Unlike traditional markets, its non-stop nature amplifies risks such as price volatility, liquidity constraints, and rapidly evolving exchange infrastructures. Regulatory uncertainty and technological vulnerabilities further complicate the landscape. To navigate this environment, a sophisticated and proactive risk management framework is essential to safeguard investments and ensure operational resilience.

Our investment approach is built on a multi-manager platform, which allocates capital across numerous independent portfolio management teams. Each team, or ‘pod’, operates distinct and uncorrelated strategies, creating a highly diversified portfolio of alpha sources. This structure allows for dynamic capital allocation, enabling us to scale successful strategies and reallocate from underperforming ones with speed.

The platform’s strength lies in its diversification, not just of assets, but of trading styles, time horizons and risk profiles. By leveraging a decentralised global talent pool while centralising risk oversight, we create a resilient ecosystem designed to perform across all market conditions.

- Systematic Market Risk

Sharp moves from margin cascades, macro events, or cross-token correlations disrupt trading strategies. - Counterparty Risk

Exchange insolvencies or trading halts jeopardise capital access, as observed in historical failures. - Liquidity Risk

Uneven liquidity across tokens and exchanges leads to slippage, affecting execution quality. - Technological Risk

API latency, outages, or cybersecurity breaches threaten the operational continuity of individual pods. - Fragmented Oversight Risk

Digital-asset portfolios operate across a maze of exchanges, account structures, and inconsistent data formats. Without a unified risk layer, exposures become scattered, updates will lag, and critical signals will be missed. This fragmentation creates blind spots where risk builds quietly, undermining holistic oversight and slowing reaction time during fast markets.

- Systematic Market Mitigation Strategy

Our managers implement adaptive risk models that perform real-time adjustments to portfolio exposures. These platform-level controls are designed to mitigate systemic shocks and stabilise the aggregate portfolio. - Counterparty Mitigation Strategy

We enforce extensive diversification across numerous trading venues. This is paired with secure off-exchange settlement and tri-party solutions to protect capital. - Liquidity Mitigation Strategy

Our framework mandates a focus on the market’s most liquid assets. We enforce real-time pod and exchange-account specific exposure limits which are monitored in real time. - Technological Mitigation Strategy

The platform provides a resilient, centralised infrastructure with redundant API connections and robust failover protocols. All teams benefit from institutional-grade encryption, regular penetration testing, and multi-signature key storage. - Fragmented Oversight Mitigation Strategy

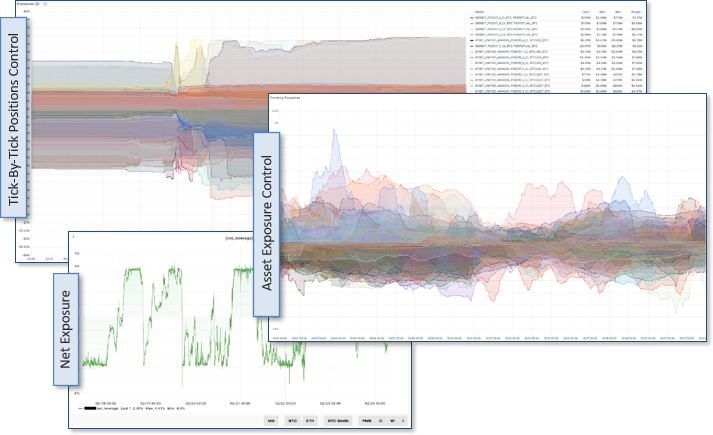

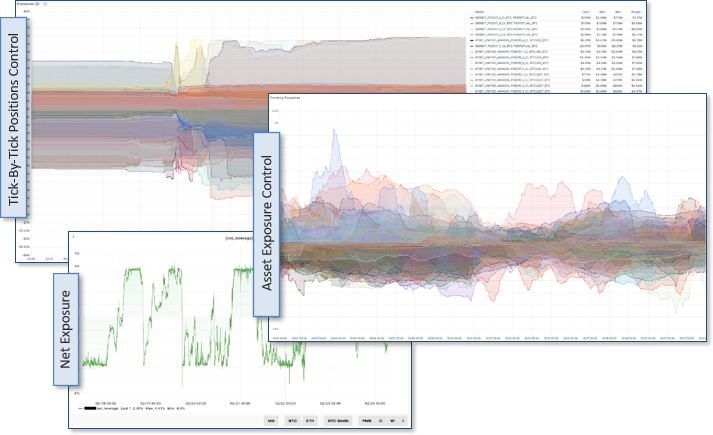

RiskZeus solves this by providing a single, real-time risk layer that consolidates all exchange accounts, pods, and funds into one integrated view. It standardises disparate exchange data, continuously tracks exposures and margin utilisation, and monitors risk across every venue. Automated alerts fire instantly at all levels when thresholds are breached, ensuring no hidden risk. The platform has been battle-tested through major stress events from the LUNA unwind to the October 2025 flash crash – demonstrating resilience during real market failures.

Nickel’s Proprietary Risk Management System (RiskZeus) integrates advanced analytics to support the fund’s strategy, presented in the following table:

| Metric | Purpose |

|---|---|

| Drawdown Analysis | Quantifies potential losses to maintain stability |

| Beta to Major Assets | Assesses correlation with Bitcoin and Ethereum for exposure management |

| Gross/Net Exposure | Tracks position sizes to control market risk |

| Instrument Concentration | Prevents over-reliance on specific assets |

| Inter-Pod Correlation | Minimises strategy overlap to enhance diversification |

These metrics inform dynamic allocation decisions and reinforce the fund’s ability to navigate volatility whilst adhering to regulatory and risk parameters.

If you would like to learn more about RiskZeus (Nickel’s proprietary RMS), we would be pleased to share additional materials or arrange a live platform demo. These sessions provide a clear view of how we monitor exposures, pod risk limits, and utilise live trading data to manage portfolio risk.

To request further information or arrange a live RiskZeus demonstration, please reach out below.