Market Overview

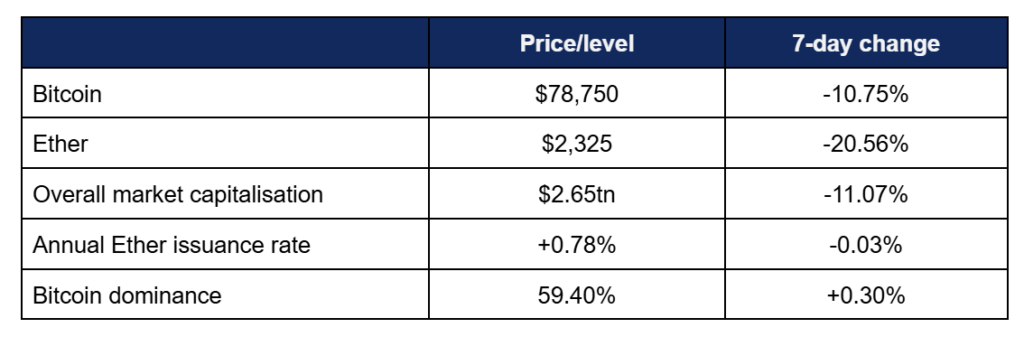

Digital assets suffered one of their worst weeks in recent memory, as Bitcoin dropped to its lowest levels since 2024 off the back of international geopolitical tensions and risk-off behaviour.

- Bitcoin started the week strongly, briefly spiking above $90,000 for a weekly high of $90,340 on Wednesday, before shifting into a consistent decline punctuated by a major weekend drop from $83,000 to $77,000 within a few hours on Saturday

- This eventually led to a low of $74,570 on Monday, as Bitcoin’s lowest price since 2024 and longest monthly losing streak since 2018 wiped out the gains since Trump’s return to office, making for a weekly range of around $15,000

- The appointment of a perceived inflation hawk as next Federal Reserve chair was cited as one potential factor between risk-off activity, alongside a variety of other factors, including US threats against Iran, and reduced domestic confidence in President Trump

- Bernstein analysts posited the arrival of a “short term crypto bear cycle”, although they predicted recovery within 2026

- Ether echoed Bitcoin, but fell further, from a high of $3,038 to a low of $2,165

- Overall market capitalisation pulled back in line with double-digit declines across the board

- According to industry monitoring site DeFi Llama, total value locked in DeFi dropped nearly $14bn to $106.4bn

Digital assets experienced a very challenging week amidst chaos in global markets, as Bitcoin hit its lowest levels since 2024, and overall market capitalisation dipped to its lowest point in over 10 months. Yet beneath the pressure, adoption accelerated, reflecting optimism for the future: Fidelity unveiled plans for a stablecoin, tokenisation activity surged, Dubai Insurance enabled crypto payments, and Tether reported over $10bn in profits – reinforcing long-term conviction despite short-term stress.

ETF News

What Happened?

- Digital asset investment products experienced a second consecutive week of outflows, as global markets (including recently buoyant precious metals) struggled with uncertainty and continued risk-off sentiment

- According to Coinshares data published on Monday, the trading week ending Friday the 30th logged around $1.7bn weekly outflows, on a par with last week

- Coinshares Head of Research, James Butterfill, posited that “this reflects a combination of factors, including the appointment of a more hawkish US Federal Reserve Chair, continued whale selling associated with the [historic narrative of a] four-year cycle, and heightened geopolitical volatility”

- America accounted for the vast majority of these outflows ($1.65bn), whilst German and Swiss products managed to post minor inflows

- Kraken’s global economist Thomas Perfumo flagged up a pause in Federal Reserve rate cuts as a catalyst for money moving out of ETFs this week, alongside tightened global liquidity

- He told industry publication TheBlock “Global liquidity, the factor with the greatest influence on crypto market performance, remains tight,” he said. “Interest rates are only one component of overall liquidity conditions. By contrast, gold has historically benefited from a weakening U.S. dollar and continues to absorb flows from more risk-sensitive investors”

- Spot Bitcoin ETFs registered four days of outflows, from Tuesday to Friday

- Of these, three days logged nine-figure outflows, from $147m to a high of $818m on Thursday

- Despite these figures, more funds actually returned daily inflows than last week – albeit at rather modest levels compared to post-launch averages

- Fidelity’s FBTC secured $20m inflows on Wednesday in the week’s best performance, followed by BlackRock’s market-leading IBIT with $16m on Monday

- FBTC was the only fund to manage two days of inflows, but others that achieved at least seven-digit flows throughout the week included ARK Invest’s ARKB, VanEck’s HODL, WisdomTree’s BTCW, and Grayscale’s 0,15% fee mini-ETF

- IBIT dominated overall outflows, returning three days of nine-figure losses, ranging from $103m to $528m

- Spot Ether ETFs outperformed Bitcoin funds, with two days of inflows (including $117m on Monday), and eight-figure daily inflows for BlackRock’s ETHA ($27m) and Grayscale’s ETH ($10m)

- However, Ether funds did still experience three days of outflows, topping out at $253m on Friday

- Fidelity’s FETH gained $137m on Monday for the week’s largest gain, contrasting ETHA’s Friday flight of $157m for the week’s largest outflows

- In a Friday research note, JP Morgan analysts wrote that Bitcoin futures appeared oversold, especially in comparison with gold and silver

Crypto Treasury news

What happened ?

- Hostile market conditions led to challenges for crypto treasury firms, including Strategy’s Bitcoin position going underwater for the first time since 2023

- Leading Bitcoin treasury firm Strategy (formerly MicroStrategy) faced up to the unfamiliar position of Bitcoin dropping below its average purchase price of $76,037 this week, although industry analysts said flexible options for its $8.2bn in convertible debt meant near-term solvency risk was unlikely

- However at these prices, with stock effectively trading at a discount to mNAV, new share issuance becomes a less attractive proposition for future Bitcoin buy funding

- Its most recent purchases, 855 Bitcoin worth $75.3m (funded by sale of common stock), were conducted before the weekend price crash, meaning they all came in significantly above its historic average price

- Leading Ether treasury firm Bitmine is far deeper underwater on its Ether holdings, with a $6bn unrealised loss reported

- However, it added nearly $100m more this week as chairman Thomas Lee indicated buying action in response to a “disconnect” between market price and onchain activity

- He wrote that “During the crypto winter of 2021-2022 or 2018-2019, Ethereum transaction activity and active wallets declined, which is counter to what we have seen in the past 12 months”

- Additionally, the firm is now staking 2.9 million Ether, generating an estimated $188m in returns annually by operating as validator nodes securing the Ethereum blockchain

Tokenisation news

What happened?

- New data emerged this week revealing the remarkable rate of growth for tokenised assets over the last year

- A new report from Sentora and DLnews showcased tokenised equities as an area of particular growth, thanks to recent SEC and DTCC guideline developments

- According to the report, “tokenised stocks reached roughly $963 million in market value as of January 2026, representing a year-on-year increase of nearly 2,878% from just $32 million a year earlier”

- Ondo Global Markets currently dominates in the space, accounting for about half of all tokenised equity value, followed by xStocks and Securitize

- These trends appear primed to accelerate, after Sentora identified December 2025 as a key inflection point, as it included both the DTCC’s no-action letter connected to a tokenisation pilot and new SEC guidance regarding broker-dealer custody

- In a filing on Wednesday, the aforementioned Securitize (a tokenisation partner of BlackRock for its onchain money market fund BUIDL) revealed 841% revenue growth in Q1-Q3 2025

- This was on top of the firm’s 2024 revenue doubling year-on-year, demonstrating consistent growth in the tokenisation space

- Securitize intends to go public via a SPAC merger with Cantor Equity Partners II, a firm backed by Cantor Fitzgerald (formerly run by current United States Commerce Secretary Howard Lutnick)

- Meanwhile, asset manager (and crypto ETF issuer) WisdomTree’s CEO Jonathan Steinberg revealed that the firm now manages around $780m of assets onchain (including a tokenised version of its debt market fund), and remarked “What were once emerging initiatives, including models, tokenised assets and private markets, are now real businesses contributing to momentum today while still early in their growth”

Regulatory news

What Happened?

- After recent delays, there were some partial advances to the CLARITY market structure bill in the US this week – but bipartisan consensus remains elusive as opposition to president Trump mounts

- The Senate Agriculture Panel advanced it version of the bill, albeit with votes directly along party lines and no Democrats voting in favour

- Existing Democrat digital asset supporters such as Senator Cory Brooker argued that the bill required stronger ethical guardrails in place, particularly preventing lawmakers and cabinet members (including the US President) from conducting digital asset activity while in office

- Conflicts of interest for the president are viewed as a pertinent issue, since his family’s personal fortune is now estimated to be one-fifth crypto

- Committee chair John Boozman argued that ethical matters were beyond the panel’s purview, and a matter for the Senate to decide

- The companion bill in the Senate banking committee has however stalled over banking industry opposition to yield on crypto stablecoins, but the White House summoned executives from both industries for a Monday meeting to hash out differences

- Reuters reported representatives of Circle, Coinbase, Kraken, Ripple, and various trade groups would sit across from members of the American Bankers Association

- Speaking about the meeting, TD Cowen analysts theorised that President Trump’s personal intervention would be necessary to reach an agreement

- TD Cowen’s Washington research group chief Jared Seiberg stated “Our view is that it will require President Trump’s personal intervention to force the crypto and banking industries to make the compromises needed for crypto market structure legislation to have a chance of advancing in Congress”

- Securing Democrat support is still viewed as a challenge, with Seiberg saying “We are not saying legislation is impossible in 2026. Industry could get on the same page and the GOP could give Democrats enough concessions for it to pass. It is that the path forward is getting harder rather than easier”

- The Wall Street Journal reported on particular tensions surfacing at Davos, involving a foul-mouthed outburst from JP Morgan CEO (and long-time crypto critic) Jamie Dimon towards Coinbase CEO Brian Armstrong

- The stablecoin yield issue is seemingly so divisive that the Journal dubbed Armstrong “Enemy Number One on Wall Street”

- Elsewhere in regulatory news, Trump nominated a new Federal Reserve chair in the form of Kevin Warsh, a Stanford Business School lecturer with previous experience at the Federal Reserve board of governors and Duquesne Family Office

- Warsh is viewed as generally pro-crypto, but his hawkish reputation led to a nervous response from the markets

- Speaking at the Hoover Institution, Warsh stated “Bitcoin doesn’t trouble me. I think of it as an important asset that can help inform policymakers when they’re doing things right and wrong. It is not a substitute to the Dollar. I think it can often be a very good policeman for policy”

- On Thursday, the CFTC and SEC announced a “Project Crypto” joint initiative to prep both agencies for forthcoming digital asset legislation

- New CFTC chair Michael Selig instructed his staff to consider “joint codification” of SEC chair Paul Atkins’ proposed taxonomy for digital assets whilst Congress finalises its regulatory efforts

- Additionally, the SEC unveiled a fresh playbook for tokenised securities, clarifying guidance for onchain stock issuance

- In its statement, the SEC said that “tokenised securities fall into two clear categories: those issued or authorised by the underlying company, and those created by third parties without issuer involvement”; the latter often amounting to synthetic exposure, rather than conferring all shareholder benefits

IPO and Investment News

What Happened?

- TradFi trading giant Robinhood invested in institutional crypto infrastructure firm Talos at a $1.5bn valuation

- This investment was part of an extended Series B round, following a previous Series B valuing the firm at $1.25bn

- Talos CEO Anton Katz told industry publication Coindesk “We extended our series B round to accommodate interest from strategic partners who recognise Talos’s role in providing core institutional infrastructure for digital assets. At a time when traditional asset classes are increasingly migrating to digital rails, these partners wanted to be more closely aligned with our growth”

- Other participants in the extended round included Sony Innovation Fund, IMC, QCP, and Karatage, joining returning backers a16z crypto, BNY and Fidelity Investments

- Elsewhere, Coindesk reported that crypto custodians Copper are considering going public, with sources indicating the involvement of Goldman Sachs, Citi and Deutsche Bank in the process

- Rival custodians BitGo recently launched on NYSE with a $2bn raise, following a slew of successful IPOs last year

What happened: Fidelity moves to issue stablecoin

How is this significant?

- Multi-trillion investment manager Fidelity became one of the largest institutions to enter the stablecoin space this week, announcing the Fidelity Digital Dollar, or FIDD

- Fidelity Digital Assets President Mike O’Reilly told Bloomberg that the asset class is a crucial building block for the future of finance; “We believe stablecoins have the potential to serve as foundational payment and settlement instruments. Real-time settlement, 24/7, low-cost treasury management, are all meaningful benefits that stablecoins can bring to both our retail and our institutional clients”

- Unlike some institutional stablecoin-adjacent digital assets like JP Morgan’s JPM Coin, FIDD will be, as O’Reilly suggested, available to retail customers as well as institutions, available on crypto exchanges, and issued on the public Ethereum blockchain

- FIDD will be directly issued by Fidelity Digital Assets, which gained national trust bank approval back in November

- O’Reilly cited recent regulatory changes as a key towards the company’s decision; “The recent passage of the GENIUS Act was a significant milestone for the industry in providing clear regulatory guardrails for payment stablecoins. We’re thrilled to launch a fiat-backed stablecoin at a time of increasing regulatory clarity to… enable continued progress towards a more efficient financial system”

- Market response was broadly positive, as one industry executive told American Banker; “When a firm with Fidelity’s distribution decides to mint and redeem dollars on a public chain, the market is telling you where treasury, settlement and capital markets’ plumbing is heading”

What happened: Tether generates over $10bn profit in 2025

How is this significant?

- The world’s largest stablecoin issuer released its latest financial attestations this week, pointing towards another successful year as stablecoin market capitalisation reached new records

- Total USDT in circulation has reached a new high of $186bn, backed by $193bn in assets with $6.3bn excess reserves

- Meanwhile, its investment portfolio (separate from excess reserves) hit $20bn

- Tether reported $10bn in net profit, alongside $17.4bn in gold reserves (currently 140 tons worth), and $10bn Bitcoin holdings

- The scale of the company’s gold treasury (part of a wider diversification strategy as interest rate cuts will reduce earnings on their treasuries held as backing reserves) is so notable that Jefferies identified them as a “significant new buyer” which “could drive sustained gold demand”

- CEO Paolo Ardoino stated “With USDT issuance at record levels, reserves exceeding liabilities by billions of dollars, Treasury exposure at historic highs, and strong risk management, Tether enters 2026 with one of the strongest balance sheets of any global company”

- Additionally, Tether announced the official launch of USAT, its new GENIUS-compliant stablecoin tailored for the US market, integrated into several major exchanges including Kraken and Bybit

- USAT CEO Bo Hines commented “With the launch of USAT, we see a digital dollar that is designed to meet federal regulatory expectations. Our focus is stability, transparency, and responsible governance, ensuring that the United States continues to lead in dollar innovation”

What happened: Dubai Insurance enables policy holders to transact via digital assets

How is this significant?

- In a partnership with Standard Chartered’s digital asset firm Zodia Custody, Dubai Insurance launched a digital wallet that will allow its customers to pay premiums and receive payouts in crypto assets like Bitcoin and Ether

- Dubai Insurance CEO Abdellatif Abuqurah stated “By becoming the first insurance company to enable the receipt of premiums and payment of claims in digital assets through a secure digital wallet, we are redefining how insurance services are delivered while remaining firmly aligned with regulatory and governance frameworks”

- The launch was framed as a further advance in the UAE’s march towards becoming a digital asset hub, building on recent central bank laws bringing DeFi into traditional banking compliance

- Zodia MENA’s commercial MD Zane Suren told a local fintech site “Dubai Insurance’s launch of a crypto-enabled digital wallet is a meaningful step forward in bringing digital assets into everyday financial services in the Middle East”

What happened: UAE royal family reportedly invests in Trump-linked crypto venture

How is this significant?

- The Wall Street Journal reported this week that an Abu Dhabi investment vehicle backed by UAE National Security Adviser Sheikh Tahnoon bin Zayed Al Nahyan purchased a 49% stake in Trump family-backed World Liberty Financial for $500m ahead of the US President’s inauguration last year

- This made Aryam Investment 1 the DeFi firm’s largest outside shareholder

- According to the report, this included a first instalment payment of $250m, $187m of which allegedly went to Trump family entities

- A spokesperson for World Liberty Financial responded to subsequent Bloomberg requests for comment by denying any form of impropriety

- David Wachsman said “Neither President Trump nor Steve Witkoff had any involvement whatsoever in this transaction and have had no involvement in World Liberty Financial since taking office. The idea that, when raising capital, a privately-held American company should be held to some unique standard that no other similar company would be held is both ridiculous and un-American”

- The Journal reported that the second $250m instalment was due in July last year, but didn’t include any information on its alleged distribution

- Although the firm has denied any allegations of conflicts of interest, the report came at an inopportune time for president Trump, as his domestic policies have reduced approval, complicating attempts to pass market structure legislation

- In other UAE-related news, the country’s central bank approved the issuance of a US Dollar-backed stablecoin

- USDU will be issued by Abu Dhabi-based Universal Digital, and Senior Executive Juha Viitala stated “Being the first Foreign Payment Token registered by the UAE Central Bank – and supported by leading UAE banks – gives institutions the clarity and confidence they have been waiting for. It lays the groundwork for a more transparent and efficient digital-asset market in the UAE and beyond”

- Joel Van Dusen of banking partner Mashreq added “We see growing institutional interest in regulated digital-value instruments, and Universal’s introduction of USDU is a timely step that supports this market’s maturation”

What happened: Nomura-backed crypto venture applies for US banking licence

How is this significant?

- Laser Digital, the digital asset arm of Japanese financial giant Nomura Holdings, this week applied for a national trust banking licence to provide crypto custody

- If granted, it would also offer spot trading and staking under direct federal regulatory supervision according to a press release

- However, a few days later reports also emerged that Nomura CEO Hiroyuki Moriuchi is tightening risk controls within the group in order to cut down on losses tied to crypto volatility

- This includes scaling back existing crypto positions, but Bloomberg Japan wrote that “Nomura reaffirmed its long-term commitment to the digital asset sector, describing it as a promising area for future growth”

This weekly financial roundup is for informational purposes only and is not financial, investment, or legal advice. Information is based on public sources as of publication and may change. Consult a professional before acting.