-backed nature of stablecoins with the fractional reserve system used by banks, as France’s central bank governor categorised interest-bearing private tokens as a “fundamental threat to the banking system”

- Upon returning from Switzerland, Armstrong tweeted that an executive at a top 10 global bank told him crypto was now their “number one priority”, classifying it as an “existential” issue for them

- Japanese finance giant Nomura (through its Laser Digital crypto subsidiary) is introducing a yield-bearing tokenised Bitcoin fund

- In a press release, the firm revealed collaboration with tokenisation specialists KAIO, and claimed the new fund (only available to accredited and institutional investors) “is designed to offer a long-term, long-only exposure to Bitcoin, combined with, among others, diversified market-neutral strategies generating a yield as a stream of income”

- Laser Digital co-founder Jez Mohideen stated “Recent market volatility has shown that yield-bearing, market neutral funds built on calculated DeFi strategies are the natural evolution of crypto asset management”

IPO and Investment News

What happened?

- The Financial Times reported this week that French hardware wallet manufacturer Ledger is readying for an IPO at a $4bn valuation

- This represents a near-tripling of valuation since a 2023 funding round, with the firm benefitting from increased security concerns as the overall digital asset market has grown, with the company’s revenues growing into hundreds of millions

- Sources told the FT that “Ledger is working with Goldman Sachs, Jefferies, and Barclays to facilitate an IPO as soon as this year”

- BitGo became the first major crypto company to go public in 2026, after raising nearly $213m pre-launch

- Its listing was 13 times oversubscribed despite current subdued market conditions, with shares rising 25% on launch before paring back gains to 3.8% at the end of their first trading day

- Blockchain infrastructure firm Zerohash is raising $250m at a $1.5bn valuation, after recently walking away from a Mastercard takeover attempt

- Zerohash claims Mastercard is still considering a strategic investment despite the acquisition plans falling apart, potentially joining the likes of Interactive Brokers, Morgan Stanley, and Apollo from Zerohash’s most recent funding round

What happened: UBS becomes latest banking giant to offer crypto trading

How is this significant?

- Swiss bank UBS, one of the world’s largest wealth managers ($4.7tn in wealth assets under management), became the latest in a long line of TradFi powerhouses to open up to digital assets this week

- Bloomberg reported that the banking giant “is in the process of selecting partners for a crypto offering”, allowing private banking clients to buy and sell Bitcoin and Ether

- Initially, this service will be offered to clients in Switzerland, before later rolling out to the APAC region and the US, according to sources

- Bloomberg’s source said the digital asset move was driven by demand from wealthy clients, and a spokesperson told the publication “As part of UBS’s digital asset strategy, we actively monitor developments and explore initiatives that reflect client needs, regulatory developments, market trends and robust risk controls. We recognise the importance of distributed ledger technology like blockchain, which underpins digital assets”

- UBS follows in the footsteps of numerous other global banking behemoths to introduce or expand digital asset offerings, including the likes of Morgan Stanley, State Street, BNY Mellon, and JP Morgan

- It also marks the latest bank to perform an about-turn on previous criticisms of the asset class, after former chairman Axel Weber stated in 2021 that crypto “will not survive…Governments will not tolerate this to become really big”, in the wake of Bitcoin hitting a then-record high of $66,000

What happened: BlackRock identifies digital assets within key themes for 2026

How is this significant?

- BlackRock, the world’s largest asset manager, continued its backing of digital assets, identifying them as key themes “driving the market in unprecedented ways” for the upcoming year

- In its 2026 Thematic Outlook, the firm’s iShares division highlighted its IBIT spot Bitcoin ETF as the fastest-growing fund in history, with around $70bn in net assets

- BlackRock said its chosen themes are “reshaping our daily lives”, and that “themes like crypto remain top of mind for investors”

- The asset manager highlighted tokenisation as a “new way to access capital markets”, highlighting CEO Larry Fink’s numerous endorsements of the concept

- Analysts wrote that stablecoins are just the starting point in an evolving tokenisation tale; “In our view, as tokenisation continues to rise, so will the opportunity to access assets beyond cash and US Treasuries via the blockchain”

- It highlighted the Ethereum blockchain as a key beneficiary of potential growth in tokenisation, as it currently accounts for almost two-thirds of all tokenised assets

What happened: PwC releases Global Crypto Regulation Report

How is this significant?

- Big Four accounting firm PwC released the fourth edition of its Global Crypto Regulation Report series this week, outlining its vision for industry legislation this year

- PwC wrote that the regulatory environment will be less defined by “debate and more by execution and competition between jurisdictions to attract capital and legitimacy”

- A particular theme of interest along those lines is increased cross-border coordination, with regional efforts alongside national legislation

- Global and US Head of Digital Assets, Matt Blumenfeld, said that such efforts are a boon to institutional adoption; “Regulation is no longer a constraint; it’s actively reshaping markets and enabling digital assets to become the architecture that allows them to scale responsibly. This collaboration aims to foster safe innovation and interoperability in the global digital finance ecosystem”

- Despite higher compliance costs, the firm believes clear rules will enable deeper institutional participation, greater banking assets, and a raft of new products as “DeFi trading venues and market conduct converge to global norms”

- Another major talking point of PwC’s research was that crypto adoption has “crossed a critical threshold” and passed the point of no return as “Regulatory momentum is accelerating, and with it, the pace of institutional adoption… [there’s] confidence for institutions to innovate, scale, and integrate digital assets into the core of the global financial system”

- Other key themes identified by PwC include further implementation of stablecoin regimes, increased traction for tokenised money, and wider adoption of crypto assets as “eligible collateral for margining and risk mitigation”

- Global Digital Finance Executive Director Elise Soucie Watts stated “Global digital asset regulation has reached an inflection point… This is no longer a question of if regulation will arrive, but how quickly firms can now adopt to operating in parallel regimes”

- PwC legal partner Michael Huertas added “The winners will be those who build compliance, resilience, and transparency into their core operations”

What happened: Government usage of digital assets rises thanks to borderless nature

How is this significant?

- Digital assets reaffirmed the viability of several key properties – including borderless transactions and decentralisation – as data emerged of sanctioned economies increasing their exposure to the asset class

- According to a new report by blockchain analytics firm Elliptic, the Central Bank of Iran “bought more than $500m in dollar-backed digital assets in the past year to mitigate a currency crisis and bypass US sanctions”

- In particular, the CBI purchased USDT stablecoins in April and May of last year, after oil export restrictions “sapped forex supplies”, as Elliptic said it “appeared the CBI has been using stablecoin to help stem the rial’s collapse and to settle payments related to international trade”

- Fellow blockchain forensics firm Chainalysis released a report valuing Iran’s domestic digital asset market at nearly $7.8bn, as citizens use the asset class to hedge against domestic currency devaluation and premiums paid on fiat currency alternatives

- Chainalysis plotted adoption and activity against a timeline of major domestic and geopolitical events, showcasing spikes in activity during periods of increased tension and conflict

- Meanwhile, a ruble-pegged stablecoin also saw a large increase in adoption last year according to Elliptic data, surpassing $100bn in overall transaction value within a year of its launch

- The A7A5 token was “created to circumvent sanctions on Russia” and has registered around 250,000 separate transactions by over 41,000 accounts, but daily transaction volumes have declined significantly since further EU sanctions against Russia in the second half of last year, indicating that challenges remain when reliant on centralised exchanges in the absence of organic local DeFi (and decentralised exchange) activity

- In contrast to the Iranian approach of adopting internationally-popular digital assets, Russia decided to create its own in a more siloed approach, making them more vulnerable to increased sanction policy

- An Elliptic spokesperson said “A7A5 faces the challenge that there is very little liquidity when it comes to exchanging it for other crypto assets. We’re likely to see them encourage further cryptocurrency exchanges to list A7A5 for trading, however, this will be challenging given the sanctions risks those exchanges would then face”

- The UK also demonstrated the continued friction of legacy financial infrastructure – not for any international transfers, but for purely local transactions, as British banks blocked or delayed around 40% of payments to crypto platforms in 2025

- Industry body UK Cryptoasset Business Council called for immediate FCA guidance to remedy these issues

What happened: Ethereum developers address quantum computing concerns

How is this significant?

- After last week’s news that Jefferies Head of Equity strategy Christopher Wood removed Bitcoin over post-2030 quantum computing concerns, the Ethereum ecosystem developers came out to secure the long-term viability of the chain

- Essentially, quantum computing means an exponential increase in computing power and efficiency, leading to concerns that the cryptography securing blockchain networks could be cracked by future networks of supercomputers

- The Ethereum Foundation identified post-quantum cryptography as a “top strategic priority”, forming a dedicated team for the issue

- Senior researcher Justin Drake tweeted “After years of quiet R&D, Ethereum Foundation management has officially declared PQ [post-quantum] security a top strategic priority. It’s now 2026, timelines are accelerating. Time to go full PQ”

- In addition, it instituted a $1m “Poseidon Prize” to harden key hash functions involved in the blockchain’s cryptography, on top of an existing $1m Proximity Prize dedicated to more general post-quantum advances

- Elsewhere in the industry, Coinbase announced an “independent advisory board to evaluate quantum risks to blockchain networks”, including prominent blockchain researchers such as Drake

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.